| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 4805912000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4802546100 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4810316500 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4810297035 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4810225080 | Doc | 55.0% | CN | US | 2025-05-12 |

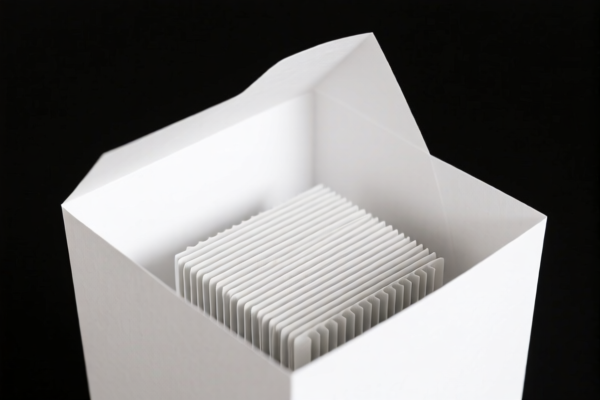

Product Name: Low Basis Weight Condenser Paper

Classification HS Codes and Tax Details:

- HS CODE: 4805912000

- Description: Low basis weight writing paper, uncoated, for writing, printing, or other graphic purposes, with weight less than 150g/m².

- Total Tax Rate: 55.0%

-

Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 4802546100

- Description: Low basis weight writing paper, uncoated, for writing, printing, or other graphic purposes, with weight less than 40g/m².

- Total Tax Rate: 55.0%

-

Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 4810316500

- Description: Low basis weight bleached coated paper, coated with kaolin or other inorganic substances, with weight less than 150g/m².

- Total Tax Rate: 55.0%

-

Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 4810297035

- Description: Low basis weight coated paper, coated with kaolin or other inorganic substances, for writing, printing, or other graphic purposes, with low basis weight characteristics.

- Total Tax Rate: 55.0%

-

Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 4810225080

- Description: High-quality light-coated paper, with the term "light-coated" included in the product name, falling under the category of light-coated paper.

- Total Tax Rate: 55.0%

- Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Key Notes and Recommendations:

- Tariff Increase Alert:

- Starting April 11, 2025, an additional 30.0% tariff will be applied to all the above HS codes. This is a significant increase from the current 25.0% additional tariff.

-

Plan accordingly for increased import costs if your product will be imported after this date.

-

Anti-Dumping Duties:

-

No specific anti-dumping duties are mentioned for these HS codes. However, it is advisable to verify if any anti-dumping or countervailing duties apply based on the country of origin and product specifications.

-

Certifications and Documentation:

- Ensure that your product meets the weight and coating specifications for the selected HS code.

- Confirm whether certifications (e.g., environmental, quality, or safety) are required for import into the destination country.

-

Verify the unit price and material composition to ensure correct classification and avoid misdeclaration penalties.

-

Proactive Action:

- Double-check the product’s basis weight and coating type to ensure it aligns with the HS code used.

-

Consult with customs brokers or legal advisors if the product is close to the boundary of multiple HS codes (e.g., between coated and uncoated paper). Product Name: Low Basis Weight Condenser Paper

Classification HS Codes and Tax Details: -

HS CODE: 4805912000

- Description: Low basis weight writing paper, uncoated, for writing, printing, or other graphic purposes, with weight less than 150g/m².

- Total Tax Rate: 55.0%

-

Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 4802546100

- Description: Low basis weight writing paper, uncoated, for writing, printing, or other graphic purposes, with weight less than 40g/m².

- Total Tax Rate: 55.0%

-

Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 4810316500

- Description: Low basis weight bleached coated paper, coated with kaolin or other inorganic substances, with weight less than 150g/m².

- Total Tax Rate: 55.0%

-

Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 4810297035

- Description: Low basis weight coated paper, coated with kaolin or other inorganic substances, for writing, printing, or other graphic purposes, with low basis weight characteristics.

- Total Tax Rate: 55.0%

-

Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 4810225080

- Description: High-quality light-coated paper, with the term "light-coated" included in the product name, falling under the category of light-coated paper.

- Total Tax Rate: 55.0%

- Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Key Notes and Recommendations:

- Tariff Increase Alert:

- Starting April 11, 2025, an additional 30.0% tariff will be applied to all the above HS codes. This is a significant increase from the current 25.0% additional tariff.

-

Plan accordingly for increased import costs if your product will be imported after this date.

-

Anti-Dumping Duties:

-

No specific anti-dumping duties are mentioned for these HS codes. However, it is advisable to verify if any anti-dumping or countervailing duties apply based on the country of origin and product specifications.

-

Certifications and Documentation:

- Ensure that your product meets the weight and coating specifications for the selected HS code.

- Confirm whether certifications (e.g., environmental, quality, or safety) are required for import into the destination country.

-

Verify the unit price and material composition to ensure correct classification and avoid misdeclaration penalties.

-

Proactive Action:

- Double-check the product’s basis weight and coating type to ensure it aligns with the HS code used.

- Consult with customs brokers or legal advisors if the product is close to the boundary of multiple HS codes (e.g., between coated and uncoated paper).

Customer Reviews

No reviews yet.