| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 9503000071 | Doc | 30.0% | CN | US | 2025-05-12 |

| 9503000073 | Doc | 30.0% | CN | US | 2025-05-12 |

| 8470300000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4820900000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 8548000000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 8210000000 | Doc | 58.7% | CN | US | 2025-05-12 |

Okay, let's break down the HS codes and tax implications for your declared goods. I'll provide a structured analysis to help you understand the classification and potential costs.

Understanding HS Codes: A Quick Primer

HS codes (Harmonized System codes) are internationally standardized codes used to classify traded products. The first 6 digits are generally consistent worldwide, while countries can add further digits for more specific classifications. Here's how to interpret them:

- Chapter (First 2 digits): Broad category of goods.

- Heading (Next 2 digits): More specific grouping within the chapter.

- Subheading (Next 2 digits): Even more detailed classification.

- Further digits (Country-specific): Used for national tariff purposes.

Analysis of Your Declared Goods

Here's a breakdown of each item, its HS code, and tax details:

1. Tricycles, Scooters, Pedal Cars (for under 3-year-olds)

- HS Code: 9503.00.00.71

- Chapter: 95 – Toys, Games and Sports Equipment

- Heading: 9503 – Toys, games and sports equipment; gymnastic or athletic articles

- Tax Details:

- Basic Duty: 0.0%

- Additional Duty: 0.0%

- Additional Duty (Post April 2, 2025): 30%

- Total Tax: 30.0%

- Notes: This classification is for wheeled toys and dolls specifically intended for children under 3 years of age. Please ensure the labeling clearly indicates this age range.

2. Tricycles, Scooters, Pedal Cars (for 3-12 year-olds)

- HS Code: 9503.00.00.73

- Chapter: 95 – Toys, Games and Sports Equipment

- Heading: 9503 – Toys, games and sports equipment; gymnastic or athletic articles

- Tax Details:

- Basic Duty: 0.0%

- Additional Duty: 0.0%

- Additional Duty (Post April 2, 2025): 30%

- Total Tax: 30.0%

- Notes: Similar to the above, but for children aged 3-12. Verify the age labeling on these products.

3. Calculating Machines (Other)

- HS Code: 8470.30.00.00

- Chapter: 84 – Nuclear reactors, boilers, machinery and mechanical appliances; parts thereof

- Heading: 8470 – Calculating machines

- Tax Details:

- Basic Duty: 0.0%

- Additional Duty: 25.0%

- Additional Duty (Post April 2, 2025): 30%

- Total Tax: 55.0%

- Notes: This covers a broad range of calculating machines. Please confirm the specific functionality of these machines to ensure accurate classification.

4. Stationery (Other)

- HS Code: 4820.90.00.00

- Chapter: 48 – Articles of paper or paperboard, not including those of Chapter 49

- Heading: 4820 – Notebooks, exercise books, etc.

- Tax Details:

- Basic Duty: 0.0%

- Additional Duty: 25.0%

- Additional Duty (Post April 2, 2025): 30%

- Total Tax: 55.0%

- Notes: This is a catch-all for various stationery items. Ensure the materials are primarily paper or paperboard.

5. Electrical Parts of Machinery

- HS Code: 8548.00.00.00

- Chapter: 85 – Electrical machinery and equipment

- Heading: 8548 – Electrical parts

- Tax Details:

- Basic Duty: 0.0%

- Additional Duty: 25.0%

- Additional Duty (Post April 2, 2025): 30%

- Total Tax: 55.0%

- Notes: This is a broad category. Provide detailed specifications of the electrical parts to confirm the correct classification.

6. Hand-Operated Mechanical Appliances

- HS Code: 8210.00.00.00

- Chapter: 82 – Blades, cutting tools, hand tools

- Heading: 8210 – Hand tools

- Tax Details:

- Basic Duty: 3.7%

- Additional Duty: 25.0%

- Additional Duty (Post April 2, 2025): 30%

- Total Tax: 58.7%

- Notes: This covers hand-operated appliances used in food preparation. Confirm the weight is under 10kg and the appliances are indeed hand-operated.

