| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5112203000 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5516320520 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5112909010 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5112113060 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5111909000 | Doc | 80.0% | CN | US | 2025-05-12 |

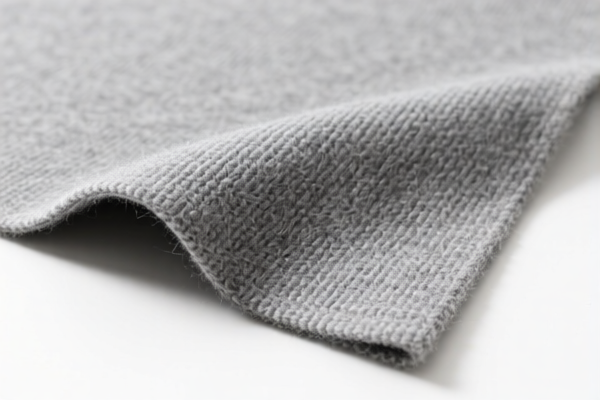

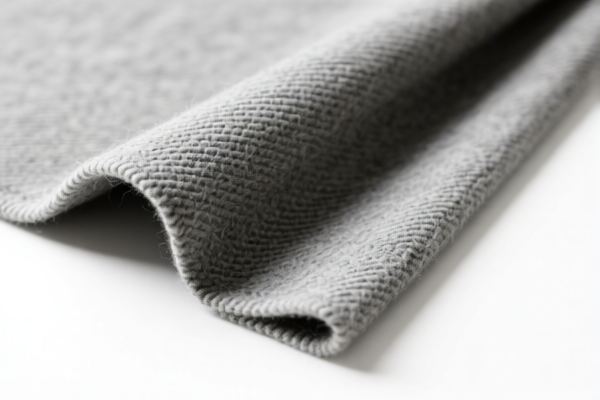

Product Name: Lightweight Combed Wool Blend Lining Fabric

Classification HS Codes and Tax Information:

✅ HS CODE: 5112203000

Description: Mixed combed wool blend lining fabric.

- Material: Combed wool blended with man-made fibers.

- Fabric Type: Woven fabric, suitable for lining.

- Tariff Summary:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax: 80.0%

✅ HS CODE: 5516320520

Description: Combed wool blend lining fabric with synthetic short fibers.

- Material: Wool or fine animal hair blended with synthetic short fibers (≤85% by weight).

- Fabric Type: Woven, dyed, combed, suitable for lining.

- Tariff Summary:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax: 80.0%

✅ HS CODE: 5112909010

Description: Cotton-blend combed wool lining fabric.

- Material: Combed wool blended with cotton.

- Fabric Type: Woven fabric, suitable for lining.

- Tariff Summary:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax: 80.0%

✅ HS CODE: 5112113060

Description: Lightweight combed wool lining fabric.

- Material: Combed wool or fine animal hair.

- Fabric Type: Woven fabric, lightweight (≤200g/m²), suitable for lining.

- Tariff Summary:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax: 80.0%

✅ HS CODE: 5111909000

Description: Combed wool lining fabric.

- Material: Combed wool or fine animal hair.

- Fabric Type: Woven, carded wool fabric, suitable for lining.

- Tariff Summary:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax: 80.0%

📌 Important Notes and Recommendations:

- Tariff Increase Alert:

-

A special tariff of 30.0% will be applied after April 11, 2025. Ensure your import timeline is planned accordingly.

-

Material Verification:

-

Confirm the exact composition (e.g., wool percentage, blend with cotton or synthetic fibers) to ensure correct HS code classification.

-

Certifications Required:

-

Check if certifications (e.g., origin, textile compliance, environmental standards) are required for import.

-

Unit Price and Tax Calculation:

-

Verify the unit price and total value of the goods to calculate the correct tax amount.

-

Customs Declaration:

- Provide detailed product descriptions, including fabric weight, finish (e.g., dyed, combed), and intended use (e.g., lining).

If you need further assistance with HS code verification or customs documentation, feel free to provide more product details.

Product Name: Lightweight Combed Wool Blend Lining Fabric

Classification HS Codes and Tax Information:

✅ HS CODE: 5112203000

Description: Mixed combed wool blend lining fabric.

- Material: Combed wool blended with man-made fibers.

- Fabric Type: Woven fabric, suitable for lining.

- Tariff Summary:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax: 80.0%

✅ HS CODE: 5516320520

Description: Combed wool blend lining fabric with synthetic short fibers.

- Material: Wool or fine animal hair blended with synthetic short fibers (≤85% by weight).

- Fabric Type: Woven, dyed, combed, suitable for lining.

- Tariff Summary:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax: 80.0%

✅ HS CODE: 5112909010

Description: Cotton-blend combed wool lining fabric.

- Material: Combed wool blended with cotton.

- Fabric Type: Woven fabric, suitable for lining.

- Tariff Summary:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax: 80.0%

✅ HS CODE: 5112113060

Description: Lightweight combed wool lining fabric.

- Material: Combed wool or fine animal hair.

- Fabric Type: Woven fabric, lightweight (≤200g/m²), suitable for lining.

- Tariff Summary:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax: 80.0%

✅ HS CODE: 5111909000

Description: Combed wool lining fabric.

- Material: Combed wool or fine animal hair.

- Fabric Type: Woven, carded wool fabric, suitable for lining.

- Tariff Summary:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax: 80.0%

📌 Important Notes and Recommendations:

- Tariff Increase Alert:

-

A special tariff of 30.0% will be applied after April 11, 2025. Ensure your import timeline is planned accordingly.

-

Material Verification:

-

Confirm the exact composition (e.g., wool percentage, blend with cotton or synthetic fibers) to ensure correct HS code classification.

-

Certifications Required:

-

Check if certifications (e.g., origin, textile compliance, environmental standards) are required for import.

-

Unit Price and Tax Calculation:

-

Verify the unit price and total value of the goods to calculate the correct tax amount.

-

Customs Declaration:

- Provide detailed product descriptions, including fabric weight, finish (e.g., dyed, combed), and intended use (e.g., lining).

If you need further assistance with HS code verification or customs documentation, feel free to provide more product details.

Customer Reviews

No reviews yet.