| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3903901000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3903190000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3901905501 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3905911000 | Doc | 59.0% | CN | US | 2025-05-12 |

| 3905290000 | Doc | 59.0% | CN | US | 2025-05-12 |

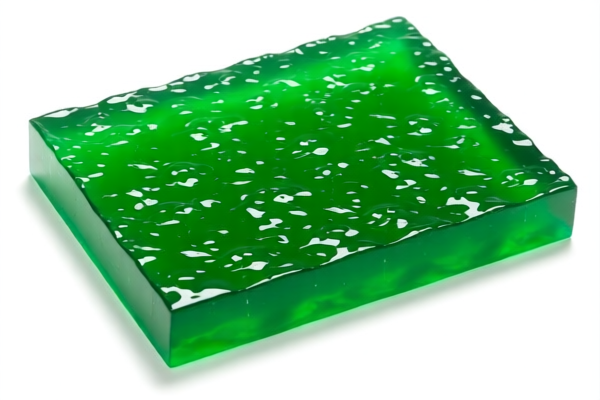

Product Name: MBS Copolymer

Classification Analysis and Customs Compliance Guidance:

✅ HS CODE Classification Options:

- HS CODE: 3903901000

- Description: MBS copolymer modified materials match this HS code description highly.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This is the most accurate classification for MBS copolymer.

-

HS CODE: 3903190000

- Description: Styrene copolymers fall under the category of styrene polymers, aligning with HS code 3903.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This is a broader category and may not be the most specific for MBS copolymer.

-

HS CODE: 3901905501

- Description: Ethylene-styrene copolymers align with the description of HS code 39019090.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This is a more general classification and may not be the best fit for MBS.

-

HS CODE: 3905911000

- Description: Vinyl acetate-styrene copolymers align with HS code 39050000.

- Total Tax Rate: 59.0%

- Breakdown:

- Base Tariff: 4.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This is a lower tax rate but may not be the correct classification for MBS.

-

HS CODE: 3905290000

- Description: Vinyl acetate-styrene copolymers align with HS code 3905.

- Total Tax Rate: 59.0%

- Breakdown:

- Base Tariff: 4.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Similar to above, this is a lower tax rate but may not be the correct classification for MBS.

⚠️ Important Notes:

- April 11, 2025 Special Tariff: A 30% additional tariff will be imposed on all the above HS codes after this date. This is a time-sensitive policy and must be considered in cost planning.

- Anti-dumping duties: Not applicable for this product category (MBS copolymer).

- Base Tariff: Varies between 4.0% and 6.5% depending on the HS code.

- Additional Tariff: Uniformly 25.0% across all options.

📌 Proactive Advice:

- Verify Material Composition: Confirm that the product is indeed MBS (methyl methacrylate-styrene) copolymer and not a different type of copolymer (e.g., vinyl acetate-styrene).

- Check Unit Price and Certification: Ensure that the product meets any required certifications (e.g., REACH, RoHS) for import compliance.

- Consult Customs Broker: For accurate classification and to avoid delays in customs clearance, it is recommended to consult a customs broker or a classification expert.

- Monitor Policy Updates: Stay informed about any changes in tariff policies, especially the April 11, 2025 deadline.

If you provide more details about the product (e.g., chemical structure, application, and origin), I can help further refine the classification.

Product Name: MBS Copolymer

Classification Analysis and Customs Compliance Guidance:

✅ HS CODE Classification Options:

- HS CODE: 3903901000

- Description: MBS copolymer modified materials match this HS code description highly.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This is the most accurate classification for MBS copolymer.

-

HS CODE: 3903190000

- Description: Styrene copolymers fall under the category of styrene polymers, aligning with HS code 3903.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This is a broader category and may not be the most specific for MBS copolymer.

-

HS CODE: 3901905501

- Description: Ethylene-styrene copolymers align with the description of HS code 39019090.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This is a more general classification and may not be the best fit for MBS.

-

HS CODE: 3905911000

- Description: Vinyl acetate-styrene copolymers align with HS code 39050000.

- Total Tax Rate: 59.0%

- Breakdown:

- Base Tariff: 4.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This is a lower tax rate but may not be the correct classification for MBS.

-

HS CODE: 3905290000

- Description: Vinyl acetate-styrene copolymers align with HS code 3905.

- Total Tax Rate: 59.0%

- Breakdown:

- Base Tariff: 4.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Similar to above, this is a lower tax rate but may not be the correct classification for MBS.

⚠️ Important Notes:

- April 11, 2025 Special Tariff: A 30% additional tariff will be imposed on all the above HS codes after this date. This is a time-sensitive policy and must be considered in cost planning.

- Anti-dumping duties: Not applicable for this product category (MBS copolymer).

- Base Tariff: Varies between 4.0% and 6.5% depending on the HS code.

- Additional Tariff: Uniformly 25.0% across all options.

📌 Proactive Advice:

- Verify Material Composition: Confirm that the product is indeed MBS (methyl methacrylate-styrene) copolymer and not a different type of copolymer (e.g., vinyl acetate-styrene).

- Check Unit Price and Certification: Ensure that the product meets any required certifications (e.g., REACH, RoHS) for import compliance.

- Consult Customs Broker: For accurate classification and to avoid delays in customs clearance, it is recommended to consult a customs broker or a classification expert.

- Monitor Policy Updates: Stay informed about any changes in tariff policies, especially the April 11, 2025 deadline.

If you provide more details about the product (e.g., chemical structure, application, and origin), I can help further refine the classification.

Customer Reviews

No reviews yet.