Important Reminders & Recommendations:

- Material Composition: For items like stationery, confirm the primary material is paper or paperboard.

- Detailed Specifications: Provide detailed specifications for electrical parts and machinery components to ensure accurate classification.

- Age Labeling: For toys, ensure clear age labeling to match the HS code classification.

- Post-April 2, 2025 Tariffs: Be aware of the additional tariffs coming into effect on April 2, 2025.

- Country of Origin: Double-check the country of origin for each item.

- Valuation: Ensure accurate valuation of your goods, as this impacts duty calculations.

- Certifications: Depending on the specific products (especially toys), you may need to provide certifications related to safety standards (e.g., ASTM, EN71).

Disclaimer: I am an AI assistant and this information is for general guidance only. It is always best to consult with a licensed customs broker or relevant authorities for definitive classification and compliance advice.

Customer Reviews

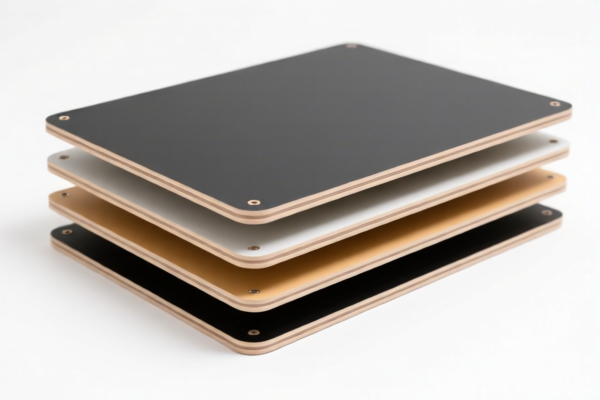

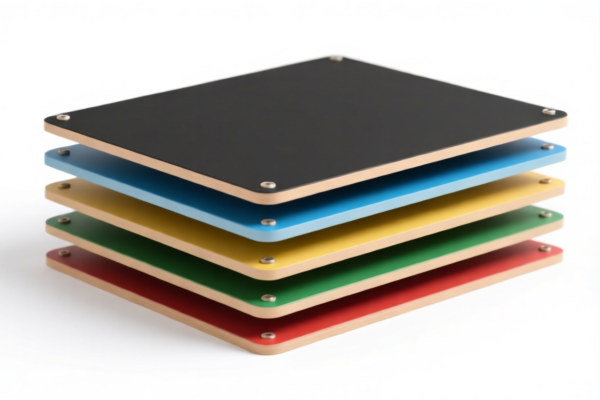

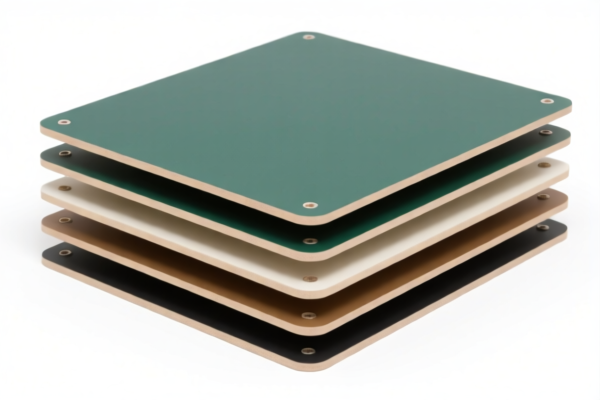

The page provided a good overview of the different HS codes for the multiplication board, but I wish the images were labeled more clearly to match the HS codes listed.

I really appreciated the explanation of HS Code 8210000000 for hand-operated appliances. The 58.7% tariff and note about weight under 10kg were very specific and useful.

Helpful details on the 55% tariff for calculating machines under HS Code 8470300000. It’s good to know the additional duty after April 2, 2025.

The breakdown of HS Code 9503000071 for tricycles for under 3-year-olds was very clear. Great for understanding the 30% tariff rate and the age-specific classification.