| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5112303000 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5112909010 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5212151020 | Doc | 55.0% | CN | US | 2025-05-12 |

| 5408311000 | Doc | 67.0% | CN | US | 2025-05-12 |

| 5212151020 | Doc | 55.0% | CN | US | 2025-05-12 |

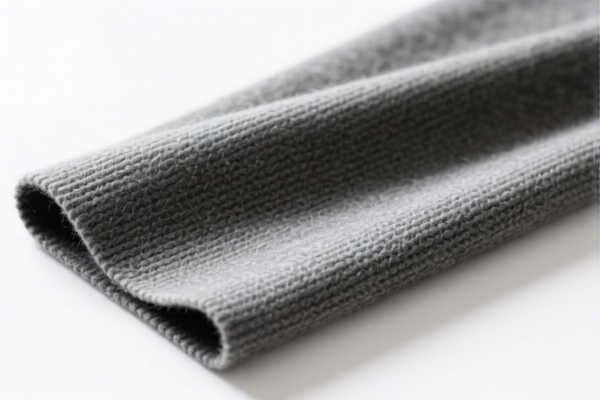

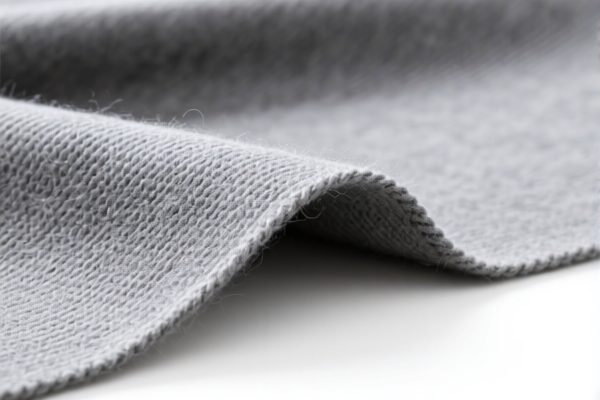

Here is the structured classification and tariff information for the Lightweight Combed Wool Blend Fabric for Shirts, based on the provided HS codes and tax details:

✅ HS CODE: 5112303000

Product Description: Mixed combed wool and wool blend fabric

Total Tax Rate: 80.0%

- Base Tariff Rate: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to general wool blends, not specifically for shirts.

✅ HS CODE: 5112909010

Product Description: Combed wool and cotton blend fabric for shirts

Total Tax Rate: 80.0%

- Base Tariff Rate: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a more specific code for shirt fabric made from wool and cotton blends.

✅ HS CODE: 5212151020

Product Description: Lightweight printed combed cotton and wool blend fabric

Total Tax Rate: 55.0%

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to cotton and wool blends, and may be more suitable if the fabric is primarily cotton with wool content.

✅ HS CODE: 5408311000

Product Description: Wool blend lightweight lining fabric

Total Tax Rate: 67.0%

- Base Tariff Rate: 12.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is for lining fabric, not for shirts, and may not be the best fit for your product.

📌 Key Observations and Recommendations:

- Best Fit:

- HS CODE 5112909010 is the most appropriate for shirt fabric made from combed wool and cotton blends.

-

HS CODE 5212151020 is also a strong candidate if the fabric is cotton-based with wool content.

-

Tariff Changes After April 11, 2025:

- All listed codes will face an additional 30.0% tariff after this date.

-

This is a time-sensitive policy, so plan your import schedule accordingly.

-

Anti-Dumping Duties:

- No specific anti-dumping duties are mentioned for this product category in the provided data.

-

However, always verify with customs or a compliance expert if the product is subject to anti-dumping or countervailing duties.

-

Proactive Actions Required:

- Verify the fabric composition (e.g., wool percentage, cotton percentage, and any other fibers).

- Check the unit price to ensure it aligns with the HS code classification.

- Confirm required certifications (e.g., origin, textile certifications, etc.) for customs clearance.

- Review the product’s end use (e.g., for shirts, lining, or other purposes) to ensure correct classification.

Let me know if you need help selecting the most accurate HS code based on your fabric’s exact composition and intended use. Here is the structured classification and tariff information for the Lightweight Combed Wool Blend Fabric for Shirts, based on the provided HS codes and tax details:

✅ HS CODE: 5112303000

Product Description: Mixed combed wool and wool blend fabric

Total Tax Rate: 80.0%

- Base Tariff Rate: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to general wool blends, not specifically for shirts.

✅ HS CODE: 5112909010

Product Description: Combed wool and cotton blend fabric for shirts

Total Tax Rate: 80.0%

- Base Tariff Rate: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a more specific code for shirt fabric made from wool and cotton blends.

✅ HS CODE: 5212151020

Product Description: Lightweight printed combed cotton and wool blend fabric

Total Tax Rate: 55.0%

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to cotton and wool blends, and may be more suitable if the fabric is primarily cotton with wool content.

✅ HS CODE: 5408311000

Product Description: Wool blend lightweight lining fabric

Total Tax Rate: 67.0%

- Base Tariff Rate: 12.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is for lining fabric, not for shirts, and may not be the best fit for your product.

📌 Key Observations and Recommendations:

- Best Fit:

- HS CODE 5112909010 is the most appropriate for shirt fabric made from combed wool and cotton blends.

-

HS CODE 5212151020 is also a strong candidate if the fabric is cotton-based with wool content.

-

Tariff Changes After April 11, 2025:

- All listed codes will face an additional 30.0% tariff after this date.

-

This is a time-sensitive policy, so plan your import schedule accordingly.

-

Anti-Dumping Duties:

- No specific anti-dumping duties are mentioned for this product category in the provided data.

-

However, always verify with customs or a compliance expert if the product is subject to anti-dumping or countervailing duties.

-

Proactive Actions Required:

- Verify the fabric composition (e.g., wool percentage, cotton percentage, and any other fibers).

- Check the unit price to ensure it aligns with the HS code classification.

- Confirm required certifications (e.g., origin, textile certifications, etc.) for customs clearance.

- Review the product’s end use (e.g., for shirts, lining, or other purposes) to ensure correct classification.

Let me know if you need help selecting the most accurate HS code based on your fabric’s exact composition and intended use.

Customer Reviews

No reviews yet.