| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 4411940010 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4411940050 | Doc | 55.0% | CN | US | 2025-05-12 |

✅ Customs Classification and Tariff Analysis for Low Density Bitumen Fiberboard (Waterproof)

📦 Product Description Summary

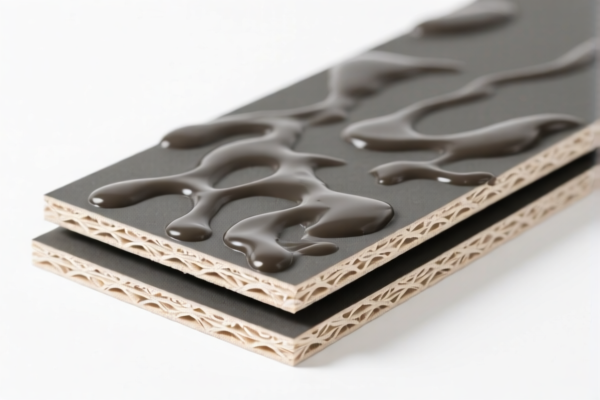

You are dealing with low-density fiberboard made from wood or other ligneous materials, impregnated with bitumen, and not mechanically worked or surface covered. The product has a density not exceeding 0.5 g/cm³.

🔍 HS Code Classification

There are two possible HS codes based on the density range and product description:

Option 1:

HS CODE: 4411940010

Description:

- Fiberboard of wood or other ligneous materials

- Not mechanically worked or surface covered

- Density exceeding 0.35 g/cm³ but not exceeding 0.5 g/cm³

- Impregnated with bitumen

Tariff Details:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 55.0%

Option 2:

HS CODE: 4411940050

Description:

- Fiberboard of wood or other ligneous materials

- Not mechanically worked or surface covered

- Density not exceeding 0.5 g/cm³

- Other (not in the 0.35–0.5 g/cm³ range)

- Impregnated with bitumen

Tariff Details:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 55.0%

📌 Key Notes and Recommendations

- Both HS codes have the same total tariff rate (55.0%), but the classification depends on the exact density of the product.

- Verify the product's density (e.g., lab test or manufacturer documentation) to determine the correct HS code.

- Check the product's unit price and material composition to ensure it meets the criteria for "impregnated with bitumen" and not "surface covered."

- Certifications may be required for import (e.g., product safety, environmental compliance).

- April 11, 2025, is a critical date — the special tariff increases from 25% to 30% after this date. Ensure your import timeline aligns with this.

🛑 Proactive Advice

- Confirm the exact density of the fiberboard before finalizing the HS code.

- Review the product's technical specifications (e.g., bitumen content, surface treatment).

- Consult with a customs broker or classification expert if the product description is ambiguous.

- Keep records of product testing and documentation to support customs declarations.

Let me know if you need help with certification requirements or customs documentation templates.

✅ Customs Classification and Tariff Analysis for Low Density Bitumen Fiberboard (Waterproof)

📦 Product Description Summary

You are dealing with low-density fiberboard made from wood or other ligneous materials, impregnated with bitumen, and not mechanically worked or surface covered. The product has a density not exceeding 0.5 g/cm³.

🔍 HS Code Classification

There are two possible HS codes based on the density range and product description:

Option 1:

HS CODE: 4411940010

Description:

- Fiberboard of wood or other ligneous materials

- Not mechanically worked or surface covered

- Density exceeding 0.35 g/cm³ but not exceeding 0.5 g/cm³

- Impregnated with bitumen

Tariff Details:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 55.0%

Option 2:

HS CODE: 4411940050

Description:

- Fiberboard of wood or other ligneous materials

- Not mechanically worked or surface covered

- Density not exceeding 0.5 g/cm³

- Other (not in the 0.35–0.5 g/cm³ range)

- Impregnated with bitumen

Tariff Details:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 55.0%

📌 Key Notes and Recommendations

- Both HS codes have the same total tariff rate (55.0%), but the classification depends on the exact density of the product.

- Verify the product's density (e.g., lab test or manufacturer documentation) to determine the correct HS code.

- Check the product's unit price and material composition to ensure it meets the criteria for "impregnated with bitumen" and not "surface covered."

- Certifications may be required for import (e.g., product safety, environmental compliance).

- April 11, 2025, is a critical date — the special tariff increases from 25% to 30% after this date. Ensure your import timeline aligns with this.

🛑 Proactive Advice

- Confirm the exact density of the fiberboard before finalizing the HS code.

- Review the product's technical specifications (e.g., bitumen content, surface treatment).

- Consult with a customs broker or classification expert if the product description is ambiguous.

- Keep records of product testing and documentation to support customs declarations.

Let me know if you need help with certification requirements or customs documentation templates.

Customer Reviews

No reviews yet.