| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3908902000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 5503110000 | Doc | 59.3% | CN | US | 2025-05-12 |

| 5402510000 | Doc | 63.8% | CN | US | 2025-05-12 |

| 3908907000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3902100000 | Doc | 61.5% | CN | US | 2025-05-12 |

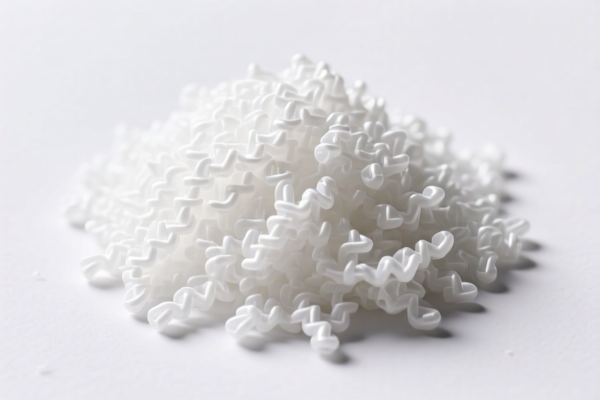

Product Name: Low Shrinkage Grade Polyamide Raw Material

Classification: Polyamide (Nylon) in primary form or raw material form

✅ HS CODE: 3908902000

Description: Polyamide in primary form

Total Tax Rate: 55.0%

Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Key Notes and Recommendations:

- Tariff Increase Alert:

-

Starting April 11, 2025, an additional 30.0% tariff will be applied on top of the base and existing additional tariffs. This will significantly increase the total tax burden.

-

Material Verification:

-

Confirm that the product is indeed in primary form (not processed or compounded) to ensure correct classification under HS 3908902000.

-

Certifications Required:

-

Ensure compliance with any import certifications or technical specifications required by the importing country (e.g., China).

-

Alternative HS Codes:

- If the product is synthetic short fiber raw material, consider HS 5503110000 (with a higher total tax of 59.3%).

- If the product is other polyamide in primary form, consider HS 3908907000 (total tax 61.5%).

📌 Proactive Advice:

- Check Material Specifications:

-

Confirm the chemical structure and processing stage of the polyamide to avoid misclassification.

-

Review Tariff Changes:

-

Stay updated on April 11, 2025 tariff adjustments and consider early import planning or tariff mitigation strategies.

-

Consult Customs Broker:

- For complex classifications or large-volume imports, consult a customs broker or compliance expert to avoid penalties.

📌 Summary of Tax Rates by HS Code:

| HS Code | Description | Total Tax Rate | Base Tariff | Additional Tariff | April 11 Special Tariff |

|---|---|---|---|---|---|

| 3908902000 | Polyamide in primary form | 55.0% | 0.0% | 25.0% | 30.0% |

| 5503110000 | Synthetic short fiber raw material | 59.3% | 4.3% | 25.0% | 30.0% |

| 5402510000 | Polyamide material | 63.8% | 8.8% | 25.0% | 30.0% |

| 3908907000 | Other polyamide in primary form | 61.5% | 6.5% | 25.0% | 30.0% |

| 3902100000 | Propylene or other olefins polymer | 61.5% | 6.5% | 25.0% | 30.0% |

Let me know if you need help with certification requirements, customs documentation, or tariff calculation tools.

Product Name: Low Shrinkage Grade Polyamide Raw Material

Classification: Polyamide (Nylon) in primary form or raw material form

✅ HS CODE: 3908902000

Description: Polyamide in primary form

Total Tax Rate: 55.0%

Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Key Notes and Recommendations:

- Tariff Increase Alert:

-

Starting April 11, 2025, an additional 30.0% tariff will be applied on top of the base and existing additional tariffs. This will significantly increase the total tax burden.

-

Material Verification:

-

Confirm that the product is indeed in primary form (not processed or compounded) to ensure correct classification under HS 3908902000.

-

Certifications Required:

-

Ensure compliance with any import certifications or technical specifications required by the importing country (e.g., China).

-

Alternative HS Codes:

- If the product is synthetic short fiber raw material, consider HS 5503110000 (with a higher total tax of 59.3%).

- If the product is other polyamide in primary form, consider HS 3908907000 (total tax 61.5%).

📌 Proactive Advice:

- Check Material Specifications:

-

Confirm the chemical structure and processing stage of the polyamide to avoid misclassification.

-

Review Tariff Changes:

-

Stay updated on April 11, 2025 tariff adjustments and consider early import planning or tariff mitigation strategies.

-

Consult Customs Broker:

- For complex classifications or large-volume imports, consult a customs broker or compliance expert to avoid penalties.

📌 Summary of Tax Rates by HS Code:

| HS Code | Description | Total Tax Rate | Base Tariff | Additional Tariff | April 11 Special Tariff |

|---|---|---|---|---|---|

| 3908902000 | Polyamide in primary form | 55.0% | 0.0% | 25.0% | 30.0% |

| 5503110000 | Synthetic short fiber raw material | 59.3% | 4.3% | 25.0% | 30.0% |

| 5402510000 | Polyamide material | 63.8% | 8.8% | 25.0% | 30.0% |

| 3908907000 | Other polyamide in primary form | 61.5% | 6.5% | 25.0% | 30.0% |

| 3902100000 | Propylene or other olefins polymer | 61.5% | 6.5% | 25.0% | 30.0% |

Let me know if you need help with certification requirements, customs documentation, or tariff calculation tools.

Customer Reviews

No reviews yet.