| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 6806900090 | Doc | 55.0% | CN | US | 2025-05-12 |

| 6806900020 | Doc | 55.0% | CN | US | 2025-05-12 |

| 6811899000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 6811820000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3403911000 | Doc | 61.0% | CN | US | 2025-05-12 |

| 3404905110 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3404905150 | Doc | 55.0% | CN | US | 2025-05-12 |

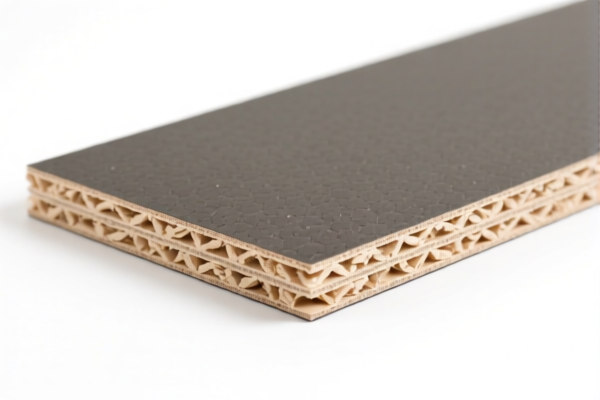

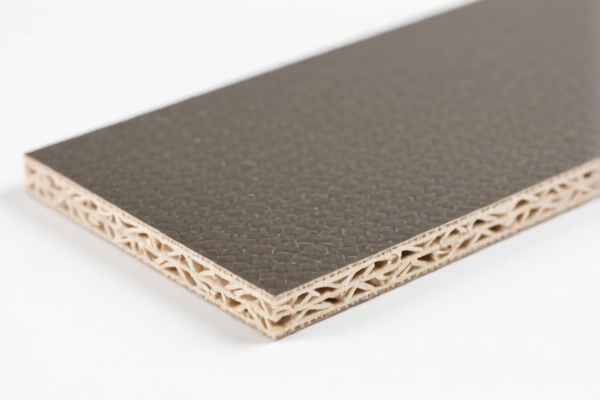

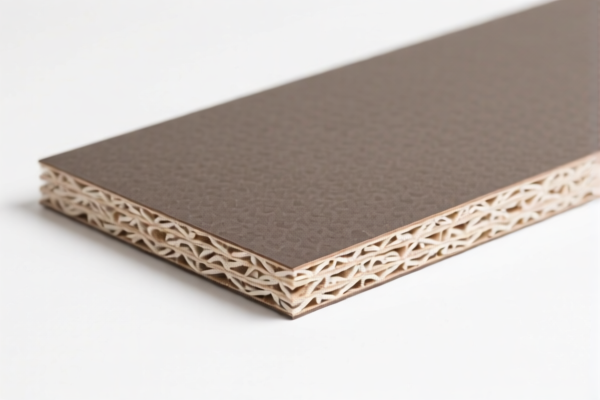

✅ Customs Classification and Tariff Analysis for Low Density Bitumen Fiberboard (Thermal Insulation)

Based on your product description and the provided HS codes, the Low Density Bitumen Fiberboard (Thermal Insulation) is not directly listed in the HS codes you provided. However, we can analyze the most relevant HS codes and tariff implications for similar products. Here's a structured breakdown:

🔍 1. Most Likely HS Code for Bitumen Fiberboard (Thermal Insulation)

HS CODE: 6806900090

Description:

- Slag wool, rock wool, and similar mineral wools; exfoliated vermiculite, expanded clays, foamed slag, and similar expanded mineral materials; mixtures and articles of heat-insulating, sound-insulating, or sound-absorbing mineral materials, other than those of heading 6811 or 6812, or of chapter 69: Other: Other: Other.

Tariff Details: - Base Tariff Rate: 0.0% - Additional Tariff: 25.0% - Special Tariff after April 11, 2025: 30.0% - Total Tariff: 55.0%

📌 2. Key Considerations for Classification

- Material Composition:

- If your product is made of bitumen fiber and used for thermal insulation, it may fall under Chapter 68, specifically 6806.

- However, 6806 typically covers mineral wools (e.g., slag wool, rock wool), not bitumen-based products.

-

If the product is fiberboard made from bitumen and fibers, it may be classified under 3918.99.00 (Plastics, other, not elsewhere specified) or 4504.90.00 (Other articles of wood or of wood substitutes), depending on the exact composition.

-

Alternative HS Code (if bitumen-based):

- HS CODE:

3918.99.00(Plastics, other, not elsewhere specified) – if the product is plastic-based. - HS CODE:

4504.90.00(Other articles of wood or of wood substitutes) – if the product is fiberboard-like but not mineral wool.

📉 3. Tariff Summary (for 6806900090)

- Base Tariff: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 55.0%

⚠️ Important Note: The 30% additional tariff after April 11, 2025, is a time-sensitive policy and may change depending on trade agreements or policy updates.

📌 4. Proactive Advice for Importers

- Verify Material Composition:

-

Confirm whether the product is bitumen-based fiberboard, mineral wool, or plastic-based. This will determine the correct HS code.

