| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921902510 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

| 3921902100 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921901500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 7019905150 | Doc | 59.3% | CN | US | 2025-05-12 |

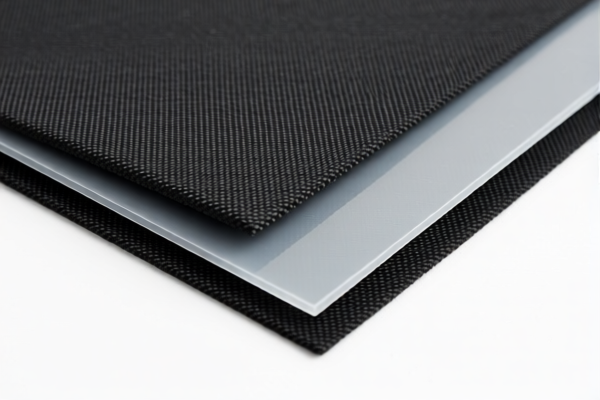

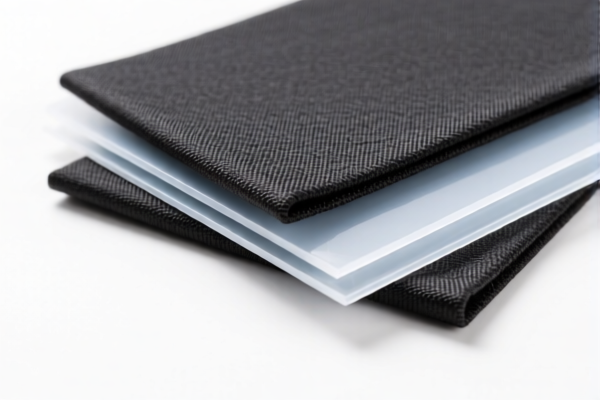

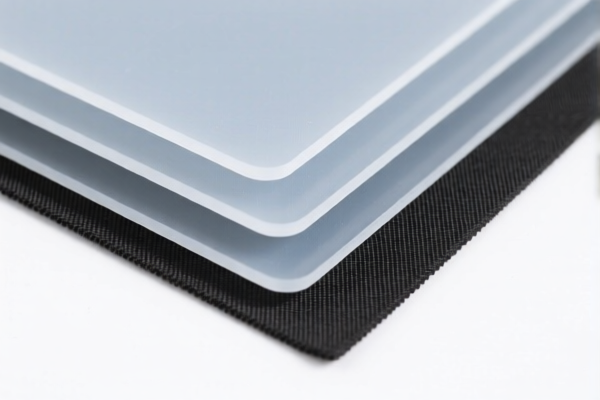

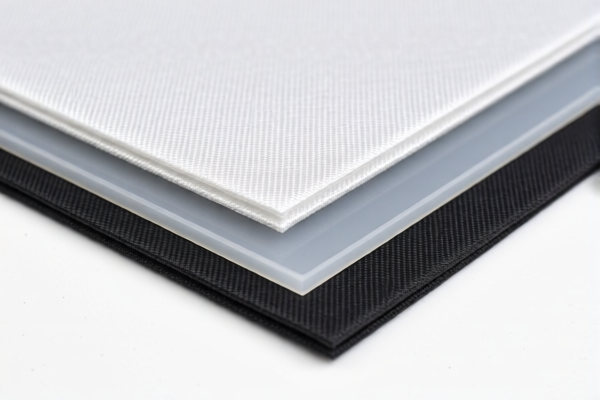

✅ Product Classification: Lightweight Textile Reinforced Plastic Sheets

Below is the detailed classification and tariff information for the product "Lightweight Textile Reinforced Plastic Sheets" based on the provided HS codes and tax details.

📦 HS CODE Classification Overview

| HS CODE | Description | Total Tax Rate | Base Tariff | Additional Tariff | April 11, 2025 Special Tariff |

|---|---|---|---|---|---|

| 3921902510 | Textile-reinforced plastic sheets | 61.5% | 6.5% | 25.0% | 30.0% |

| 3921902900 | Fiber-reinforced textile plastic sheets | 59.4% | 4.4% | 25.0% | 30.0% |

| 3921902100 | Cotton-reinforced plastic sheets | 61.5% | 6.5% | 25.0% | 30.0% |

| 3921901500 | Lightweight textile composite plastic sheets | 61.5% | 6.5% | 25.0% | 30.0% |

| 7019905150 | Glass fiber-reinforced lightweight plastic sheets | 59.3% | 4.3% | 25.0% | 30.0% |

📌 Key Tax Rate Notes

- Base Tariff: The standard duty rate applied to all imports.

