Found 2 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 4411940010 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4411940050 | Doc | 55.0% | CN | US | 2025-05-12 |

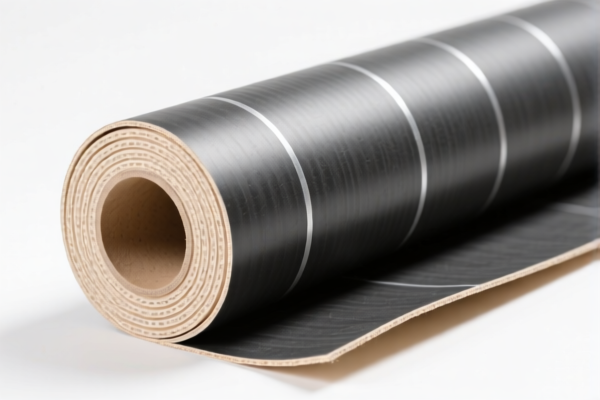

✅ Customs Classification and Tariff Analysis for Low Density Bitumen Fiberboard (Roll)

Based on your provided product descriptions and HS codes, here is the structured analysis and guidance for customs compliance and tariff calculation:

🔍 Product Classification Overview

Product 1:

- Description: Fiberboard of wood or other ligneous materials, impregnated with bitumen, with a density not exceeding 0.5 g/cm³, not mechanically worked or surface covered, and density exceeding 0.35 g/cm³.

- HS Code: 4411940010

- Tariff Details:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 55.0%

Product 2:

- Description: Fiberboard of wood or other ligneous materials, impregnated with bitumen, with a density not exceeding 0.5 g/cm³, not mechanically worked or surface covered, and density not specified beyond 0.35 g/cm³.

- HS Code: 4411940050

- Tariff Details:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 55.0%

📌 Key Notes on Tariff Changes

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be applied after April 11, 2025. This is a time-sensitive policy and must be considered in your import planning.

- No Anti-Dumping or Countervailing Duties: No specific anti-dumping or countervailing duties are currently listed for this product category.

- No Specific Tariff on Iron or Aluminum: These products are not classified under iron or aluminum categories, so no additional duties apply.

🛠️ Proactive Compliance Advice

- Verify Material Composition: Ensure the fiberboard is indeed made of wood or ligneous materials and is impregnated with bitumen. Any deviation in composition may affect the HS code.

- Check Density Specifications: Confirm the exact density of the product (whether it falls in the 0.35–0.5 g/cm³ range or below 0.35 g/cm³), as this determines the correct HS code.

- Unit Price and Certification: Confirm the unit price and whether any certifications (e.g., environmental, safety, or import permits) are required for the product in the destination country.

- Document the Processing: Since the product is "not mechanically worked or surface covered," ensure that the processing method is clearly documented to support the HS code classification.

📋 Summary Table for Reference

| Product Description | HS Code | Base Tariff | Additional Tariff | Special Tariff (after 2025.4.11) | Total Tariff |

|---|---|---|---|---|---|

| Fiberboard, bitumen-impregnated, density 0.35–0.5 g/cm³ | 4411940010 | 0.0% | 25.0% | 30.0% | 55.0% |

| Fiberboard, bitumen-impregnated, density ≤0.5 g/cm³ | 4411940050 | 0.0% | 25.0% | 30.0% | 55.0% |

📞 Next Steps for Importers

- Confirm the exact product specifications and HS code with a customs broker or classification expert.

- Prepare documentation (e.g., commercial invoice, packing list, and product specifications).

- Monitor the April 11, 2025 deadline to avoid unexpected tariff increases.

- Consider applying for any available preferential trade agreements if applicable.

Let me know if you need help with HS code verification or customs documentation!

✅ Customs Classification and Tariff Analysis for Low Density Bitumen Fiberboard (Roll)

Based on your provided product descriptions and HS codes, here is the structured analysis and guidance for customs compliance and tariff calculation:

🔍 Product Classification Overview

Product 1:

- Description: Fiberboard of wood or other ligneous materials, impregnated with bitumen, with a density not exceeding 0.5 g/cm³, not mechanically worked or surface covered, and density exceeding 0.35 g/cm³.

- HS Code: 4411940010

- Tariff Details:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 55.0%

Product 2:

- Description: Fiberboard of wood or other ligneous materials, impregnated with bitumen, with a density not exceeding 0.5 g/cm³, not mechanically worked or surface covered, and density not specified beyond 0.35 g/cm³.

- HS Code: 4411940050

- Tariff Details:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 55.0%

📌 Key Notes on Tariff Changes

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be applied after April 11, 2025. This is a time-sensitive policy and must be considered in your import planning.

- No Anti-Dumping or Countervailing Duties: No specific anti-dumping or countervailing duties are currently listed for this product category.

- No Specific Tariff on Iron or Aluminum: These products are not classified under iron or aluminum categories, so no additional duties apply.

🛠️ Proactive Compliance Advice

- Verify Material Composition: Ensure the fiberboard is indeed made of wood or ligneous materials and is impregnated with bitumen. Any deviation in composition may affect the HS code.

- Check Density Specifications: Confirm the exact density of the product (whether it falls in the 0.35–0.5 g/cm³ range or below 0.35 g/cm³), as this determines the correct HS code.

- Unit Price and Certification: Confirm the unit price and whether any certifications (e.g., environmental, safety, or import permits) are required for the product in the destination country.

- Document the Processing: Since the product is "not mechanically worked or surface covered," ensure that the processing method is clearly documented to support the HS code classification.

📋 Summary Table for Reference

| Product Description | HS Code | Base Tariff | Additional Tariff | Special Tariff (after 2025.4.11) | Total Tariff |

|---|---|---|---|---|---|

| Fiberboard, bitumen-impregnated, density 0.35–0.5 g/cm³ | 4411940010 | 0.0% | 25.0% | 30.0% | 55.0% |

| Fiberboard, bitumen-impregnated, density ≤0.5 g/cm³ | 4411940050 | 0.0% | 25.0% | 30.0% | 55.0% |

📞 Next Steps for Importers

- Confirm the exact product specifications and HS code with a customs broker or classification expert.

- Prepare documentation (e.g., commercial invoice, packing list, and product specifications).

- Monitor the April 11, 2025 deadline to avoid unexpected tariff increases.

- Consider applying for any available preferential trade agreements if applicable.

Let me know if you need help with HS code verification or customs documentation!

Customer Reviews

No reviews yet.