| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 8304000000 | Doc | 33.9% | CN | US | 2025-05-12 |

| 9403993005 | Doc | 55.0% | CN | US | 2025-05-12 |

| 9403993010 | Doc | 55.0% | CN | US | 2025-05-12 |

| 7610900020 | Doc | 110.7% | CN | US | 2025-05-12 |

| 7610900040 | Doc | 110.7% | CN | US | 2025-05-12 |

| 3926909987 | Doc | 42.8% | CN | US | 2025-05-12 |

| 3926909989 | Doc | 42.8% | CN | US | 2025-05-12 |

| 4411940010 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4411940050 | Doc | 55.0% | CN | US | 2025-05-12 |

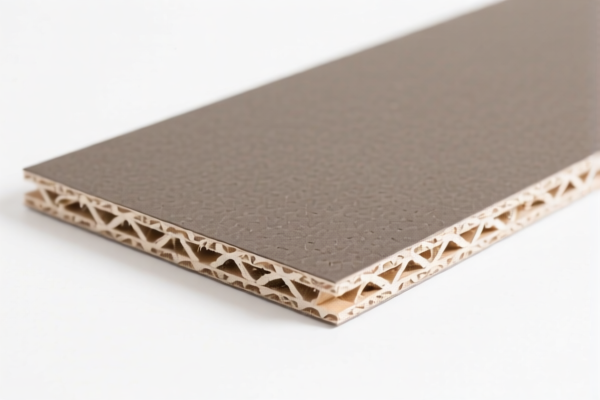

Customs Compliance Analysis for Low Density Bitumen Fiberboard (Custom)

Based on your product description and the provided HS codes, the most relevant classification for Low Density Bitumen Fiberboard (Custom) is:

✅ HS CODE: 4411940010

Description:

Fiberboard of wood or other ligneous materials, whether or not bonded with resins or other organic substances: Other: Of a density not exceeding 0.5 g/cm³: Of a density exceeding 0.35 g/cm³ but not exceeding 0.5 g/cm³: Not mechanically worked or surface covered: Impregnated with bitumen

🔍 Tariff Breakdown (as of now)

- Base Tariff Rate: 0.0%

- Additional Tariff (before April 11, 2025): 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tariff Rate: 55.0%

⚠️ Time-Sensitive Policy Alert

- April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied after April 11, 2025.

This is a critical date for customs clearance planning and cost estimation.

📌 Key Considerations for Compliance

- Material Verification: Confirm that the fiberboard is impregnated with bitumen and has a density not exceeding 0.5 g/cm³. This is essential for correct classification under HS code 4411940010.

- Unit Price and Certification: Ensure that the product is not classified under a different HS code due to additional features (e.g., surface treatment, mechanical working). If the fiberboard is used in construction or industrial applications, double-check for alternative classifications.

- Documentation: Maintain records of material composition, density, and treatment (bitumen impregnation) for customs audits.

📌 Proactive Advice

- Check for Exemptions or Preferential Tariffs: If your product qualifies for any free trade agreements (e.g., RCEP, CPTPP), confirm the applicable rates.

- Consult a Customs Broker: For complex or high-value shipments, a customs broker can help ensure compliance and avoid delays.

- Monitor Tariff Updates: Stay informed about any changes in tariff policies, especially around the April 11, 2025 deadline.

📊 Summary Table

| Tariff Component | Rate |

|---|---|

| Base Tariff | 0.0% |

| Additional Tariff | 25.0% |

| April 11, 2025 Tariff | 30.0% |

| Total Tariff | 55.0% |

If you have further details about the product (e.g., intended use, dimensions, or packaging), I can provide a more tailored compliance review.

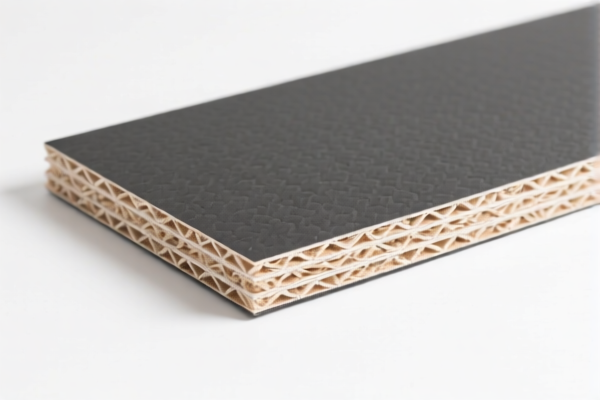

Customs Compliance Analysis for Low Density Bitumen Fiberboard (Custom)

Based on your product description and the provided HS codes, the most relevant classification for Low Density Bitumen Fiberboard (Custom) is:

✅ HS CODE: 4411940010

Description:

Fiberboard of wood or other ligneous materials, whether or not bonded with resins or other organic substances: Other: Of a density not exceeding 0.5 g/cm³: Of a density exceeding 0.35 g/cm³ but not exceeding 0.5 g/cm³: Not mechanically worked or surface covered: Impregnated with bitumen

🔍 Tariff Breakdown (as of now)

- Base Tariff Rate: 0.0%

- Additional Tariff (before April 11, 2025): 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tariff Rate: 55.0%

⚠️ Time-Sensitive Policy Alert

- April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied after April 11, 2025.

This is a critical date for customs clearance planning and cost estimation.

📌 Key Considerations for Compliance

- Material Verification: Confirm that the fiberboard is impregnated with bitumen and has a density not exceeding 0.5 g/cm³. This is essential for correct classification under HS code 4411940010.

- Unit Price and Certification: Ensure that the product is not classified under a different HS code due to additional features (e.g., surface treatment, mechanical working). If the fiberboard is used in construction or industrial applications, double-check for alternative classifications.

- Documentation: Maintain records of material composition, density, and treatment (bitumen impregnation) for customs audits.

📌 Proactive Advice

- Check for Exemptions or Preferential Tariffs: If your product qualifies for any free trade agreements (e.g., RCEP, CPTPP), confirm the applicable rates.

- Consult a Customs Broker: For complex or high-value shipments, a customs broker can help ensure compliance and avoid delays.

- Monitor Tariff Updates: Stay informed about any changes in tariff policies, especially around the April 11, 2025 deadline.

📊 Summary Table

| Tariff Component | Rate |

|---|---|

| Base Tariff | 0.0% |

| Additional Tariff | 25.0% |

| April 11, 2025 Tariff | 30.0% |

| Total Tariff | 55.0% |

If you have further details about the product (e.g., intended use, dimensions, or packaging), I can provide a more tailored compliance review.

Customer Reviews

No reviews yet.