| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3908902000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 5503110000 | Doc | 59.3% | CN | US | 2025-05-12 |

| 3907700000 | Doc | 61.5% | CN | US | 2025-05-12 |

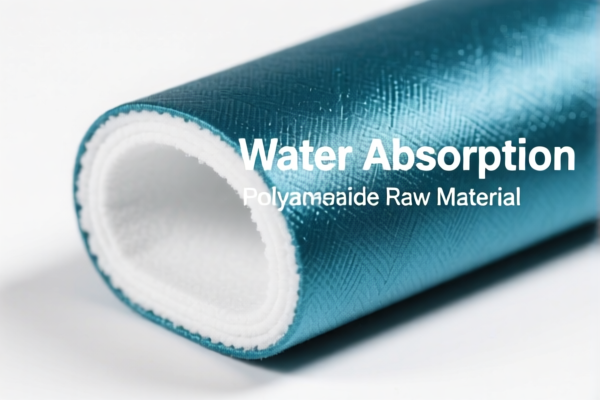

Product Classification and Customs Compliance Analysis for "Low Water Absorption Grade Polyamide Raw Material"

✅ HS CODE: 3908902000

Product Description:

- Polyamide in primary form, suitable for low water absorption resin, high-performance polyamide raw material, low shrinkage resin, engineering-grade polyamide raw material, injection molding-grade raw material, etc.

Tariff Summary: - Base Tariff Rate: 0.0% - Additional Tariff (General): 25.0% - Special Tariff after April 11, 2025: 30.0% - Total Tax Rate: 55.0%

⚠️ Important Notes:

- April 11 Special Tariff: A 30% additional tariff will be imposed on this product after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

- No Anti-dumping duties currently reported for this product category.

- No specific anti-dumping duties on iron or aluminum apply here, as this is a polymer-based product.

📌 Proactive Advice:

- Verify Material Specifications: Ensure the product is indeed in its primary form (not compounded or processed) to qualify for this HS code.

- Check Unit Price and Certification: Confirm whether any certifications (e.g., RoHS, REACH, or specific import permits) are required for the destination market.

- Monitor Tariff Updates: Keep track of any regulatory changes after April 11, 2025, as this could significantly impact import costs.

📊 Comparison with Other HS Codes:

| HS CODE | Description | Total Tax Rate | Notes |

|---|---|---|---|

| 3908902000 | Polyamide raw material (primary form) | 55.0% | ✅ Most likely correct code |

| 5503110000 | Synthetic short fiber made of nylon or polyamide | 59.3% | ❌ Not suitable for raw material |

| 3907700000 | Polylactic acid resin (PLA) | 61.5% | ❌ Not applicable for polyamide |

📢 Conclusion:

- The most appropriate HS code for "Low Water Absorption Grade Polyamide Raw Material" is 3908902000.

- Be mindful of the 30% additional tariff after April 11, 2025, and ensure proper documentation and classification to avoid customs delays or penalties. Product Classification and Customs Compliance Analysis for "Low Water Absorption Grade Polyamide Raw Material"

✅ HS CODE: 3908902000

Product Description:

- Polyamide in primary form, suitable for low water absorption resin, high-performance polyamide raw material, low shrinkage resin, engineering-grade polyamide raw material, injection molding-grade raw material, etc.

Tariff Summary: - Base Tariff Rate: 0.0% - Additional Tariff (General): 25.0% - Special Tariff after April 11, 2025: 30.0% - Total Tax Rate: 55.0%

⚠️ Important Notes:

- April 11 Special Tariff: A 30% additional tariff will be imposed on this product after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

- No Anti-dumping duties currently reported for this product category.

- No specific anti-dumping duties on iron or aluminum apply here, as this is a polymer-based product.

📌 Proactive Advice:

- Verify Material Specifications: Ensure the product is indeed in its primary form (not compounded or processed) to qualify for this HS code.

- Check Unit Price and Certification: Confirm whether any certifications (e.g., RoHS, REACH, or specific import permits) are required for the destination market.

- Monitor Tariff Updates: Keep track of any regulatory changes after April 11, 2025, as this could significantly impact import costs.

📊 Comparison with Other HS Codes:

| HS CODE | Description | Total Tax Rate | Notes |

|---|---|---|---|

| 3908902000 | Polyamide raw material (primary form) | 55.0% | ✅ Most likely correct code |

| 5503110000 | Synthetic short fiber made of nylon or polyamide | 59.3% | ❌ Not suitable for raw material |

| 3907700000 | Polylactic acid resin (PLA) | 61.5% | ❌ Not applicable for polyamide |

📢 Conclusion:

- The most appropriate HS code for "Low Water Absorption Grade Polyamide Raw Material" is 3908902000.

- Be mindful of the 30% additional tariff after April 11, 2025, and ensure proper documentation and classification to avoid customs delays or penalties.

Customer Reviews

No reviews yet.