| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 6406901580 | Doc | 52.4% | CN | US | 2025-05-12 |

| 6406901540 | Doc | 52.4% | CN | US | 2025-05-12 |

| 1401904000 | Doc | 58.2% | CN | US | 2025-05-12 |

| 3917390050 | Doc | 33.1% | CN | US | 2025-05-12 |

| 3925100000 | Doc | 61.3% | CN | US | 2025-05-12 |

| 3925900000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 4411940010 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4411940050 | Doc | 55.0% | CN | US | 2025-05-12 |

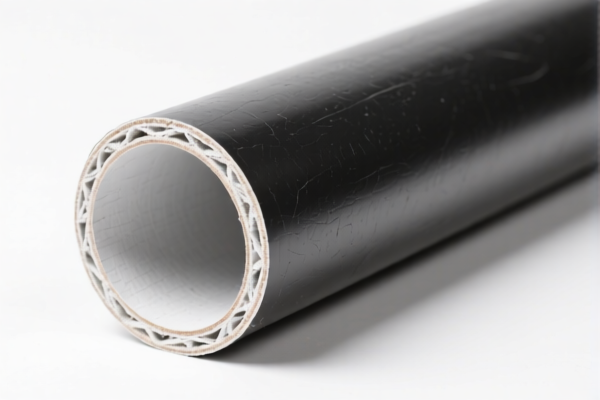

Product Classification: Low Density Bitumen Fiberboard (Piping)

Based on your description, the most accurate HS code for Low Density Bitumen Fiberboard (Piping) is:

✅ HS CODE: 4411940010

Description:

Fiberboard of wood or other ligneous materials, whether or not bonded with resins or other organic substances: Other: Of a density not exceeding 0.5 g/cm³: Of a density exceeding 0.35 g/cm³ but not exceeding 0.5 g/cm³: Not mechanically worked or surface covered: Impregnated with bitumen

🔍 Tariff Breakdown (as of now)

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff Rate: 55.0%

⚠️ Important Notes and Alerts

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed after April 11, 2025. This is a time-sensitive policy — ensure your import timeline is aligned accordingly.

- No Anti-Dumping or Countervailing Duties: No specific anti-dumping or countervailing duties are currently applicable for this product.

- No Specific Tariff for Iron or Aluminum: This product is made of fiberboard impregnated with bitumen, not metal, so no additional duties on iron or aluminum apply.

📌 Proactive Advice for Importers

- Verify Material Composition: Confirm that the fiberboard is indeed low density (≤ 0.5 g/cm³) and impregnated with bitumen to ensure correct classification.

- Check Unit Price and Certification: Some countries may require technical specifications or certifications for imported building materials. Confirm if any are needed for your destination market.

- Monitor Tariff Updates: Keep an eye on April 11, 2025, as the additional tariff will increase significantly after that date.

- Consult a Customs Broker: For large or complex shipments, consider engaging a customs broker to ensure compliance and avoid delays.

📊 Summary Table

| Tariff Type | Rate |

|---|---|

| Base Tariff | 0.0% |

| Additional Tariff | 25.0% |

| April 11, 2025 Tariff | 30.0% |

| Total Tariff Rate | 55.0% |

Let me know if you need help with certification requirements, customs documentation, or comparative analysis with other HS codes.

Product Classification: Low Density Bitumen Fiberboard (Piping)

Based on your description, the most accurate HS code for Low Density Bitumen Fiberboard (Piping) is:

✅ HS CODE: 4411940010

Description:

Fiberboard of wood or other ligneous materials, whether or not bonded with resins or other organic substances: Other: Of a density not exceeding 0.5 g/cm³: Of a density exceeding 0.35 g/cm³ but not exceeding 0.5 g/cm³: Not mechanically worked or surface covered: Impregnated with bitumen

🔍 Tariff Breakdown (as of now)

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff Rate: 55.0%

⚠️ Important Notes and Alerts

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed after April 11, 2025. This is a time-sensitive policy — ensure your import timeline is aligned accordingly.

- No Anti-Dumping or Countervailing Duties: No specific anti-dumping or countervailing duties are currently applicable for this product.

- No Specific Tariff for Iron or Aluminum: This product is made of fiberboard impregnated with bitumen, not metal, so no additional duties on iron or aluminum apply.

📌 Proactive Advice for Importers

- Verify Material Composition: Confirm that the fiberboard is indeed low density (≤ 0.5 g/cm³) and impregnated with bitumen to ensure correct classification.

- Check Unit Price and Certification: Some countries may require technical specifications or certifications for imported building materials. Confirm if any are needed for your destination market.

- Monitor Tariff Updates: Keep an eye on April 11, 2025, as the additional tariff will increase significantly after that date.

- Consult a Customs Broker: For large or complex shipments, consider engaging a customs broker to ensure compliance and avoid delays.

📊 Summary Table

| Tariff Type | Rate |

|---|---|

| Base Tariff | 0.0% |

| Additional Tariff | 25.0% |

| April 11, 2025 Tariff | 30.0% |

| Total Tariff Rate | 55.0% |

Let me know if you need help with certification requirements, customs documentation, or comparative analysis with other HS codes.

Customer Reviews

No reviews yet.