| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921901500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921901910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921190090 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

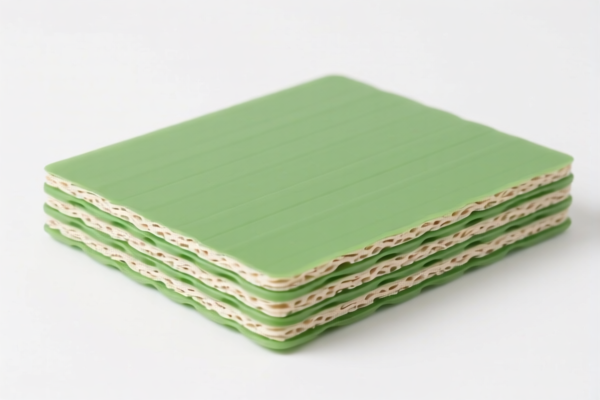

Product Classification: Lightweight Textile Plastic Boards

HS CODE: 3921901500, 3921901910, 3921190090, 3921902900

🔍 Classification Overview

Your product, "Lightweight Textile Plastic Boards", is classified under Chapter 3921 of the Harmonized System (HS), which covers Plastics and articles thereof. Specifically, it falls under the following HS codes depending on the exact composition and weight of the textile component:

- 3921901500: Plastic boards combined with textile materials (textile component is the heaviest single fiber).

- 3921901910: Plastic boards combined with textile materials (textile component is the heaviest overall, with weight ≤1.492 kg/m²).

- 3921190090: Other plastic boards, including porous ones (not textile-composite).

- 3921902900: Plastic boards combined with other materials (textile or otherwise), with weight >1.492 kg/m².

📊 Tariff Summary (as of now)

| HS Code | Base Tariff | Additional Tariff | April 11, 2025 Special Tariff | Total Tax Rate |

|---|---|---|---|---|

| 3921901500 | 6.5% | 25.0% | 30.0% | 61.5% |

| 3921901910 | 5.3% | 25.0% | 30.0% | 60.3% |

| 3921190090 | 6.5% | 25.0% | 30.0% | 61.5% |

| 3921902900 | 4.4% | 25.0% | 30.0% | 59.4% |

⚠️ Important Notes on Tariffs

- Additional Tariffs (25.0%): These are standard additional tariffs applied to all imports under this category.

- April 11, 2025 Special Tariff (30.0%): A new layer of tariffs will be imposed after April 11, 2025, increasing the total tax burden significantly.

- No Anti-Dumping Duties Listed: As of now, no specific anti-dumping duties are listed for this product category (but always verify with customs or a trade compliance expert).

📌 Proactive Advice for Importers

- Verify Material Composition: Ensure the textile component is the heaviest by weight (for 3921901500 and 3921901910).

- Check Weight per Square Meter: If the textile component is ≤1.492 kg/m², it may fall under 3921901910; otherwise, it may be 3921902900.

- Confirm Unit Price and Certification: Some products may require specific certifications (e.g., REACH, RoHS) depending on the end-use.

- Monitor Tariff Changes: The April 11, 2025 tariff increase is time-sensitive. Plan your import schedule accordingly.

- Consult Customs or Trade Compliance Experts: For complex classifications or high-value shipments.

📚 Example Clarification

If your product is a lightweight board made of plastic and cotton fabric, with the cotton being the heaviest component, and weight per square meter is 1.2 kg, it would likely fall under HS Code 3921901910 with a total tax rate of 60.3%.

Let me know if you need help determining the exact HS code for your specific product or if you need assistance with customs documentation.

Product Classification: Lightweight Textile Plastic Boards

HS CODE: 3921901500, 3921901910, 3921190090, 3921902900

🔍 Classification Overview

Your product, "Lightweight Textile Plastic Boards", is classified under Chapter 3921 of the Harmonized System (HS), which covers Plastics and articles thereof. Specifically, it falls under the following HS codes depending on the exact composition and weight of the textile component:

- 3921901500: Plastic boards combined with textile materials (textile component is the heaviest single fiber).

- 3921901910: Plastic boards combined with textile materials (textile component is the heaviest overall, with weight ≤1.492 kg/m²).

- 3921190090: Other plastic boards, including porous ones (not textile-composite).

- 3921902900: Plastic boards combined with other materials (textile or otherwise), with weight >1.492 kg/m².

📊 Tariff Summary (as of now)

| HS Code | Base Tariff | Additional Tariff | April 11, 2025 Special Tariff | Total Tax Rate |

|---|---|---|---|---|

| 3921901500 | 6.5% | 25.0% | 30.0% | 61.5% |

| 3921901910 | 5.3% | 25.0% | 30.0% | 60.3% |

| 3921190090 | 6.5% | 25.0% | 30.0% | 61.5% |

| 3921902900 | 4.4% | 25.0% | 30.0% | 59.4% |

⚠️ Important Notes on Tariffs

- Additional Tariffs (25.0%): These are standard additional tariffs applied to all imports under this category.

- April 11, 2025 Special Tariff (30.0%): A new layer of tariffs will be imposed after April 11, 2025, increasing the total tax burden significantly.

- No Anti-Dumping Duties Listed: As of now, no specific anti-dumping duties are listed for this product category (but always verify with customs or a trade compliance expert).

📌 Proactive Advice for Importers

- Verify Material Composition: Ensure the textile component is the heaviest by weight (for 3921901500 and 3921901910).

- Check Weight per Square Meter: If the textile component is ≤1.492 kg/m², it may fall under 3921901910; otherwise, it may be 3921902900.

- Confirm Unit Price and Certification: Some products may require specific certifications (e.g., REACH, RoHS) depending on the end-use.

- Monitor Tariff Changes: The April 11, 2025 tariff increase is time-sensitive. Plan your import schedule accordingly.

- Consult Customs or Trade Compliance Experts: For complex classifications or high-value shipments.

📚 Example Clarification

If your product is a lightweight board made of plastic and cotton fabric, with the cotton being the heaviest component, and weight per square meter is 1.2 kg, it would likely fall under HS Code 3921901910 with a total tax rate of 60.3%.

Let me know if you need help determining the exact HS code for your specific product or if you need assistance with customs documentation.

Customer Reviews

No reviews yet.