- Additional Tariff: A general surcharge applied to all imports (25.0%).

- April 11, 2025 Special Tariff: An extra 30.0% tariff imposed after April 11, 2025, likely due to trade policy adjustments or anti-dumping measures.

- Anti-dumping duties: Not explicitly listed in the data, but the 30.0% special tariff may include such duties depending on the product origin and country of import.

⚠️ Time-Sensitive Policy Alert

Additional tariffs of 30.0% will be imposed after April 11, 2025.

This is a critical date for customs clearance and cost estimation. Ensure your import timeline accounts for this.

📌 Proactive Advice for Importers

- Verify Material Composition: Confirm whether the product is textile-reinforced, fiber-reinforced, or cotton-reinforced, as this determines the correct HS code.

- Check Unit Price and Certification: Some HS codes may require specific certifications (e.g., textile content, fiber type, or composite structure).

- Review Country of Origin: Tariff rates may vary depending on the country of origin, especially if anti-dumping duties apply.

- Plan for Increased Costs: With the 30.0% special tariff after April 11, 2025, budgeting should include this additional cost.

📊 Summary of Tax Rates by HS Code

| HS CODE | Total Tax Rate | Base | Additional | April 11, 2025 |

|---|---|---|---|---|

| 3921902510 | 61.5% | 6.5% | 25.0% | 30.0% |

| 3921902900 | 59.4% | 4.4% | 25.0% | 30.0% |

| 3921902100 | 61.5% | 6.5% | 25.0% | 30.0% |

| 3921901500 | 61.5% | 6.5% | 25.0% | 30.0% |

| 7019905150 | 59.3% | 4.3% | 25.0% | 30.0% |

If you need help selecting the most appropriate HS code based on your product's exact composition, feel free to provide more details.

✅ Product Classification: Lightweight Textile Reinforced Plastic Sheets

Below is the detailed classification and tariff information for the product "Lightweight Textile Reinforced Plastic Sheets" based on the provided HS codes and tax details.

📦 HS CODE Classification Overview

| HS CODE | Description | Total Tax Rate | Base Tariff | Additional Tariff | April 11, 2025 Special Tariff |

|---|---|---|---|---|---|

| 3921902510 | Textile-reinforced plastic sheets | 61.5% | 6.5% | 25.0% | 30.0% |

| 3921902900 | Fiber-reinforced textile plastic sheets | 59.4% | 4.4% | 25.0% | 30.0% |

| 3921902100 | Cotton-reinforced plastic sheets | 61.5% | 6.5% | 25.0% | 30.0% |

| 3921901500 | Lightweight textile composite plastic sheets | 61.5% | 6.5% | 25.0% | 30.0% |

| 7019905150 | Glass fiber-reinforced lightweight plastic sheets | 59.3% | 4.3% | 25.0% | 30.0% |

📌 Key Tax Rate Notes

- Base Tariff: The standard duty rate applied to all imports.

- Additional Tariff: A general surcharge applied to all imports (25.0%).

- April 11, 2025 Special Tariff: An extra 30.0% tariff imposed after April 11, 2025, likely due to trade policy adjustments or anti-dumping measures.

- Anti-dumping duties: Not explicitly listed in the data, but the 30.0% special tariff may include such duties depending on the product origin and country of import.

⚠️ Time-Sensitive Policy Alert

Additional tariffs of 30.0% will be imposed after April 11, 2025.

This is a critical date for customs clearance and cost estimation. Ensure your import timeline accounts for this.

📌 Proactive Advice for Importers

- Verify Material Composition: Confirm whether the product is textile-reinforced, fiber-reinforced, or cotton-reinforced, as this determines the correct HS code.

- Check Unit Price and Certification: Some HS codes may require specific certifications (e.g., textile content, fiber type, or composite structure).

- Review Country of Origin: Tariff rates may vary depending on the country of origin, especially if anti-dumping duties apply.

- Plan for Increased Costs: With the 30.0% special tariff after April 11, 2025, budgeting should include this additional cost.

📊 Summary of Tax Rates by HS Code

| HS CODE | Total Tax Rate | Base | Additional | April 11, 2025 |

|---|---|---|---|---|

| 3921902510 | 61.5% | 6.5% | 25.0% | 30.0% |

| 3921902900 | 59.4% | 4.4% | 25.0% | 30.0% |

| 3921902100 | 61.5% | 6.5% | 25.0% | 30.0% |

| 3921901500 | 61.5% | 6.5% | 25.0% | 30.0% |

| 7019905150 | 59.3% | 4.3% | 25.0% | 30.0% |

If you need help selecting the most appropriate HS code based on your product's exact composition, feel free to provide more details.

Customer Reviews

No reviews yet.