| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 9608500000 | Doc | The rate applicable to each article in the absence of this subhe+30.0% | CN | US | 2025-05-12 |

| 9017800000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3926909989 | Doc | 42.8% | CN | US | 2025-05-12 |

Okay, let's break down the HS codes and tax implications for your declared "MULTIFUNCTION PEN". Here's a detailed analysis, structured for clarity:

Understanding HS Codes – A Quick Primer

HS codes (Harmonized System codes) are internationally standardized codes used to classify traded products. The first 6 digits are generally consistent worldwide, while the last digits can vary by country. Here's what the digits typically represent:

- Chapter (First 2 digits): Broad category of the product.

- Heading (Next 2 digits): More specific grouping within the chapter.

- Subheading (Next 2 digits): Even more detailed classification.

- Last Digits: National-level specification (varies by country).

Analysis of Your Declared Items

Let's go through each item individually:

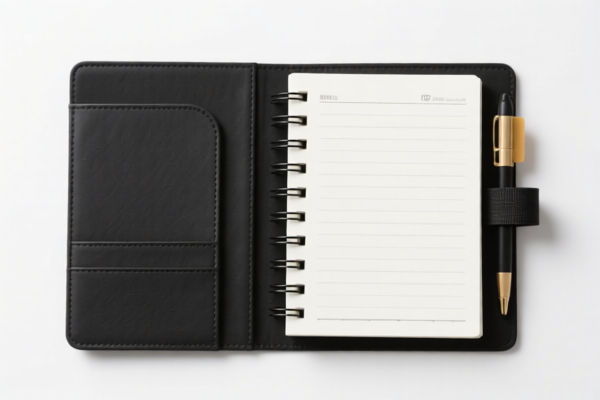

1. HS Code: 9608.50.00.00 – Sets of articles from two or more of the subheadings 9608.10, 9608.20, 9608.30 or 9608.40

- Chapter 96: Miscellaneous manufactured articles. This chapter covers a wide range of products that don't fit neatly into other categories.

- Heading 9608: Pens, pencils, brushes, felt pens, markers and crayons, ball-point pens, fountain pens, styluses, etc.

- Subheading 9608.50: Sets of articles from the other subheadings within 9608. This suggests your "MULTIFUNCTION PEN" is being declared as a set containing different types of writing/drawing instruments (e.g., a pen with a pencil, highlighter, etc.).

- Tax Implications:

- Basic Duty: The rate applicable to each article in the absence of this subheading. (This means the duty will be calculated based on the individual components of the set if declared separately).

- Additional Duty: 0.0%

- Post-April 2, 2025 Additional Duty: 30.0%

- Total Tax: Basic Duty + 30.0%

2. HS Code: 9017.80.00.00 – Drawing, marking-out or mathematical calculating instruments (for example, drafting machines, pantographs, protractors, drawing sets, slide rules, disc calculators); instruments for measuring length, for use in the hand (for example, measuring rods and tapes, micrometers, calipers), not specified or included elsewhere in this chapter; parts and accessories thereof: Other instruments

- Chapter 90: Optical, precision, medical, surgical, dental, veterinary instruments and appliances.

- Heading 9017: Drawing, marking-out, mathematical calculating instruments, measuring instruments.

- Subheading 9017.80: Other instruments. This suggests your pen might have features beyond basic writing, such as measuring capabilities or specialized drawing tools.

- Tax Implications:

- Basic Duty: 5.3%

- Additional Duty: 25.0%

- Post-April 2, 2025 Additional Duty: 30.0%

- Total Tax: 60.3%

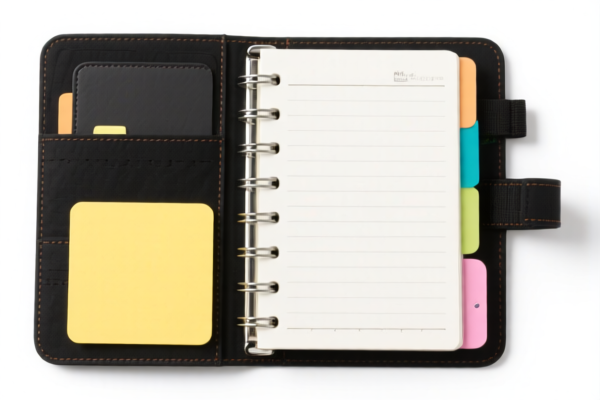

3. HS Code: 3926.90.99.89 – Other articles of plastics and articles of other materials of headings 3901 to 3914: Other: Other Other

- Chapter 39: Plastics and articles thereof.

- Heading 3926: Other articles of plastics and articles of other materials.

- Subheading 3926.90: Other. This suggests the pen's body or components are made of plastic.

- Tax Implications:

- Basic Duty: 5.3%

- Additional Duty: 7.5%

- Post-April 2, 2025 Additional Duty: 30.0%

- Total Tax: 42.8%

Important Considerations & Recommendations:

- Material Composition: The HS code selection heavily depends on the primary material of the pen. If the pen is mostly plastic, 3926.90.99.89 is appropriate. If it's a set with metal components, 9608.50.00.00 might be more suitable.

- Functionality: If the pen has significant measuring or drawing features, 9017.80.00.00 could be the correct code.

- Single vs. Set Declaration: Are you declaring the pen as a single item or as a set? This impacts the applicable HS code and duty calculation.

- Post-April 2, 2025 Tariffs: Be aware of the increased additional duties coming into effect on April 2, 2025.

- Certification: Depending on the materials used (especially plastics), you might need to provide certifications regarding safety standards or material composition.

- Value Declaration: Ensure the declared value of the pen is accurate, as duties are calculated based on this value.

- Need to verify the material and unit price.

Disclaimer: I am an AI assistant and cannot provide definitive customs advice. This information is for general guidance only. It is highly recommended to consult with a licensed customs broker or the relevant customs authorities in your country to ensure accurate classification and compliance.

Customer Reviews

I was confused about the different HS codes for my multifunction pen, but this page made it all clear. Definitely a must-read for anyone exporting pens!

The info on plastic pens under 3926909989 was useful, but I wish there were more examples of similar products to compare.

Great explanation of the 9017800000 code for pens with measuring features. It clarified the higher tax rate I saw on my import invoice.

The breakdown of the HS code 9608500000 was super helpful. I finally understand why my multifunction pen has a 30% additional duty.