Found 2 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920730000 | Doc | 57.9% | CN | US | 2025-05-12 |

| 3920795000 | Doc | 58.7% | CN | US | 2025-05-12 |

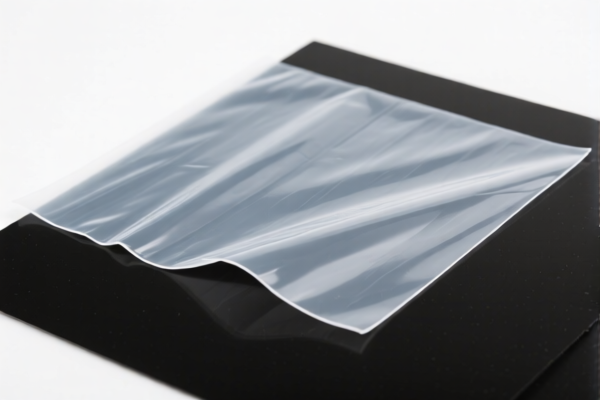

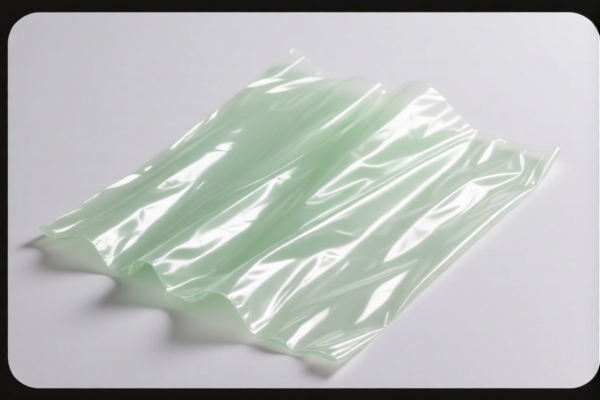

Product Name: Laminated Cellulose Acetate Sheets

HS Code: 3920730000 or 3920795000 (depending on specific product details)

🔍 Classification Overview

- HS Code 3920730000 applies to laminated cellulose acetate sheets, which are made from cellulose acetate (a derivative of cellulose).

- HS Code 3920795000 applies to plastic sheets, plates, films, foils, and strips made from cellulose derivatives, including non-cellulose plastics and non-reinforced plastics.

📊 Tariff Summary (as of now)

For HS Code 3920730000:

- Base Tariff Rate: 2.9%

- Additional Tariff (General): 25.0%

- Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 57.9%

For HS Code 3920795000:

- Base Tariff Rate: 3.7%

- Additional Tariff (General): 25.0%

- Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 58.7%

⏰ Important Policy Notes

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed on these products after April 11, 2025. This is a time-sensitive policy and may significantly increase the total tax burden.

- No Anti-Dumping Duties: As of now, no specific anti-dumping duties are listed for these HS codes.

🛠️ Proactive Advice for Importers

- Verify Material Composition: Confirm whether the product is made from cellulose acetate (HS 3920730000) or other cellulose derivatives (HS 3920795000).

- Check Unit Price and Certification: Ensure that the product meets any customs documentation requirements, such as material certificates or origin declarations.

- Monitor Tariff Updates: Keep an eye on tariff changes after April 11, 2025, as this could affect your import costs significantly.

- Consult a Customs Broker: For complex classifications or large shipments, consider professional customs brokerage support to avoid misclassification penalties.

Let me know if you need help determining which HS code applies to your specific product.

Product Name: Laminated Cellulose Acetate Sheets

HS Code: 3920730000 or 3920795000 (depending on specific product details)

🔍 Classification Overview

- HS Code 3920730000 applies to laminated cellulose acetate sheets, which are made from cellulose acetate (a derivative of cellulose).

- HS Code 3920795000 applies to plastic sheets, plates, films, foils, and strips made from cellulose derivatives, including non-cellulose plastics and non-reinforced plastics.

📊 Tariff Summary (as of now)

For HS Code 3920730000:

- Base Tariff Rate: 2.9%

- Additional Tariff (General): 25.0%

- Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 57.9%

For HS Code 3920795000:

- Base Tariff Rate: 3.7%

- Additional Tariff (General): 25.0%

- Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 58.7%

⏰ Important Policy Notes

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed on these products after April 11, 2025. This is a time-sensitive policy and may significantly increase the total tax burden.

- No Anti-Dumping Duties: As of now, no specific anti-dumping duties are listed for these HS codes.

🛠️ Proactive Advice for Importers

- Verify Material Composition: Confirm whether the product is made from cellulose acetate (HS 3920730000) or other cellulose derivatives (HS 3920795000).

- Check Unit Price and Certification: Ensure that the product meets any customs documentation requirements, such as material certificates or origin declarations.

- Monitor Tariff Updates: Keep an eye on tariff changes after April 11, 2025, as this could affect your import costs significantly.

- Consult a Customs Broker: For complex classifications or large shipments, consider professional customs brokerage support to avoid misclassification penalties.

Let me know if you need help determining which HS code applies to your specific product.

Customer Reviews

No reviews yet.