| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5112203000 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5112909010 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5212151020 | Doc | 55.0% | CN | US | 2025-05-12 |

| 5111196020 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5210496090 | Doc | 65.4% | CN | US | 2025-05-12 |

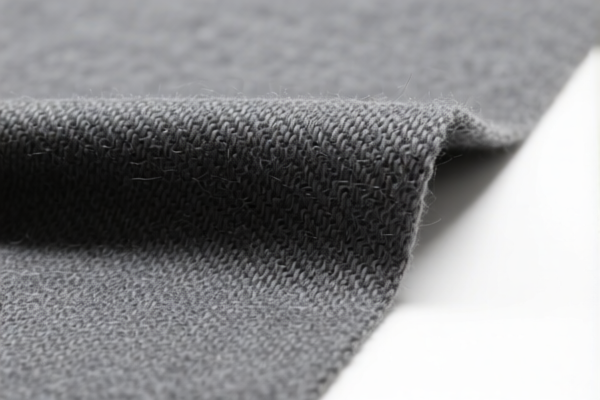

Here is the structured classification and tariff information for the Lightweight Combed Wool Blend Fabric based on the provided HS codes and tax details:

✅ HS CODE: 5112203000

Product Description: Mixed combed wool lightweight fabric

Total Tax Rate: 80.0%

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This product is subject to the April 11 Special Tariff and additional tariffs.

✅ HS CODE: 5112909010

Product Description: Cotton-blend combed wool lightweight fabric

Total Tax Rate: 80.0%

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Same as above, subject to April 11 Special Tariff and additional tariffs.

✅ HS CODE: 5212151020

Product Description: Lightweight printed combed cotton wool blend fabric

Total Tax Rate: 55.0%

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This product is not subject to base tariff, but still subject to additional tariffs and April 11 Special Tariff.

✅ HS CODE: 5111196020

Product Description: Lightweight combed fine wool fabric

Total Tax Rate: 80.0%

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Subject to April 11 Special Tariff and additional tariffs.

✅ HS CODE: 5210496090

Product Description: Lightweight blended cotton fabric

Total Tax Rate: 65.4%

- Base Tariff: 10.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Subject to additional tariffs and April 11 Special Tariff.

📌 Proactive Advice:

- Verify Material Composition: Ensure the fabric composition (e.g., wool percentage, cotton blend ratio) matches the HS code classification.

- Check Unit Price: Tariff rates may vary based on the declared value and product classification.

- Certifications Required: Confirm if any certifications (e.g., textile standards, origin documentation) are needed for customs clearance.

- April 11, 2025 Deadline: Be aware of the special tariff increase after this date. Plan your import schedule accordingly.

Let me know if you need help with HS code selection or customs documentation. Here is the structured classification and tariff information for the Lightweight Combed Wool Blend Fabric based on the provided HS codes and tax details:

✅ HS CODE: 5112203000

Product Description: Mixed combed wool lightweight fabric

Total Tax Rate: 80.0%

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This product is subject to the April 11 Special Tariff and additional tariffs.

✅ HS CODE: 5112909010

Product Description: Cotton-blend combed wool lightweight fabric

Total Tax Rate: 80.0%

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Same as above, subject to April 11 Special Tariff and additional tariffs.

✅ HS CODE: 5212151020

Product Description: Lightweight printed combed cotton wool blend fabric

Total Tax Rate: 55.0%

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This product is not subject to base tariff, but still subject to additional tariffs and April 11 Special Tariff.

✅ HS CODE: 5111196020

Product Description: Lightweight combed fine wool fabric

Total Tax Rate: 80.0%

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Subject to April 11 Special Tariff and additional tariffs.

✅ HS CODE: 5210496090

Product Description: Lightweight blended cotton fabric

Total Tax Rate: 65.4%

- Base Tariff: 10.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Subject to additional tariffs and April 11 Special Tariff.

📌 Proactive Advice:

- Verify Material Composition: Ensure the fabric composition (e.g., wool percentage, cotton blend ratio) matches the HS code classification.

- Check Unit Price: Tariff rates may vary based on the declared value and product classification.

- Certifications Required: Confirm if any certifications (e.g., textile standards, origin documentation) are needed for customs clearance.

- April 11, 2025 Deadline: Be aware of the special tariff increase after this date. Plan your import schedule accordingly.

Let me know if you need help with HS code selection or customs documentation.

Customer Reviews

No reviews yet.