| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5804299090 | Doc | 60.0% | CN | US | 2025-05-12 |

| 6303990010 | Doc | 41.3% | CN | US | 2025-05-12 |

| 6303120090 | Doc | 48.8% | CN | US | 2025-05-12 |

| 6303922030 | Doc | 48.8% | CN | US | 2025-05-12 |

| 6303120010 | Doc | 48.8% | CN | US | 2025-05-12 |

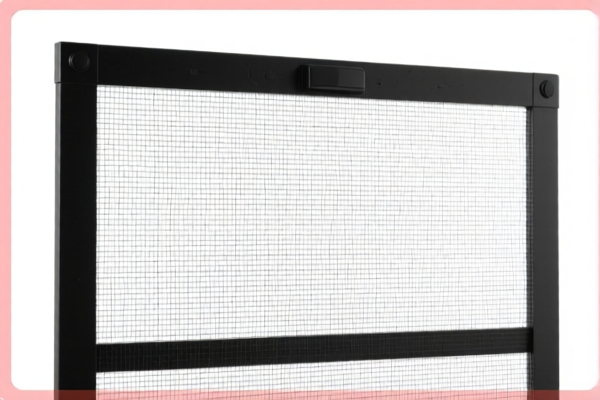

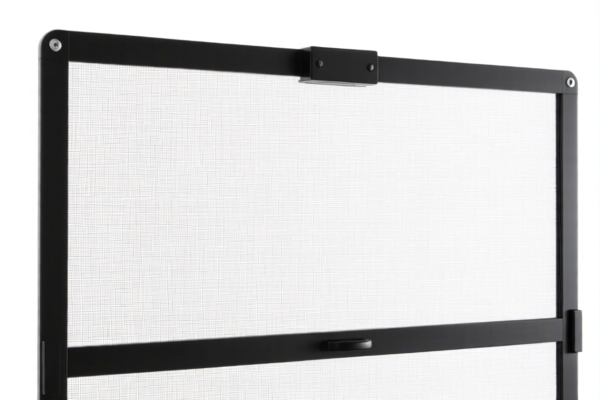

Product Name: MAGNETIC WINDOW SCREEN WITH POLYESTER MESH

Classification HS Code Analysis:

Below are the HS codes and corresponding tax details for the declared product, based on the provided data:

🔍 HS CODE: 5804299090

Description: Polyester mesh for curtains

Total Tax Rate: 60.0%

- Base Tariff: 5.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable

- Note: This code is for general polyester mesh used in curtains, not specifically for magnetic window screens.

🔍 HS CODE: 6303990010

Description: UV-resistant polyester curtains

Total Tax Rate: 41.3%

- Base Tariff: 11.3%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable

- Note: This code applies to UV-resistant polyester curtains, which may be relevant if the product includes UV protection features.

🔍 HS CODE: 6303120090

Description: Polyester UV-resistant curtains

Total Tax Rate: 48.8%

- Base Tariff: 11.3%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable

- Note: This code is for polyester UV-resistant curtains, which may be suitable if the magnetic window screen includes UV protection.

🔍 HS CODE: 6303922030

Description: Polyester UV-resistant curtains

Total Tax Rate: 48.8%

- Base Tariff: 11.3%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable

- Note: This code is similar to 6303120090 and may apply if the product is a finished curtain with UV resistance.

🔍 HS CODE: 6303120010

Description: Polyester UV-resistant curtains

Total Tax Rate: 48.8%

- Base Tariff: 11.3%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable

- Note: This code is also for polyester UV-resistant curtains, and may be applicable depending on the product's final form.

📌 Proactive Advice:

- Verify the product's final form: Is it a finished curtain or a mesh component for a magnetic window screen? This will determine the most accurate HS code.

- Check for UV resistance or other features: If the product includes UV protection, codes under 6303 may be more appropriate.

- Confirm the material composition: Ensure the product is made of polyester mesh and not a blend or with added components (e.g., magnets, frames).

- Review the unit price and classification: If the product is sold as a complete magnetic window screen, it may fall under a different category (e.g., 8483.99 for other machinery parts).

- Check required certifications: Some products may require specific certifications (e.g., UV resistance, safety standards) for import compliance.

⏰ Important Reminder:

- April 11, 2025, Special Tariff: All the listed codes will be subject to an additional 30.0% tariff after this date. Ensure your import planning accounts for this increase.

- Monitor policy updates: Tariff rates and classifications can change, so it's advisable to confirm with customs or a compliance expert before finalizing shipments.

Product Name: MAGNETIC WINDOW SCREEN WITH POLYESTER MESH

Classification HS Code Analysis:

Below are the HS codes and corresponding tax details for the declared product, based on the provided data:

🔍 HS CODE: 5804299090

Description: Polyester mesh for curtains

Total Tax Rate: 60.0%

- Base Tariff: 5.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable

- Note: This code is for general polyester mesh used in curtains, not specifically for magnetic window screens.

🔍 HS CODE: 6303990010

Description: UV-resistant polyester curtains

Total Tax Rate: 41.3%

- Base Tariff: 11.3%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable

- Note: This code applies to UV-resistant polyester curtains, which may be relevant if the product includes UV protection features.

🔍 HS CODE: 6303120090

Description: Polyester UV-resistant curtains

Total Tax Rate: 48.8%

- Base Tariff: 11.3%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable

- Note: This code is for polyester UV-resistant curtains, which may be suitable if the magnetic window screen includes UV protection.

🔍 HS CODE: 6303922030

Description: Polyester UV-resistant curtains

Total Tax Rate: 48.8%

- Base Tariff: 11.3%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable

- Note: This code is similar to 6303120090 and may apply if the product is a finished curtain with UV resistance.

🔍 HS CODE: 6303120010

Description: Polyester UV-resistant curtains

Total Tax Rate: 48.8%

- Base Tariff: 11.3%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable

- Note: This code is also for polyester UV-resistant curtains, and may be applicable depending on the product's final form.

📌 Proactive Advice:

- Verify the product's final form: Is it a finished curtain or a mesh component for a magnetic window screen? This will determine the most accurate HS code.

- Check for UV resistance or other features: If the product includes UV protection, codes under 6303 may be more appropriate.

- Confirm the material composition: Ensure the product is made of polyester mesh and not a blend or with added components (e.g., magnets, frames).

- Review the unit price and classification: If the product is sold as a complete magnetic window screen, it may fall under a different category (e.g., 8483.99 for other machinery parts).

- Check required certifications: Some products may require specific certifications (e.g., UV resistance, safety standards) for import compliance.

⏰ Important Reminder:

- April 11, 2025, Special Tariff: All the listed codes will be subject to an additional 30.0% tariff after this date. Ensure your import planning accounts for this increase.

- Monitor policy updates: Tariff rates and classifications can change, so it's advisable to confirm with customs or a compliance expert before finalizing shipments.

Customer Reviews

No reviews yet.