| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3926905900 | Doc | 57.4% | CN | US | 2025-05-12 |

| 4010313000 | Doc | 58.4% | CN | US | 2025-05-12 |

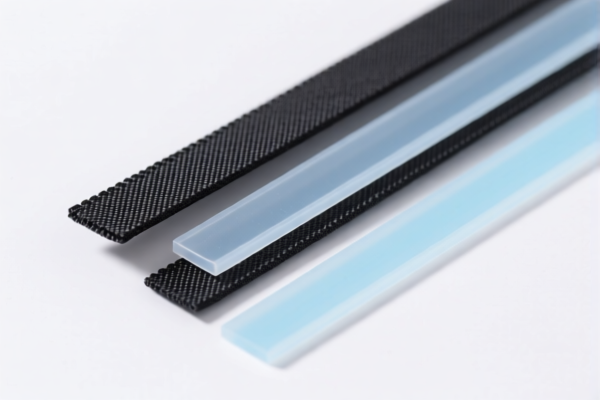

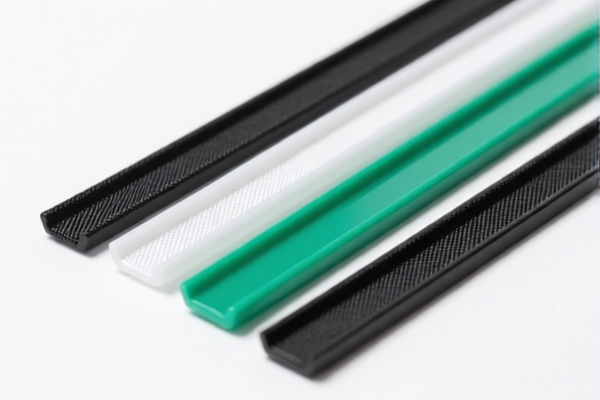

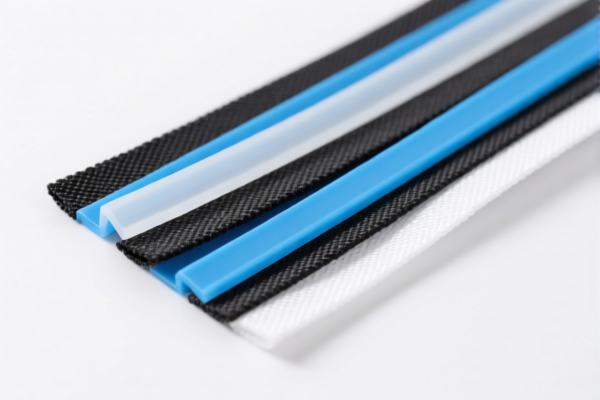

Based on the product description "Lightweight Textile Reinforced Plastic Strips", the following HS codes and tariff information are relevant:

✅ HS CODE: 3926905900

Product Description:

- This code applies to plastic strips reinforced with textile materials, which aligns with the product name "Lightweight Textile Reinforced Plastic Strips."

Tariff Breakdown: - Base Tariff Rate: 2.4% - Additional Tariff (General): 25.0% - Special Tariff (After April 2, 2025): 30.0% - Total Tax Rate: 57.4%

✅ HS CODE: 40109300

Product Description:

- This code applies to rubber conveyor or transmission belts combined with textile materials, which may be a close match if the plastic strips are used in a similar functional context (e.g., conveyor systems).

Tariff Breakdown: - Base Tariff Rate: 3.4% - Additional Tariff (General): 25.0% - Special Tariff (After April 2, 2025): 30.0% - Total Tax Rate: 58.4%

📌 Key Notes and Recommendations:

-

Tariff Changes After April 2, 2025:

Both HS codes will be subject to an additional 30% tariff after this date. Ensure your import timeline accounts for this increase. -

Material Verification:

Confirm whether the product is plastic-based (HS 3926905900) or rubber-based with textile reinforcement (HS 40109300), as this will determine the correct classification. -

Certifications and Documentation:

Check if any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product, especially if it contains textile or plastic components. -

Unit Price and Classification:

The final HS code may depend on the unit price and specific composition of the product. If the product is a composite of multiple materials, a detailed breakdown may be necessary for accurate classification.

🛑 Proactive Advice:

- Verify the exact composition of the product (e.g., type of plastic, textile material used, and whether it's used for industrial or consumer purposes).

- Consult a customs broker or classification service if the product is borderline between HS codes.

- Monitor the April 2, 2025, deadline for tariff changes to avoid unexpected costs.

Let me know if you need help with a specific import scenario or documentation. Based on the product description "Lightweight Textile Reinforced Plastic Strips", the following HS codes and tariff information are relevant:

✅ HS CODE: 3926905900

Product Description:

- This code applies to plastic strips reinforced with textile materials, which aligns with the product name "Lightweight Textile Reinforced Plastic Strips."

Tariff Breakdown: - Base Tariff Rate: 2.4% - Additional Tariff (General): 25.0% - Special Tariff (After April 2, 2025): 30.0% - Total Tax Rate: 57.4%

✅ HS CODE: 40109300

Product Description:

- This code applies to rubber conveyor or transmission belts combined with textile materials, which may be a close match if the plastic strips are used in a similar functional context (e.g., conveyor systems).

Tariff Breakdown: - Base Tariff Rate: 3.4% - Additional Tariff (General): 25.0% - Special Tariff (After April 2, 2025): 30.0% - Total Tax Rate: 58.4%

📌 Key Notes and Recommendations:

-

Tariff Changes After April 2, 2025:

Both HS codes will be subject to an additional 30% tariff after this date. Ensure your import timeline accounts for this increase. -

Material Verification:

Confirm whether the product is plastic-based (HS 3926905900) or rubber-based with textile reinforcement (HS 40109300), as this will determine the correct classification. -

Certifications and Documentation:

Check if any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product, especially if it contains textile or plastic components. -

Unit Price and Classification:

The final HS code may depend on the unit price and specific composition of the product. If the product is a composite of multiple materials, a detailed breakdown may be necessary for accurate classification.

🛑 Proactive Advice:

- Verify the exact composition of the product (e.g., type of plastic, textile material used, and whether it's used for industrial or consumer purposes).

- Consult a customs broker or classification service if the product is borderline between HS codes.

- Monitor the April 2, 2025, deadline for tariff changes to avoid unexpected costs.

Let me know if you need help with a specific import scenario or documentation.

Customer Reviews

No reviews yet.