Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917320050 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917310000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 7304390076 | Doc | 30.0% | CN | US | 2025-05-12 |

| 7304390024 | Doc | 30.0% | CN | US | 2025-05-12 |

| 7304390020 | Doc | 30.0% | CN | US | 2025-05-12 |

Here is the structured classification and tariff information for Low pressure plastic tubes, based on the provided HS codes and tax details:

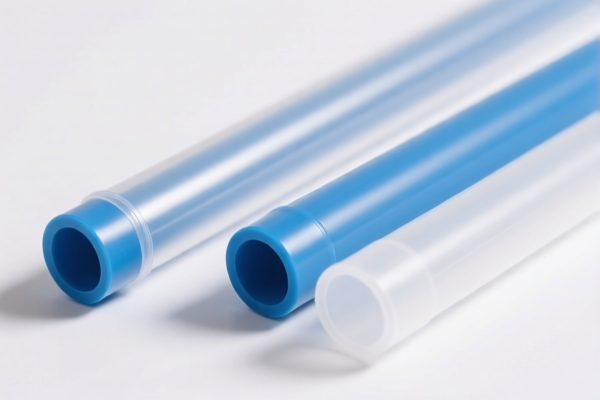

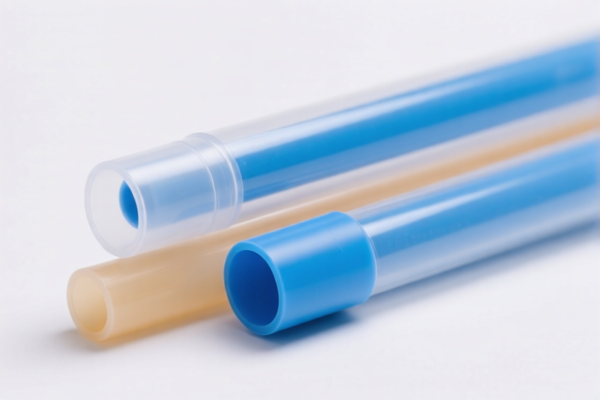

🔍 Product Classification Overview: Low Pressure Plastic Tubes

✅ HS CODE: 3917320050

- Description: Other plastic tubes and plastic fittings, not reinforced or combined with other materials, without fittings.

- Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Notes:

- This code applies to non-reinforced plastic tubes without fittings.

- Ensure the product is not reinforced or combined with other materials.

✅ HS CODE: 3917310000

- Description: Flexible plastic tubes and fittings with a minimum burst pressure of 27.6 MPa.

- Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Notes:

- This code is for flexible plastic tubes with high burst pressure.

- Confirm the burst pressure meets the 27.6 MPa requirement.

⚠️ Iron and Steel Tube HS Codes (Not Applicable for Plastic Tubes)

These codes are for iron or steel tubes, not plastic, and are included for reference only:

✅ HS CODE: 7304390076

- Description: Seamless iron or steel tubes or pipes for use in boilers, superheaters, heat exchangers, etc.

- Total Tax Rate: 30.0%

- Base Tariff: 0.0%

- Additional Tariff: 0.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Notes:

- This is not applicable for plastic tubes.

- May be relevant if the product is metal-based.

✅ HS CODE: 7304390024

- Description: Seamless iron or steel tubes or pipe profiles, usually for boilers, superheaters, etc.

- Total Tax Rate: 30.0%

- Base Tariff: 0.0%

- Additional Tariff: 0.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Notes:

- Again, not applicable for plastic tubes.

✅ HS CODE: 7304390020

- Description: Seamless iron tubes or pipes, galvanized, with an outer diameter not exceeding 114.3 mm.

- Total Tax Rate: 30.0%

- Base Tariff: 0.0%

- Additional Tariff: 0.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Notes:

- Not applicable for plastic tubes.

📌 Proactive Advice for Users

- Verify Material: Ensure the product is plastic and not reinforced or combined with other materials (e.g., metal).

- Check Burst Pressure: If the product is flexible, confirm it meets the 27.6 MPa burst pressure requirement for HS code 3917310000.

- Tariff Changes: Be aware that additional tariffs of 30.0% will apply after April 11, 2025 for both plastic and iron/steel tubes.

- Certifications: Confirm if any customs or safety certifications are required for import (e.g., RoHS, REACH, etc.).

- Unit Price: Review the unit price and total tax impact to understand the full cost implications.

Let me know if you need help determining the correct HS code based on product specifications or documentation. Here is the structured classification and tariff information for Low pressure plastic tubes, based on the provided HS codes and tax details:

🔍 Product Classification Overview: Low Pressure Plastic Tubes

✅ HS CODE: 3917320050

- Description: Other plastic tubes and plastic fittings, not reinforced or combined with other materials, without fittings.

- Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Notes:

- This code applies to non-reinforced plastic tubes without fittings.

- Ensure the product is not reinforced or combined with other materials.

✅ HS CODE: 3917310000

- Description: Flexible plastic tubes and fittings with a minimum burst pressure of 27.6 MPa.

- Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Notes:

- This code is for flexible plastic tubes with high burst pressure.

- Confirm the burst pressure meets the 27.6 MPa requirement.

⚠️ Iron and Steel Tube HS Codes (Not Applicable for Plastic Tubes)

These codes are for iron or steel tubes, not plastic, and are included for reference only:

✅ HS CODE: 7304390076

- Description: Seamless iron or steel tubes or pipes for use in boilers, superheaters, heat exchangers, etc.

- Total Tax Rate: 30.0%

- Base Tariff: 0.0%

- Additional Tariff: 0.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Notes:

- This is not applicable for plastic tubes.

- May be relevant if the product is metal-based.

✅ HS CODE: 7304390024

- Description: Seamless iron or steel tubes or pipe profiles, usually for boilers, superheaters, etc.

- Total Tax Rate: 30.0%

- Base Tariff: 0.0%

- Additional Tariff: 0.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Notes:

- Again, not applicable for plastic tubes.

✅ HS CODE: 7304390020

- Description: Seamless iron tubes or pipes, galvanized, with an outer diameter not exceeding 114.3 mm.

- Total Tax Rate: 30.0%

- Base Tariff: 0.0%

- Additional Tariff: 0.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Notes:

- Not applicable for plastic tubes.

📌 Proactive Advice for Users

- Verify Material: Ensure the product is plastic and not reinforced or combined with other materials (e.g., metal).

- Check Burst Pressure: If the product is flexible, confirm it meets the 27.6 MPa burst pressure requirement for HS code 3917310000.

- Tariff Changes: Be aware that additional tariffs of 30.0% will apply after April 11, 2025 for both plastic and iron/steel tubes.

- Certifications: Confirm if any customs or safety certifications are required for import (e.g., RoHS, REACH, etc.).

- Unit Price: Review the unit price and total tax impact to understand the full cost implications.

Let me know if you need help determining the correct HS code based on product specifications or documentation.

Customer Reviews

No reviews yet.