| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921901500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

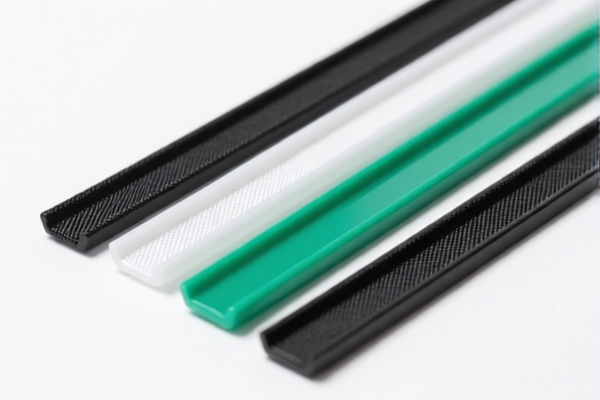

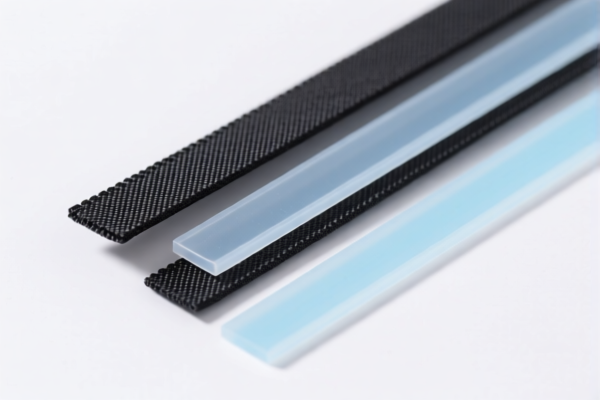

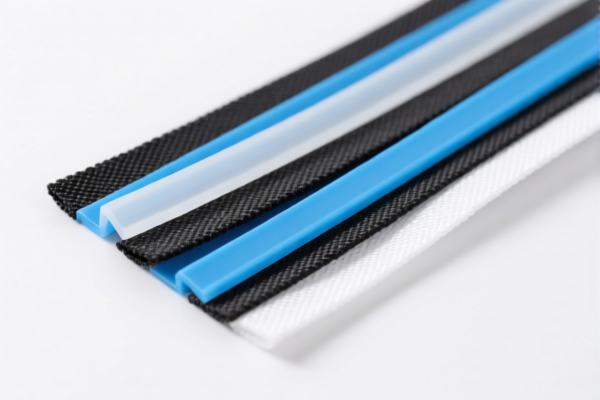

Product Name: Lightweight Textile Composite Plastic Strips

Classification HS Code: 3921902900 (Primary Code)

Note: Based on the product description, 3921902900 is the most appropriate HS code for "textile composite plastic strips" that are other plastic sheets, films, foils, and strips combined with other materials, with a weight exceeding 1.492 kg/m².

🔍 HS CODE: 3921902900

Description:

- Other plastic sheets, films, foils, and strips combined with other materials, with a weight exceeding 1.492 kg/m².

📊 Tariff Breakdown (as of now):

- Base Tariff Rate: 4.4%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff Rate: 59.4%

⚠️ Important Notes and Alerts:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed after April 11, 2025. This is a time-sensitive policy and may significantly increase the total import cost. -

Anti-dumping duties:

Not specifically mentioned for this product, but anti-dumping duties on iron and aluminum may apply to related products. Confirm with customs or a compliance expert if your product contains such materials.

📌 Proactive Advice for Importers:

-

Verify Material Composition:

Ensure the product is indeed a textile composite plastic strip with a weight exceeding 1.492 kg/m². This is critical for correct HS code classification. -

Check Unit Price and Weight:

Confirm the weight per square meter and unit price to ensure compliance with the HS code description. -

Certifications Required:

Some products may require import licenses, technical specifications, or certifications (e.g., REACH, RoHS, etc.) depending on the destination country. -

Consult Customs Authority:

For the most up-to-date and accurate tariff information, always cross-check with the local customs authority or a certified customs broker.

✅ Summary of Tax Rates:

| Tariff Type | Rate |

|---|---|

| Base Tariff | 4.4% |

| General Additional Tariff | 25.0% |

| April 11, 2025 Tariff | 30.0% |

| Total Tariff | 59.4% |

If you have more details about the material composition, weight, or intended use, I can help refine the classification further.

Product Name: Lightweight Textile Composite Plastic Strips

Classification HS Code: 3921902900 (Primary Code)

Note: Based on the product description, 3921902900 is the most appropriate HS code for "textile composite plastic strips" that are other plastic sheets, films, foils, and strips combined with other materials, with a weight exceeding 1.492 kg/m².

🔍 HS CODE: 3921902900

Description:

- Other plastic sheets, films, foils, and strips combined with other materials, with a weight exceeding 1.492 kg/m².

📊 Tariff Breakdown (as of now):

- Base Tariff Rate: 4.4%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff Rate: 59.4%

⚠️ Important Notes and Alerts:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed after April 11, 2025. This is a time-sensitive policy and may significantly increase the total import cost. -

Anti-dumping duties:

Not specifically mentioned for this product, but anti-dumping duties on iron and aluminum may apply to related products. Confirm with customs or a compliance expert if your product contains such materials.

📌 Proactive Advice for Importers:

-

Verify Material Composition:

Ensure the product is indeed a textile composite plastic strip with a weight exceeding 1.492 kg/m². This is critical for correct HS code classification. -

Check Unit Price and Weight:

Confirm the weight per square meter and unit price to ensure compliance with the HS code description. -

Certifications Required:

Some products may require import licenses, technical specifications, or certifications (e.g., REACH, RoHS, etc.) depending on the destination country. -

Consult Customs Authority:

For the most up-to-date and accurate tariff information, always cross-check with the local customs authority or a certified customs broker.

✅ Summary of Tax Rates:

| Tariff Type | Rate |

|---|---|

| Base Tariff | 4.4% |

| General Additional Tariff | 25.0% |

| April 11, 2025 Tariff | 30.0% |

| Total Tariff | 59.4% |

If you have more details about the material composition, weight, or intended use, I can help refine the classification further.

Customer Reviews

No reviews yet.