Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917320050 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917310000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 7304390076 | Doc | 30.0% | CN | US | 2025-05-12 |

| 7304390024 | Doc | 30.0% | CN | US | 2025-05-12 |

| 7304390020 | Doc | 30.0% | CN | US | 2025-05-12 |

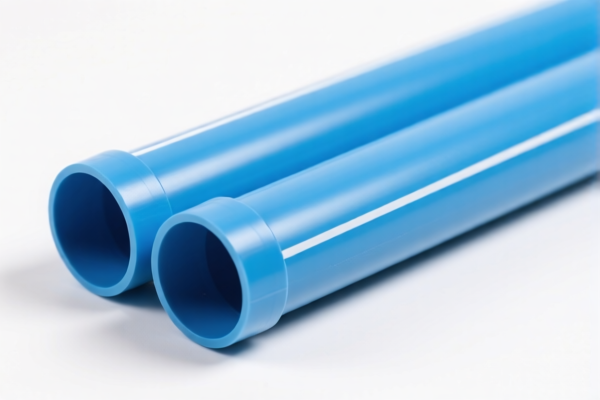

Here is the structured classification and tariff information for the "Low pressure plastic pipes" product, based on the provided HS codes and tax details:

🔍 Product Classification Overview: Low Pressure Plastic Pipes

✅ HS Code: 3917320050

- Description: Other plastic pipes and pipe fittings, not reinforced or combined with other materials, without fittings.

- Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Note: This code is for general plastic pipes that are not reinforced or combined with other materials.

✅ HS Code: 3917310000

- Description: Flexible plastic pipes and pipe fittings with a minimum burst pressure of 27.6 MPa.

- Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Note: This code is for high-pressure flexible plastic pipes, which may be subject to stricter regulations.

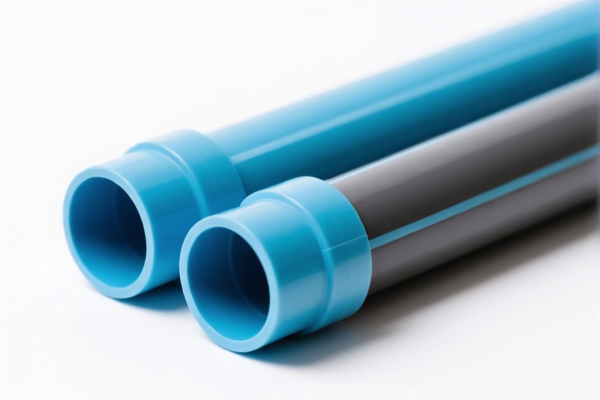

⚠️ HS Codes: 7304390076, 7304390024, 7304390020

- Description: Seamless iron or steel pipes or tubes, typically used in boilers, superheaters, heat exchangers, etc.

- Total Tax Rate: 30.0%

- Base Tariff: 0.0%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Note: These are metal pipes, not plastic, and are likely not applicable to your declared product of low pressure plastic pipes.

📌 Key Tax Rate Changes (April 11, 2025)

- Plastic pipes (HS 3917320050 & 3917310000): Tariff increases from 25.0% to 30.0% after April 11, 2025.

- Metal pipes (HS 73043900xx): Tariff increases from 0.0% to 30.0% after April 11, 2025.

🛑 Important Reminders

- Verify Material: Ensure the product is plastic, not metal (e.g., iron or steel), as metal pipes fall under different HS codes and may be subject to different regulations.

- Check Unit Price: Tariff calculations depend on the FOB price and product classification.

- Certifications Required: For plastic pipes, check if safety certifications (e.g., ISO, CE, or local standards) are required for import.

- April 11, 2025 Deadline: If your shipment is scheduled after this date, be prepared for higher tariffs.

✅ Proactive Advice

- Confirm the exact material and technical specifications of the plastic pipes (e.g., pressure rating, reinforcement, fittings).

- If the product is not reinforced and without fittings, HS 3917320050 is likely the correct code.

- If the product is flexible and has a minimum burst pressure, HS 3917310000 may apply.

- Avoid using metal pipe HS codes unless the product is indeed made of iron or steel.

Let me know if you need help with certification requirements or customs documentation for your specific product. Here is the structured classification and tariff information for the "Low pressure plastic pipes" product, based on the provided HS codes and tax details:

🔍 Product Classification Overview: Low Pressure Plastic Pipes

✅ HS Code: 3917320050

- Description: Other plastic pipes and pipe fittings, not reinforced or combined with other materials, without fittings.

- Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Note: This code is for general plastic pipes that are not reinforced or combined with other materials.

✅ HS Code: 3917310000

- Description: Flexible plastic pipes and pipe fittings with a minimum burst pressure of 27.6 MPa.

- Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Note: This code is for high-pressure flexible plastic pipes, which may be subject to stricter regulations.

⚠️ HS Codes: 7304390076, 7304390024, 7304390020

- Description: Seamless iron or steel pipes or tubes, typically used in boilers, superheaters, heat exchangers, etc.

- Total Tax Rate: 30.0%

- Base Tariff: 0.0%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Note: These are metal pipes, not plastic, and are likely not applicable to your declared product of low pressure plastic pipes.

📌 Key Tax Rate Changes (April 11, 2025)

- Plastic pipes (HS 3917320050 & 3917310000): Tariff increases from 25.0% to 30.0% after April 11, 2025.

- Metal pipes (HS 73043900xx): Tariff increases from 0.0% to 30.0% after April 11, 2025.

🛑 Important Reminders

- Verify Material: Ensure the product is plastic, not metal (e.g., iron or steel), as metal pipes fall under different HS codes and may be subject to different regulations.

- Check Unit Price: Tariff calculations depend on the FOB price and product classification.

- Certifications Required: For plastic pipes, check if safety certifications (e.g., ISO, CE, or local standards) are required for import.

- April 11, 2025 Deadline: If your shipment is scheduled after this date, be prepared for higher tariffs.

✅ Proactive Advice

- Confirm the exact material and technical specifications of the plastic pipes (e.g., pressure rating, reinforcement, fittings).

- If the product is not reinforced and without fittings, HS 3917320050 is likely the correct code.

- If the product is flexible and has a minimum burst pressure, HS 3917310000 may apply.

- Avoid using metal pipe HS codes unless the product is indeed made of iron or steel.

Let me know if you need help with certification requirements or customs documentation for your specific product.

Customer Reviews

No reviews yet.