-

Check Unit Price and Certification:

-

Some products may require certifications (e.g., fire resistance, environmental compliance) for import.

-

Review Tariff Changes:

-

Be aware of the April 11, 2025 deadline for the 30% additional tariff. If your product is subject to this, plan accordingly.

-

Consult a Customs Broker:

- For complex classifications, especially if the product is a mixture of materials, a customs broker or classification expert can help ensure compliance.

📌 5. Alternative HS Codes for Bitumen Fiberboard (if applicable)

| Description | HS Code | Base Tariff | Additional Tariff | Special Tariff (after 2025.4.2) | Total Tariff |

|---|---|---|---|---|---|

| Plastic-based fiberboard | 3918.99.00 | 0.0% | 25.0% | 30.0% | 55.0% |

| Fiberboard (wood substitute) | 4504.90.00 | 0.0% | 25.0% | 30.0% | 55.0% |

| Mineral wool (slag/rock wool) | 6806900090 | 0.0% | 25.0% | 30.0% | 55.0% |

✅ Conclusion

Your Low Density Bitumen Fiberboard (Thermal Insulation) is not directly listed in the provided HS codes, but the most likely classification is 6806900090, assuming it is mineral wool-based. However, if it is bitumen-based or plastic-based, it may fall under 3918.99.00 or 4504.90.00.

Action Required:

- Confirm the exact composition of the product.

- Verify the HS code with a customs expert or classification service.

- Be aware of the 30% additional tariff after April 11, 2025.

✅ Customs Classification and Tariff Analysis for Low Density Bitumen Fiberboard (Thermal Insulation)

Based on your product description and the provided HS codes, the Low Density Bitumen Fiberboard (Thermal Insulation) is not directly listed in the HS codes you provided. However, we can analyze the most relevant HS codes and tariff implications for similar products. Here's a structured breakdown:

🔍 1. Most Likely HS Code for Bitumen Fiberboard (Thermal Insulation)

HS CODE: 6806900090

Description:

- Slag wool, rock wool, and similar mineral wools; exfoliated vermiculite, expanded clays, foamed slag, and similar expanded mineral materials; mixtures and articles of heat-insulating, sound-insulating, or sound-absorbing mineral materials, other than those of heading 6811 or 6812, or of chapter 69: Other: Other: Other.

Tariff Details: - Base Tariff Rate: 0.0% - Additional Tariff: 25.0% - Special Tariff after April 11, 2025: 30.0% - Total Tariff: 55.0%

📌 2. Key Considerations for Classification

- Material Composition:

- If your product is made of bitumen fiber and used for thermal insulation, it may fall under Chapter 68, specifically 6806.

- However, 6806 typically covers mineral wools (e.g., slag wool, rock wool), not bitumen-based products.

-

If the product is fiberboard made from bitumen and fibers, it may be classified under 3918.99.00 (Plastics, other, not elsewhere specified) or 4504.90.00 (Other articles of wood or of wood substitutes), depending on the exact composition.

-

Alternative HS Code (if bitumen-based):

- HS CODE:

3918.99.00(Plastics, other, not elsewhere specified) – if the product is plastic-based. - HS CODE:

4504.90.00(Other articles of wood or of wood substitutes) – if the product is fiberboard-like but not mineral wool.

📉 3. Tariff Summary (for 6806900090)

- Base Tariff: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 55.0%

⚠️ Important Note: The 30% additional tariff after April 11, 2025, is a time-sensitive policy and may change depending on trade agreements or policy updates.

📌 4. Proactive Advice for Importers

- Verify Material Composition:

-

Confirm whether the product is bitumen-based fiberboard, mineral wool, or plastic-based. This will determine the correct HS code.

-

Check Unit Price and Certification:

-

Some products may require certifications (e.g., fire resistance, environmental compliance) for import.

-

Review Tariff Changes:

-

Be aware of the April 11, 2025 deadline for the 30% additional tariff. If your product is subject to this, plan accordingly.

-

Consult a Customs Broker:

- For complex classifications, especially if the product is a mixture of materials, a customs broker or classification expert can help ensure compliance.

📌 5. Alternative HS Codes for Bitumen Fiberboard (if applicable)

| Description | HS Code | Base Tariff | Additional Tariff | Special Tariff (after 2025.4.2) | Total Tariff |

|---|---|---|---|---|---|

| Plastic-based fiberboard | 3918.99.00 | 0.0% | 25.0% | 30.0% | 55.0% |

| Fiberboard (wood substitute) | 4504.90.00 | 0.0% | 25.0% | 30.0% | 55.0% |

| Mineral wool (slag/rock wool) | 6806900090 | 0.0% | 25.0% | 30.0% | 55.0% |

✅ Conclusion

Your Low Density Bitumen Fiberboard (Thermal Insulation) is not directly listed in the provided HS codes, but the most likely classification is 6806900090, assuming it is mineral wool-based. However, if it is bitumen-based or plastic-based, it may fall under 3918.99.00 or 4504.90.00.

Action Required:

- Confirm the exact composition of the product.

- Verify the HS code with a customs expert or classification service.

- Be aware of the 30% additional tariff after April 11, 2025.

Customer Reviews

No reviews yet.