| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 9406200000 | Doc | 107.9% | CN | US | 2025-05-12 |

| 9406900190 | Doc | 107.9% | CN | US | 2025-05-12 |

| 8304000000 | Doc | 33.9% | CN | US | 2025-05-12 |

| 4411940010 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4411940050 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4410900000 | Doc | 55.0% | CN | US | 2025-05-12 |

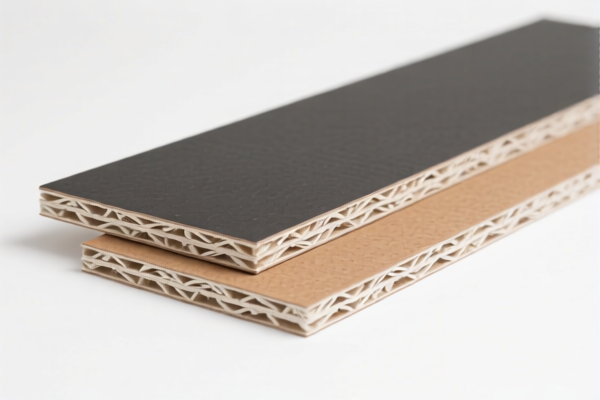

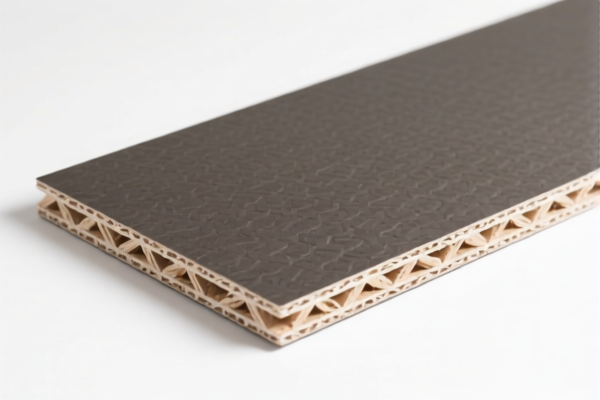

Product Classification and Tariff Analysis for Low Density Bitumen Fiberboard (Structural)

Based on your provided product description:

"Fiberboard of wood or other ligneous materials, whether or not bonded with resins or other organic substances: Other: Of a density not exceeding 0.5 g/cm³: Not mechanically worked or surface covered: Impregnated with bitumen"

This matches HS Code: 4411940010 (10-digit code).

✅ HS CODE: 4411940010

🔍 Product Description Match:

- Material: Fiberboard made from wood or other ligneous materials.

- Treatment: Impregnated with bitumen.

- Density: Not exceeding 0.5 g/cm³.

- Surface: Not mechanically worked or surface covered.

📊 Tariff Breakdown (as of now):

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Steel, Aluminum, Copper Products Additional Tariff: 50% (not applicable here, as this is a wood-based fiberboard)

📌 Total Tariff Rate: 55.0%

This is calculated as:

0.0% (base) + 25.0% (additional) + 30.0% (special after April 11, 2025)

⚠️ Time-Sensitive Policy Alert:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be applied after April 11, 2025.

- Steel, Aluminum, Copper Tariffs: Not applicable for this product (not metal-based).

📌 Proactive Advice for Importers:

- Verify Material Composition: Ensure the fiberboard is indeed made of wood or ligneous materials and is impregnated with bitumen.

- Check Density: Confirm the density is not exceeding 0.5 g/cm³ to qualify under this HS code.

- Documentation: Maintain records of material specifications, manufacturing process, and any certifications (e.g., fire resistance, environmental compliance).

- Tariff Planning: If importing after April 11, 2025, be prepared for the 30.0% additional tariff.

- Consult Customs Broker: For accurate classification and compliance, especially if the product has multiple components or finishes.

📌 Comparison with Other HS Codes (for reference):

| HS Code | Description | Total Tariff | Notes |

|---|---|---|---|

| 9406200000 | Prefabricated steel modular buildings | 107.9% | High tariff |

| 9406900190 | Other prefabricated buildings | 107.9% | High tariff |

| 8304000000 | Office equipment (e.g., filing cabinets) | 33.9% | Lower tariff |

| 4411940050 | Similar bitumen-impregnated fiberboard | 55.0% | Same as 4411940010 |

| 4410900000 | Particle board, OSB, etc. | 55.0% | Similar but different product type |

✅ Conclusion:

Your Low Density Bitumen Fiberboard (Structural) is correctly classified under HS Code 4411940010, with a total tariff rate of 55.0%. Be mindful of the 30.0% additional tariff after April 11, 2025, and ensure your product meets the material and density requirements for this classification.

Product Classification and Tariff Analysis for Low Density Bitumen Fiberboard (Structural)

Based on your provided product description:

"Fiberboard of wood or other ligneous materials, whether or not bonded with resins or other organic substances: Other: Of a density not exceeding 0.5 g/cm³: Not mechanically worked or surface covered: Impregnated with bitumen"

This matches HS Code: 4411940010 (10-digit code).

✅ HS CODE: 4411940010

🔍 Product Description Match:

- Material: Fiberboard made from wood or other ligneous materials.

- Treatment: Impregnated with bitumen.

- Density: Not exceeding 0.5 g/cm³.

- Surface: Not mechanically worked or surface covered.

📊 Tariff Breakdown (as of now):

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Steel, Aluminum, Copper Products Additional Tariff: 50% (not applicable here, as this is a wood-based fiberboard)

📌 Total Tariff Rate: 55.0%

This is calculated as:

0.0% (base) + 25.0% (additional) + 30.0% (special after April 11, 2025)

⚠️ Time-Sensitive Policy Alert:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be applied after April 11, 2025.

- Steel, Aluminum, Copper Tariffs: Not applicable for this product (not metal-based).

📌 Proactive Advice for Importers:

- Verify Material Composition: Ensure the fiberboard is indeed made of wood or ligneous materials and is impregnated with bitumen.

- Check Density: Confirm the density is not exceeding 0.5 g/cm³ to qualify under this HS code.

- Documentation: Maintain records of material specifications, manufacturing process, and any certifications (e.g., fire resistance, environmental compliance).

- Tariff Planning: If importing after April 11, 2025, be prepared for the 30.0% additional tariff.

- Consult Customs Broker: For accurate classification and compliance, especially if the product has multiple components or finishes.

📌 Comparison with Other HS Codes (for reference):

| HS Code | Description | Total Tariff | Notes |

|---|---|---|---|

| 9406200000 | Prefabricated steel modular buildings | 107.9% | High tariff |

| 9406900190 | Other prefabricated buildings | 107.9% | High tariff |

| 8304000000 | Office equipment (e.g., filing cabinets) | 33.9% | Lower tariff |

| 4411940050 | Similar bitumen-impregnated fiberboard | 55.0% | Same as 4411940010 |

| 4410900000 | Particle board, OSB, etc. | 55.0% | Similar but different product type |

✅ Conclusion:

Your Low Density Bitumen Fiberboard (Structural) is correctly classified under HS Code 4411940010, with a total tariff rate of 55.0%. Be mindful of the 30.0% additional tariff after April 11, 2025, and ensure your product meets the material and density requirements for this classification.

Customer Reviews

No reviews yet.