| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3901105010 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3901400000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3903905000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3902900010 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3902100000 | Doc | 61.5% | CN | US | 2025-05-12 |

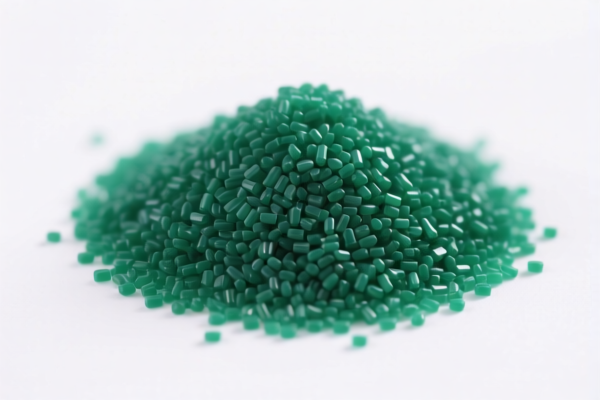

Product Name: LLDPE Injection Molding Grade Polyethylene Resin

Classification: Polyethylene Resin (Linear Low-Density Polyethylene)

✅ HS CODE: 3901105010

Description: LLDPE injection molding grade granules, classified as linear low-density polyethylene.

🔍 Tariff Breakdown (as of current regulations):

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (April 11, 2025 onwards): 30.0%

- Total Tax Rate: 61.5%

⚠️ Important Notes:

- April 11 Special Tariff: A 30.0% additional tariff is imposed on imports after April 11, 2025. This is a time-sensitive policy and must be considered in your customs planning.

- No Anti-Dumping Duties: No specific anti-dumping duties are currently applicable for this product category.

- No Special Tariffs on Iron/Aluminum: This product is not subject to additional tariffs on iron or aluminum.

📌 Proactive Advice:

- Verify Material Specifications: Ensure the product is indeed LLDPE (Linear Low-Density Polyethylene) and not misclassified as another type of polyethylene (e.g., LDPE or HDPE).

- Check Unit Price and Certification: Confirm the unit price and whether any certifications (e.g., RoHS, REACH, or specific import permits) are required for customs clearance.

- Consult Local Customs Authority: For the most up-to-date and region-specific tariff information, always cross-check with local customs or a qualified customs broker.

📊 Comparison with Other HS Codes (for reference):

| HS CODE | Description | Total Tax Rate | Notes |

|---|---|---|---|

| 3901105010 | LLDPE injection molding grade | 61.5% | ✅ Correct classification |

| 3901400000 | Injection molding polyethylene resin | 61.5% | Similar but not LLDPE |

| 3903905000 | Polystyrene injection molding resin | 61.5% | Different polymer type |

| 3902900010 | Polybutene injection molding resin | 61.5% | Different polymer type |

| 3902100000 | Polypropylene injection molding resin | 61.5% | Different polymer type |

If you are importing this product, it is crucial to ensure that the HS CODE 3901105010 is correctly applied and that all documentation (including material specifications and certifications) align with the classification.

Product Name: LLDPE Injection Molding Grade Polyethylene Resin

Classification: Polyethylene Resin (Linear Low-Density Polyethylene)

✅ HS CODE: 3901105010

Description: LLDPE injection molding grade granules, classified as linear low-density polyethylene.

🔍 Tariff Breakdown (as of current regulations):

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (April 11, 2025 onwards): 30.0%

- Total Tax Rate: 61.5%

⚠️ Important Notes:

- April 11 Special Tariff: A 30.0% additional tariff is imposed on imports after April 11, 2025. This is a time-sensitive policy and must be considered in your customs planning.

- No Anti-Dumping Duties: No specific anti-dumping duties are currently applicable for this product category.

- No Special Tariffs on Iron/Aluminum: This product is not subject to additional tariffs on iron or aluminum.

📌 Proactive Advice:

- Verify Material Specifications: Ensure the product is indeed LLDPE (Linear Low-Density Polyethylene) and not misclassified as another type of polyethylene (e.g., LDPE or HDPE).

- Check Unit Price and Certification: Confirm the unit price and whether any certifications (e.g., RoHS, REACH, or specific import permits) are required for customs clearance.

- Consult Local Customs Authority: For the most up-to-date and region-specific tariff information, always cross-check with local customs or a qualified customs broker.

📊 Comparison with Other HS Codes (for reference):

| HS CODE | Description | Total Tax Rate | Notes |

|---|---|---|---|

| 3901105010 | LLDPE injection molding grade | 61.5% | ✅ Correct classification |

| 3901400000 | Injection molding polyethylene resin | 61.5% | Similar but not LLDPE |

| 3903905000 | Polystyrene injection molding resin | 61.5% | Different polymer type |

| 3902900010 | Polybutene injection molding resin | 61.5% | Different polymer type |

| 3902100000 | Polypropylene injection molding resin | 61.5% | Different polymer type |

If you are importing this product, it is crucial to ensure that the HS CODE 3901105010 is correctly applied and that all documentation (including material specifications and certifications) align with the classification.

Customer Reviews

No reviews yet.