Found 3 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921901500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921901910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

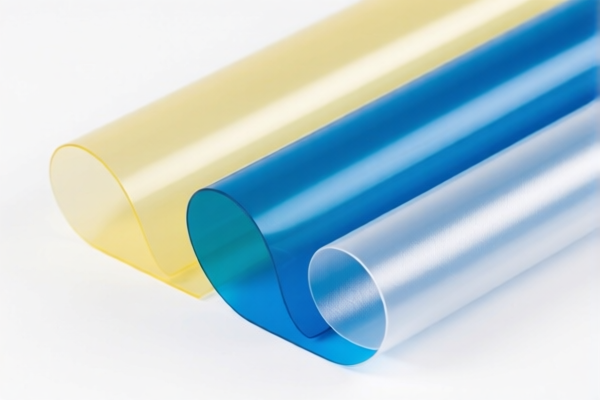

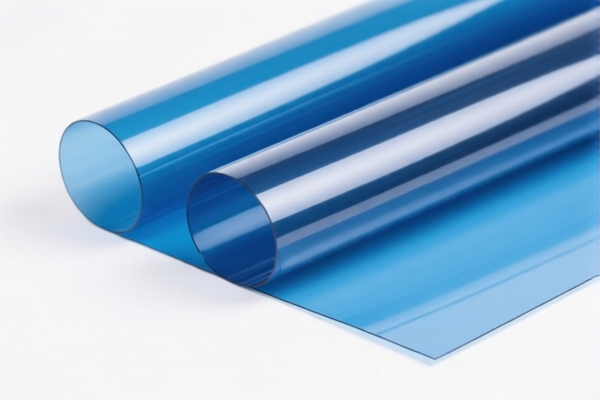

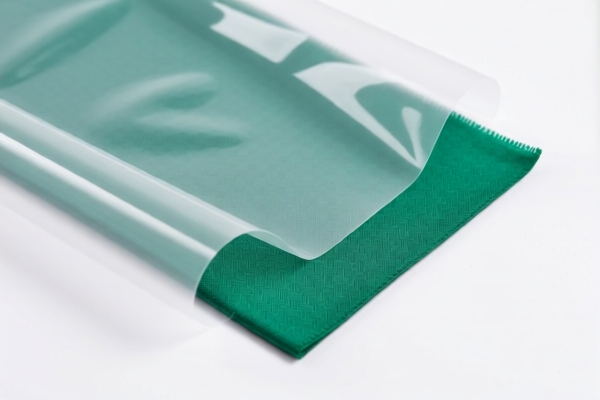

Product Classification: Lightweight Textile Composite Plastic Films

HS CODEs and Tax Details:

- HS CODE: 3921901500

- Description: Films made of plastic combined with textile materials, weighing no more than 1.492 kg/m², with synthetic fibers as the main component.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

-

Key Notes:

- This code applies specifically to films with synthetic fibers as the dominant component.

- Ensure the product description and composition match this classification.

-

HS CODE: 3921901910

- Description: Plastic sheets, plates, films, foils, and strips combined with other textile materials, weighing no more than 1.492 kg/m², with textile content exceeding any single textile fiber.

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

-

Key Notes:

- This code is for products where the textile component is not dominated by a single fiber type.

- Confirm the textile composition and weight per square meter to avoid misclassification.

-

HS CODE: 3921902900

- Description: Films made of plastic combined with textile materials.

- Total Tax Rate: 59.4%

- Breakdown:

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Key Notes:

- This is a general category for composite films with plastic and textile materials.

- May apply to a broader range of products, so ensure the specific composition and weight are verified.

Proactive Advice:

- Verify Material Composition: Confirm the exact percentage of textile and plastic components, especially whether synthetic or natural fibers dominate.

- Check Weight Per Square Meter: Ensure the product weight does not exceed 1.492 kg/m², as this is a critical classification criterion.

- Review Tariff Changes: Be aware that additional tariffs of 30.0% will apply after April 2, 2025.

- Certifications Required: Depending on the destination country, you may need to provide documentation such as material composition certificates or compliance with textile regulations.

-

Consult Customs Authority: For high-value or complex products, consider consulting local customs or a customs broker to ensure accurate classification and avoid delays. Product Classification: Lightweight Textile Composite Plastic Films

HS CODEs and Tax Details: -

HS CODE: 3921901500

- Description: Films made of plastic combined with textile materials, weighing no more than 1.492 kg/m², with synthetic fibers as the main component.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

-

Key Notes:

- This code applies specifically to films with synthetic fibers as the dominant component.

- Ensure the product description and composition match this classification.

-

HS CODE: 3921901910

- Description: Plastic sheets, plates, films, foils, and strips combined with other textile materials, weighing no more than 1.492 kg/m², with textile content exceeding any single textile fiber.

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

-

Key Notes:

- This code is for products where the textile component is not dominated by a single fiber type.

- Confirm the textile composition and weight per square meter to avoid misclassification.

-

HS CODE: 3921902900

- Description: Films made of plastic combined with textile materials.

- Total Tax Rate: 59.4%

- Breakdown:

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Key Notes:

- This is a general category for composite films with plastic and textile materials.

- May apply to a broader range of products, so ensure the specific composition and weight are verified.

Proactive Advice:

- Verify Material Composition: Confirm the exact percentage of textile and plastic components, especially whether synthetic or natural fibers dominate.

- Check Weight Per Square Meter: Ensure the product weight does not exceed 1.492 kg/m², as this is a critical classification criterion.

- Review Tariff Changes: Be aware that additional tariffs of 30.0% will apply after April 2, 2025.

- Certifications Required: Depending on the destination country, you may need to provide documentation such as material composition certificates or compliance with textile regulations.

- Consult Customs Authority: For high-value or complex products, consider consulting local customs or a customs broker to ensure accurate classification and avoid delays.

Customer Reviews

No reviews yet.