| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5516310510 | Doc | 74.8% | CN | US | 2025-05-12 |

| 5212121010 | Doc | 71.5% | CN | US | 2025-05-12 |

| 5212146010 | Doc | 62.8% | CN | US | 2025-05-12 |

| 5112113060 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5212146010 | Doc | 62.8% | CN | US | 2025-05-12 |

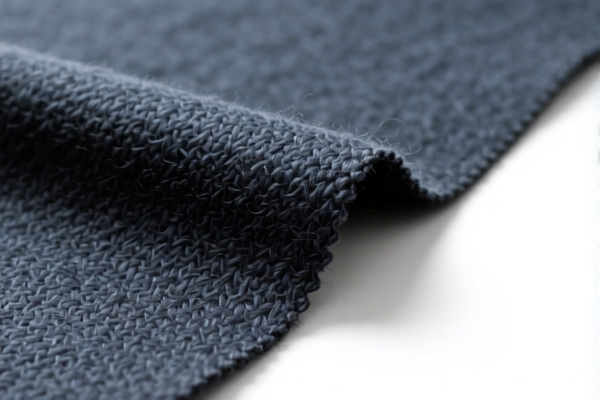

Here is the structured classification and tariff information for the Light duty Wool Blended Fabric based on the provided HS codes and tax details:

✅ HS CODE: 5516.31.05.10

Description:

- Contains less than 85% (by weight) of man-made short staple woven fabric, mainly or solely blended with wool or fine animal hair.

- Not bleached or bleached.

- Contains 36% or more (by weight) of wool or fine animal hair.

- Uncombed.

Tariff Summary:

- Base Tariff Rate: 19.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 74.8%

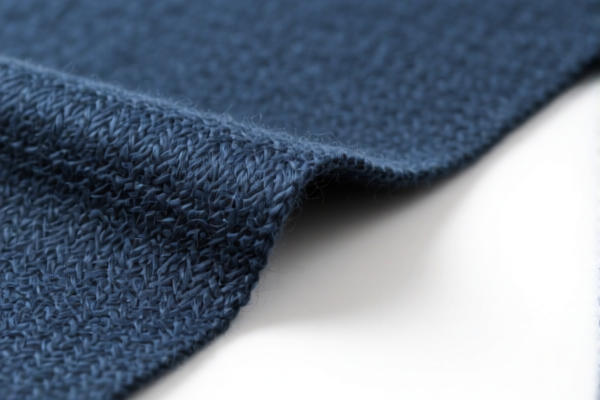

✅ HS CODE: 5212.12.10.10

Description:

- Other cotton woven fabrics, weighing not more than 200 g/m², bleached, containing 36% or more (by weight) of wool or fine animal hair.

- Uncombed.

Tariff Summary:

- Base Tariff Rate: 16.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 71.5%

✅ HS CODE: 5212.14.60.10

Description:

- Cotton woven fabrics, weighing not more than 200 g/m², made from different colored yarns, mainly or solely blended with wool or fine animal hair.

Tariff Summary:

- Base Tariff Rate: 7.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 62.8%

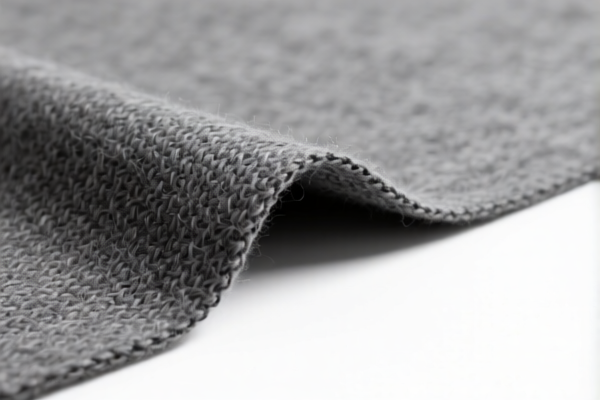

✅ HS CODE: 5112.11.30.60

Description:

- Light weight woven fabric made from combed wool.

Tariff Summary:

- Base Tariff Rate: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 80.0%

⚠️ Important Notes and Recommendations:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. Ensure your customs clearance is completed before this date if you want to avoid the extra cost. -

Material Verification:

Confirm the exact composition of the fabric (e.g., wool percentage, type of fibers used, and whether it is combed or uncombed) to ensure correct HS code classification. -

Certifications:

Check if any certifications (e.g., origin, environmental, or textile standards) are required for import, especially if the product is being imported into specific markets like the EU or US. -

Unit Price and Classification:

The unit price may affect the classification and applicable tariffs. Always verify with a customs broker or classification expert if in doubt.

Let me know if you need help with certification requirements or customs documentation for this product. Here is the structured classification and tariff information for the Light duty Wool Blended Fabric based on the provided HS codes and tax details:

✅ HS CODE: 5516.31.05.10

Description:

- Contains less than 85% (by weight) of man-made short staple woven fabric, mainly or solely blended with wool or fine animal hair.

- Not bleached or bleached.

- Contains 36% or more (by weight) of wool or fine animal hair.

- Uncombed.

Tariff Summary:

- Base Tariff Rate: 19.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 74.8%

✅ HS CODE: 5212.12.10.10

Description:

- Other cotton woven fabrics, weighing not more than 200 g/m², bleached, containing 36% or more (by weight) of wool or fine animal hair.

- Uncombed.

Tariff Summary:

- Base Tariff Rate: 16.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 71.5%

✅ HS CODE: 5212.14.60.10

Description:

- Cotton woven fabrics, weighing not more than 200 g/m², made from different colored yarns, mainly or solely blended with wool or fine animal hair.

Tariff Summary:

- Base Tariff Rate: 7.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 62.8%

✅ HS CODE: 5112.11.30.60

Description:

- Light weight woven fabric made from combed wool.

Tariff Summary:

- Base Tariff Rate: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 80.0%

⚠️ Important Notes and Recommendations:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. Ensure your customs clearance is completed before this date if you want to avoid the extra cost. -

Material Verification:

Confirm the exact composition of the fabric (e.g., wool percentage, type of fibers used, and whether it is combed or uncombed) to ensure correct HS code classification. -

Certifications:

Check if any certifications (e.g., origin, environmental, or textile standards) are required for import, especially if the product is being imported into specific markets like the EU or US. -

Unit Price and Classification:

The unit price may affect the classification and applicable tariffs. Always verify with a customs broker or classification expert if in doubt.

Let me know if you need help with certification requirements or customs documentation for this product.

Customer Reviews

No reviews yet.