| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5112196050 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5112199530 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5111909000 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5112113060 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5112199510 | Doc | 80.0% | CN | US | 2025-05-12 |

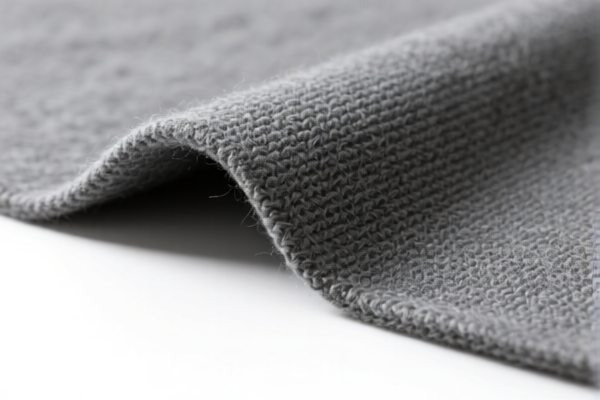

Here is the structured classification and tariff information for the Lightweight Combed Wool Inner Lining Fabric based on the provided HS codes and tax details:

✅ HS CODE: 5112196050

Product Description: Lightweight Wool Inner Lining Fabric

Total Tax Rate: 80.0%

Breakdown of Tariffs:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code is specifically for lightweight wool inner lining fabric.

✅ HS CODE: 5112199530

Product Description: Combed Wool Inner Lining Fabric

Total Tax Rate: 80.0%

Breakdown of Tariffs:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code is for combed wool inner lining fabric, likely with specific finishing or composition.

✅ HS CODE: 5111909000

Product Description: Combed Wool Inner Lining Fabric

Total Tax Rate: 80.0%

Breakdown of Tariffs:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code is for combed wool fabric, possibly with a broader application than the more specific 511219 codes.

✅ HS CODE: 5112113060

Product Description: Light Wool Inner Lining Fabric

Total Tax Rate: 80.0%

Breakdown of Tariffs:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code is for light-weight wool fabric suitable for inner lining.

✅ HS CODE: 5112199510

Product Description: Combed Wool Weaving Fabric – Lightweight Inner Lining

Total Tax Rate: 80.0%

Breakdown of Tariffs:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code is for combed wool woven fabric used as lightweight inner lining.

📌 Key Observations:

- All listed HS codes have the same total tax rate of 80.0%, which is the sum of:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

-

Special Tariff after April 11, 2025: 30.0%

-

April 11, 2025 Special Tariff: A significant increase in tariffs is scheduled to take effect after this date. Ensure your customs clearance is completed before this date to avoid the higher rate.

-

No Anti-Dumping Duties Mentioned: Based on the provided data, there are no specific anti-dumping duties listed for this product category.

🛑 Proactive Advice:

- Verify Material Composition: Confirm that the fabric is indeed made of combed wool and not a blend or synthetic material, as this can affect classification.

- Check Unit Price: The tax rate may be influenced by the declared value, so ensure the unit price is accurate.

- Certifications Required: Some countries may require specific certifications (e.g., origin, wool content, or environmental compliance) for importation.

- Consult a Customs Broker: For complex or high-value shipments, it's advisable to work with a customs broker to ensure compliance and avoid delays.

Let me know if you need help selecting the most appropriate HS code for your specific product. Here is the structured classification and tariff information for the Lightweight Combed Wool Inner Lining Fabric based on the provided HS codes and tax details:

✅ HS CODE: 5112196050

Product Description: Lightweight Wool Inner Lining Fabric

Total Tax Rate: 80.0%

Breakdown of Tariffs:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code is specifically for lightweight wool inner lining fabric.

✅ HS CODE: 5112199530

Product Description: Combed Wool Inner Lining Fabric

Total Tax Rate: 80.0%

Breakdown of Tariffs:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code is for combed wool inner lining fabric, likely with specific finishing or composition.

✅ HS CODE: 5111909000

Product Description: Combed Wool Inner Lining Fabric

Total Tax Rate: 80.0%

Breakdown of Tariffs:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code is for combed wool fabric, possibly with a broader application than the more specific 511219 codes.

✅ HS CODE: 5112113060

Product Description: Light Wool Inner Lining Fabric

Total Tax Rate: 80.0%

Breakdown of Tariffs:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code is for light-weight wool fabric suitable for inner lining.

✅ HS CODE: 5112199510

Product Description: Combed Wool Weaving Fabric – Lightweight Inner Lining

Total Tax Rate: 80.0%

Breakdown of Tariffs:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code is for combed wool woven fabric used as lightweight inner lining.

📌 Key Observations:

- All listed HS codes have the same total tax rate of 80.0%, which is the sum of:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

-

Special Tariff after April 11, 2025: 30.0%

-

April 11, 2025 Special Tariff: A significant increase in tariffs is scheduled to take effect after this date. Ensure your customs clearance is completed before this date to avoid the higher rate.

-

No Anti-Dumping Duties Mentioned: Based on the provided data, there are no specific anti-dumping duties listed for this product category.

🛑 Proactive Advice:

- Verify Material Composition: Confirm that the fabric is indeed made of combed wool and not a blend or synthetic material, as this can affect classification.

- Check Unit Price: The tax rate may be influenced by the declared value, so ensure the unit price is accurate.

- Certifications Required: Some countries may require specific certifications (e.g., origin, wool content, or environmental compliance) for importation.

- Consult a Customs Broker: For complex or high-value shipments, it's advisable to work with a customs broker to ensure compliance and avoid delays.

Let me know if you need help selecting the most appropriate HS code for your specific product.

Customer Reviews

No reviews yet.