| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921190090 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921901500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 4411129090 | Doc | 58.9% | CN | US | 2025-05-12 |

| 4411940060 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4411940020 | Doc | 55.0% | CN | US | 2025-05-12 |

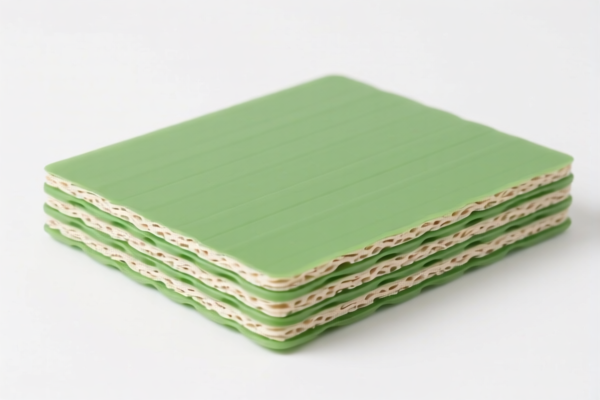

Here is the structured classification and tariff information for Lightweight Vegetable Fiber Plastic Boards, based on the provided HS codes and tax details:

✅ HS CODE: 3921190090

Description: Other plastic sheets, plates, films, foils, and tapes — porous — other plastics — other

Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Note: This code applies to porous plastic boards made from other plastics, not specifically vegetable fiber-based.

✅ HS CODE: 3921901500

Description: Plastic composite boards combined with textile materials

Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Note: This code applies to composite boards with textile components, which may not match your product unless it includes textile layers.

✅ HS CODE: 4411129090

Description: Medium-density fiberboard (MDF), thickness not exceeding 5mm

Total Tax Rate: 58.9%

- Base Tariff Rate: 3.9%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Note: This is for MDF, which is a type of wood fiberboard, not a vegetable fiber plastic board.

✅ HS CODE: 4411940060

Description: Wood or wood fiberboard, density not exceeding 0.5 g/cm³, not mechanically processed or surface-treated, other types

Total Tax Rate: 55.0%

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Note: This is for low-density wood or fiberboard, not a plastic or vegetable fiber composite.

✅ HS CODE: 4411940020

Description: Fiberboard made from wood or cellulose materials, density not exceeding 0.5 g/cm³

Total Tax Rate: 55.0%

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Note: This is for fiberboard made from cellulose, not a vegetable fiber plastic board.

📌 Proactive Advice for You:

- Verify Material Composition: Ensure the product is made from vegetable fiber and plastic composite, not purely wood or textile-based.

- Check Unit Price and Certification: Confirm if any environmental or safety certifications (e.g., FSC, ISO, etc.) are required for import.

- Review HS Code Accuracy: If the product is a vegetable fiber-plastic composite, it may not be covered by the above HS codes. Consider consulting a customs broker or using a HS code lookup tool with detailed product descriptions.

- Monitor April 11, 2025 Policy Changes: Be aware that additional tariffs will increase after this date, which could significantly impact your import costs.

Let me know if you'd like help identifying the most accurate HS code for your specific product. Here is the structured classification and tariff information for Lightweight Vegetable Fiber Plastic Boards, based on the provided HS codes and tax details:

✅ HS CODE: 3921190090

Description: Other plastic sheets, plates, films, foils, and tapes — porous — other plastics — other

Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Note: This code applies to porous plastic boards made from other plastics, not specifically vegetable fiber-based.

✅ HS CODE: 3921901500

Description: Plastic composite boards combined with textile materials

Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Note: This code applies to composite boards with textile components, which may not match your product unless it includes textile layers.

✅ HS CODE: 4411129090

Description: Medium-density fiberboard (MDF), thickness not exceeding 5mm

Total Tax Rate: 58.9%

- Base Tariff Rate: 3.9%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Note: This is for MDF, which is a type of wood fiberboard, not a vegetable fiber plastic board.

✅ HS CODE: 4411940060

Description: Wood or wood fiberboard, density not exceeding 0.5 g/cm³, not mechanically processed or surface-treated, other types

Total Tax Rate: 55.0%

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Note: This is for low-density wood or fiberboard, not a plastic or vegetable fiber composite.

✅ HS CODE: 4411940020

Description: Fiberboard made from wood or cellulose materials, density not exceeding 0.5 g/cm³

Total Tax Rate: 55.0%

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Note: This is for fiberboard made from cellulose, not a vegetable fiber plastic board.

📌 Proactive Advice for You:

- Verify Material Composition: Ensure the product is made from vegetable fiber and plastic composite, not purely wood or textile-based.

- Check Unit Price and Certification: Confirm if any environmental or safety certifications (e.g., FSC, ISO, etc.) are required for import.

- Review HS Code Accuracy: If the product is a vegetable fiber-plastic composite, it may not be covered by the above HS codes. Consider consulting a customs broker or using a HS code lookup tool with detailed product descriptions.

- Monitor April 11, 2025 Policy Changes: Be aware that additional tariffs will increase after this date, which could significantly impact your import costs.

Let me know if you'd like help identifying the most accurate HS code for your specific product.

Customer Reviews

No reviews yet.