| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 4412316100 | Doc | 63.0% | CN | US | 2025-05-12 |

| 4412343265 | Doc | 63.0% | CN | US | 2025-05-12 |

| 4412343285 | Doc | 63.0% | CN | US | 2025-05-12 |

| 4412525100 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4412524100 | Doc | 63.0% | CN | US | 2025-05-12 |

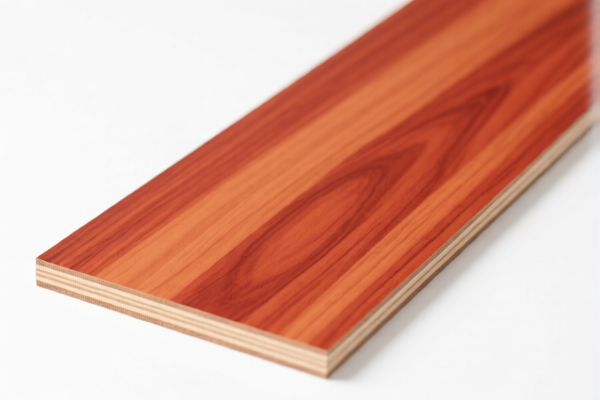

Product Name: Light Red Meranti Veneered Plywood

Classification: HS Code (Harmonized System Code)

Below is the detailed breakdown of the HS codes and associated tariffs for Light Red Meranti Veneered Plywood:

🔍 HS Code Classification Overview

- HS Code 4412.31.61.00

- Base Tariff Rate: 8.0%

- Additional Tariff: 25.0%

- Tariff after April 2, 2025: 30.0%

-

Total Tax Rate: 63.0%

-

HS Code 4412.34.32.65

- Base Tariff Rate: 8.0%

- Additional Tariff: 25.0%

- Tariff after April 2, 2025: 30.0%

-

Total Tax Rate: 63.0%

-

HS Code 4412.34.32.85

- Base Tariff Rate: 8.0%

- Additional Tariff: 25.0%

- Tariff after April 2, 2025: 30.0%

-

Total Tax Rate: 63.0%

-

HS Code 4412.52.51.00

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Tariff after April 2, 2025: 30.0%

-

Total Tax Rate: 55.0%

-

HS Code 4412.52.41.00

- Base Tariff Rate: 8.0%

- Additional Tariff: 25.0%

- Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 63.0%

📌 Key Notes on Tariff Changes

-

April 2, 2025 Tariff Adjustment:

A 30.0% additional tariff will be applied to all the above HS codes after April 2, 2025. This is a time-sensitive policy and must be considered in your import planning. -

Base Tariff Variations:

- Some HS codes (e.g., 4412.52.51.00) have a 0.0% base tariff, which may be due to preferential trade agreements or specific product classifications.

-

Others (e.g., 4412.31.61.00) have an 8.0% base tariff, which is standard for certain types of plywood.

-

No Anti-Dumping or Countervailing Duties Mentioned:

There is no indication of anti-dumping or countervailing duties for this product in the provided data.

🛠️ Proactive Advice for Importers

-

Verify Material and Unit Price:

Confirm the exact composition and specifications of the plywood to ensure correct HS code classification. -

Check Required Certifications:

Some HS codes may require specific documentation (e.g., wood product certifications, origin certificates) to qualify for preferential treatment or to avoid additional tariffs. -

Plan for Tariff Increases:

With the 30.0% additional tariff coming into effect on April 2, 2025, consider adjusting your import timelines or sourcing strategies accordingly. -

Consult a Customs Broker or Trade Compliance Specialist:

For complex or high-value shipments, professional assistance is recommended to ensure full compliance and avoid unexpected costs.

Let me know if you need help determining the most appropriate HS code for your specific product or if you need guidance on documentation requirements.

Product Name: Light Red Meranti Veneered Plywood

Classification: HS Code (Harmonized System Code)

Below is the detailed breakdown of the HS codes and associated tariffs for Light Red Meranti Veneered Plywood:

🔍 HS Code Classification Overview

- HS Code 4412.31.61.00

- Base Tariff Rate: 8.0%

- Additional Tariff: 25.0%

- Tariff after April 2, 2025: 30.0%

-

Total Tax Rate: 63.0%

-

HS Code 4412.34.32.65

- Base Tariff Rate: 8.0%

- Additional Tariff: 25.0%

- Tariff after April 2, 2025: 30.0%

-

Total Tax Rate: 63.0%

-

HS Code 4412.34.32.85

- Base Tariff Rate: 8.0%

- Additional Tariff: 25.0%

- Tariff after April 2, 2025: 30.0%

-

Total Tax Rate: 63.0%

-

HS Code 4412.52.51.00

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Tariff after April 2, 2025: 30.0%

-

Total Tax Rate: 55.0%

-

HS Code 4412.52.41.00

- Base Tariff Rate: 8.0%

- Additional Tariff: 25.0%

- Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 63.0%

📌 Key Notes on Tariff Changes

-

April 2, 2025 Tariff Adjustment:

A 30.0% additional tariff will be applied to all the above HS codes after April 2, 2025. This is a time-sensitive policy and must be considered in your import planning. -

Base Tariff Variations:

- Some HS codes (e.g., 4412.52.51.00) have a 0.0% base tariff, which may be due to preferential trade agreements or specific product classifications.

-

Others (e.g., 4412.31.61.00) have an 8.0% base tariff, which is standard for certain types of plywood.

-

No Anti-Dumping or Countervailing Duties Mentioned:

There is no indication of anti-dumping or countervailing duties for this product in the provided data.

🛠️ Proactive Advice for Importers

-

Verify Material and Unit Price:

Confirm the exact composition and specifications of the plywood to ensure correct HS code classification. -

Check Required Certifications:

Some HS codes may require specific documentation (e.g., wood product certifications, origin certificates) to qualify for preferential treatment or to avoid additional tariffs. -

Plan for Tariff Increases:

With the 30.0% additional tariff coming into effect on April 2, 2025, consider adjusting your import timelines or sourcing strategies accordingly. -

Consult a Customs Broker or Trade Compliance Specialist:

For complex or high-value shipments, professional assistance is recommended to ensure full compliance and avoid unexpected costs.

Let me know if you need help determining the most appropriate HS code for your specific product or if you need guidance on documentation requirements.

Customer Reviews

The information is accurate and detailed, but the layout could be more user-friendly. Still, it’s a great resource for understanding the tariff changes after April 2, 2025.

I was looking for HS codes for Light Red Meranti Veneered Plywood and found exactly what I needed. The 55% tariff for 4412.52.51.00 caught my eye—it’s a game-changer for cost planning.

The HS code breakdown is thorough, but I wish there was a comparison table for the different codes. Still, the tariff info is spot-on and easy to understand.

Clear details on HS Code 4412.31.61.00 for Light Red Meranti Veneered Plywood. The tariff breakdown and upcoming changes are very helpful for planning my imports.