| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3701300000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3701200060 | Doc | 58.7% | CN | US | 2025-05-12 |

| 3704000000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3705000000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3701996030 | Doc | 55.0% | CN | US | 2025-05-12 |

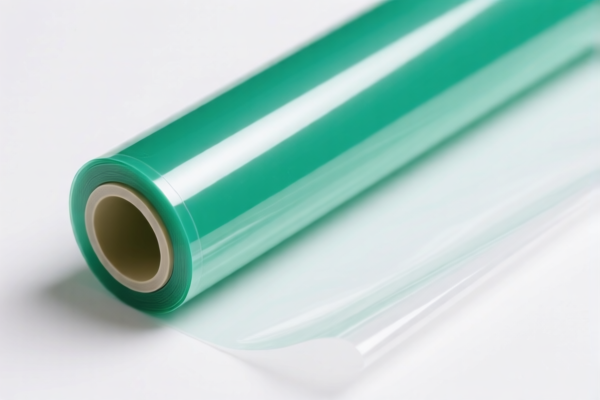

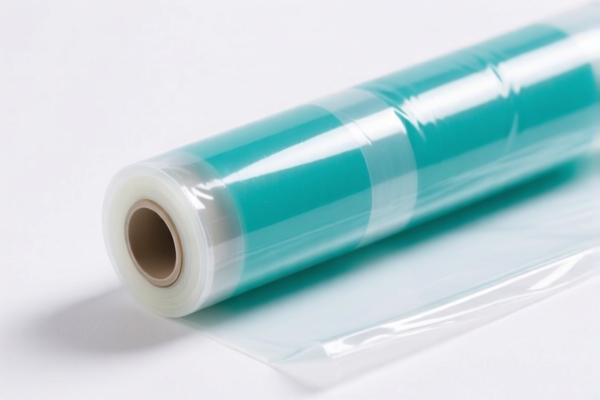

Product Name: Laminated Cellulose Acetate Film

Classification: Based on the provided HS codes, the product may fall under the following categories depending on its specific use and state (exposed or unexposed, photographic or not):

🔍 HS Code Classification Overview

1. HS Code: 3701300000

- Description: Photographic film and sensitized plates

- Total Tax Rate: 55.0%

- Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This code is for photographic film and plates, which may include cellulose acetate film if used for photographic purposes.

- Proactive Advice: Confirm if the film is used for photography or other industrial purposes, as this will affect classification.

2. HS Code: 3701200060

- Description: Sensitized film and plates, flat, unexposed, of any material except paper, paperboard, or textile; flat printing film, unexposed, whether or not in packages: other printing film

- Total Tax Rate: 58.7%

- Tax Breakdown:

- Base Tariff: 3.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This code applies to unexposed, sensitized film used for printing.

- Proactive Advice: If the film is used for printing or industrial applications, this may be the correct classification.

3. HS Code: 3704000000

- Description: Exposed but undeveloped photographic film

- Total Tax Rate: 55.0%

- Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This code applies to film that has been exposed but not yet developed.

- Proactive Advice: If the film is used in a photographic process and has been exposed, this may be the correct classification.

4. HS Code: 3705000000

- Description: Film (e.g., cellulose acetate film)

- Total Tax Rate: 55.0%

- Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This is a general category for film, including cellulose acetate film.

- Proactive Advice: This may be the most general and likely classification for laminated cellulose acetate film unless it is specifically used for photography or printing.

5. HS Code: 3701996030

- Description: Other photographic film and sensitized plates, not of paper, paperboard, or textile materials, unexposed; instant print plates, sensitized, unexposed, whether or not in packages: other: other: other artistic graphic film

- Total Tax Rate: 55.0%

- Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This code applies to unexposed, sensitized film used for artistic or graphic purposes.

- Proactive Advice: If the film is used for artistic or graphic applications, this may be the correct classification.

📌 Key Takeaways and Recommendations

- Tariff Summary:

- Base Tariff: 0.0% to 3.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Total Tax Rate: 55.0% to 58.7%

-

Time-Sensitive Policy Alert:

-

April 11, 2025 Special Tariff: A 30.0% additional tariff will be applied after this date. Ensure your customs clearance is completed before this date to avoid higher costs.

-

Proactive Actions Required:

- Verify Material and Use: Confirm whether the film is used for photography, printing, or other industrial/artistic purposes.

- Check Certifications: Ensure any required documentation (e.g., material specifications, usage details) is prepared for customs.

- Consult with Customs Broker: For precise classification, especially if the product is used in a specialized application.

Let me know if you need help determining the most accurate HS code based on the product's specific use or composition.

Product Name: Laminated Cellulose Acetate Film

Classification: Based on the provided HS codes, the product may fall under the following categories depending on its specific use and state (exposed or unexposed, photographic or not):

🔍 HS Code Classification Overview

1. HS Code: 3701300000

- Description: Photographic film and sensitized plates

- Total Tax Rate: 55.0%

- Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This code is for photographic film and plates, which may include cellulose acetate film if used for photographic purposes.

- Proactive Advice: Confirm if the film is used for photography or other industrial purposes, as this will affect classification.

2. HS Code: 3701200060

- Description: Sensitized film and plates, flat, unexposed, of any material except paper, paperboard, or textile; flat printing film, unexposed, whether or not in packages: other printing film

- Total Tax Rate: 58.7%

- Tax Breakdown:

- Base Tariff: 3.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This code applies to unexposed, sensitized film used for printing.

- Proactive Advice: If the film is used for printing or industrial applications, this may be the correct classification.

3. HS Code: 3704000000

- Description: Exposed but undeveloped photographic film

- Total Tax Rate: 55.0%

- Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This code applies to film that has been exposed but not yet developed.

- Proactive Advice: If the film is used in a photographic process and has been exposed, this may be the correct classification.

4. HS Code: 3705000000

- Description: Film (e.g., cellulose acetate film)

- Total Tax Rate: 55.0%

- Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This is a general category for film, including cellulose acetate film.

- Proactive Advice: This may be the most general and likely classification for laminated cellulose acetate film unless it is specifically used for photography or printing.

5. HS Code: 3701996030

- Description: Other photographic film and sensitized plates, not of paper, paperboard, or textile materials, unexposed; instant print plates, sensitized, unexposed, whether or not in packages: other: other: other artistic graphic film

- Total Tax Rate: 55.0%

- Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This code applies to unexposed, sensitized film used for artistic or graphic purposes.

- Proactive Advice: If the film is used for artistic or graphic applications, this may be the correct classification.

📌 Key Takeaways and Recommendations

- Tariff Summary:

- Base Tariff: 0.0% to 3.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Total Tax Rate: 55.0% to 58.7%

-

Time-Sensitive Policy Alert:

-

April 11, 2025 Special Tariff: A 30.0% additional tariff will be applied after this date. Ensure your customs clearance is completed before this date to avoid higher costs.

-

Proactive Actions Required:

- Verify Material and Use: Confirm whether the film is used for photography, printing, or other industrial/artistic purposes.

- Check Certifications: Ensure any required documentation (e.g., material specifications, usage details) is prepared for customs.

- Consult with Customs Broker: For precise classification, especially if the product is used in a specialized application.

Let me know if you need help determining the most accurate HS code based on the product's specific use or composition.

Customer Reviews

No reviews yet.