| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 9017800000 | Doc | 60.3% | CN | US | 2025-05-12 |

Understanding the Classification of "Other Instruments" - HS Code 9017.80.00.00

This document provides a detailed breakdown of the HS code 9017.80.00.00 classification for "Other Instruments," along with associated tariffs and important considerations for customs clearance.

1. HS Code Breakdown:

- 90: Chapter 90 covers "Instruments and apparatus which measure, check, weigh or count; measuring, checking, testing, navigating and similar instruments and apparatus.” This broadly defines the category your item falls under.

- 17: This heading specifically covers "Instruments and apparatus which measure or check length, width, height, depth, angle or other dimensions.”

- 80: This subheading covers "Other instruments and apparatus.” This is where your "Other Instruments" are classified. It's a catch-all for measuring/checking instruments not specifically covered in more detailed subheadings.

- 00: This further specifies the item within the subheading. "00" often indicates a general classification within the 'Other' category.

In essence, HS Code 9017.80.00.00 is used for measuring, checking, testing, navigating and similar instruments and apparatus that don't fit into more specific categories within Chapter 90.

2. Tariff Details:

Based on the provided information, the applicable tariffs are:

- Basic Duty: 5.3%

- Additional Duty (Current): 25.0%

- Additional Duty (Post April 2025): 30.0%

- Total Tax (Current): 60.3% (Calculated as Basic Duty + Additional Duty)

Important Note: The additional duty rate will increase to 30.0% after April 2025. This is a significant change that will impact the overall cost of importing.

3. Key Considerations & Potential Issues:

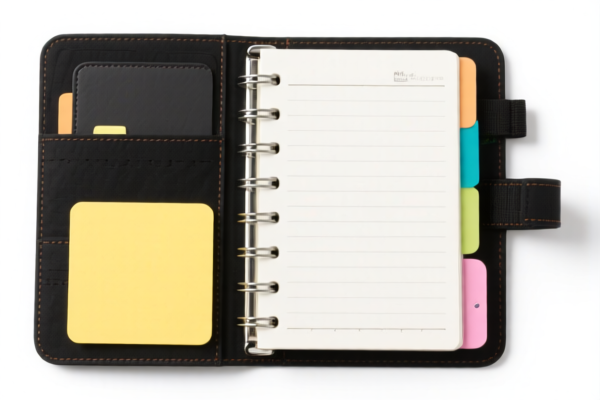

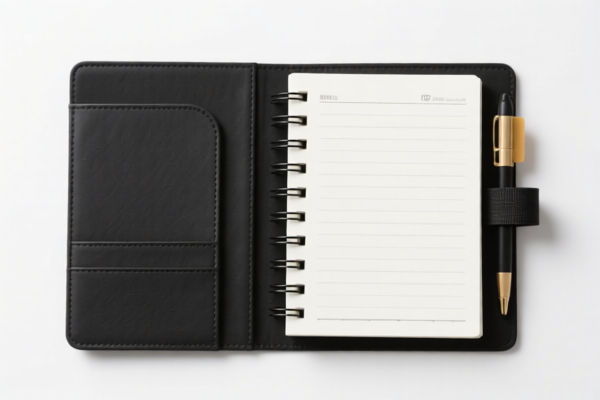

- Specificity of "Other Instruments": The term "Other Instruments" is broad. Customs officials may require a detailed description of the instrument's function, materials, and intended use to ensure correct classification. Providing technical specifications, catalogs, and even photos is highly recommended.

- Material Composition: The material the instrument is made of can influence tariff rates. Certain materials may be subject to higher duties. Please verify the exact materials used in the instrument's construction.

- Functionality: The primary function of the instrument is crucial. If the instrument has multiple functions, the classification may be based on the dominant function.

- Certification: Depending on the instrument's application (e.g., medical, safety-related), specific certifications (e.g., CE, RoHS, CCC) may be required for import. Please confirm if any certifications are needed based on the instrument's intended use and destination market.

- Valuation: The declared value of the instrument is critical. Customs will scrutinize the value to ensure it reflects the actual transaction price. Ensure the declared value is accurate and supported by appropriate documentation (e.g., invoice, sales contract).

4. Recommended Actions:

- Detailed Product Description: Prepare a comprehensive description of the instrument, including its function, specifications, materials, and intended use.

- Supporting Documentation: Gather all relevant documentation, such as catalogs, technical specifications, and photos.

- Material Verification: Confirm the exact materials used in the instrument's construction.

- Certification Check: Determine if any certifications are required for import based on the instrument's application.

- Valuation Accuracy: Ensure the declared value is accurate and supported by appropriate documentation.

- Post-April 2025 Planning: Factor in the increased additional duty rate of 30.0% when planning imports after April 2025.

Disclaimer: This information is for general guidance only and does not constitute professional customs advice. Regulations can change, and it is essential to consult with a qualified customs broker or consultant for specific advice tailored to your situation.

Customer Reviews

The page provided a good overview of HS Code 9017.80.00.00, but I wish there was more guidance on how to determine the dominant function of the product for classification.

The detailed tariff breakdown and the note about the increasing duty rate after April 2025 were really useful for planning my imports. Highly recommend this page.

The information about the classification of 'Other Instruments' was clear and easy to understand. I especially liked the breakdown of the HS code digits.

Great breakdown of HS Code 9017.80.00.00 for multifunctional pens. The tariff details and upcoming changes after April 2025 were super helpful.