| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 4904000020 | Doc | 37.5% | CN | US | 2025-05-12 |

| 4904000040 | Doc | 37.5% | CN | US | 2025-05-12 |

| 4911100080 | Doc | 37.5% | CN | US | 2025-05-12 |

| 4911998000 | Doc | 37.5% | CN | US | 2025-05-12 |

| 9209991000 | Doc | 43.2% | CN | US | 2025-05-12 |

| 9209998000 | Doc | 42.8% | CN | US | 2025-05-12 |

Here's a classification of "MUSIC SHEET STORAGE BOOK" based on the provided reference data, presented in a structured format:

-

4904.00.00.20 - Music, printed or in manuscript, whether or not bound or illustrated; Sheet music, whether or not stapled or folded, but not otherwise bound.

- 49: Chapter 49 covers Printed Books, Newspapers, Pictures and other products of the printing industry; manuscripts, typescripts and plans and microfilms.

- 04: Specifically relates to Music, printed or in manuscript.

- 00.00.20: This further specifies sheet music that is not bound. If the book is simply a folder to hold sheet music, rather than a collection of bound sheets, this is the most likely HS code.

-

4911.10.00.80 - Other printed matter, including printed pictures and photographs: Trade advertising material, commercial catalogs and the like.

- 49: Chapter 49 - Printed Books, Newspapers, Pictures and other products of the printing industry.

- 11: This code covers other printed matter.

- 10.00.80: This is for trade advertising material and commercial catalogs. If the storage book includes promotional material or is designed as a catalog for other music products, this code might apply.

-

4911.99.80.00 - Other printed matter, including printed pictures and photographs: Other: Other: Other: Other

- 49: Chapter 49 - Printed Books, Newspapers, Pictures and other products of the printing industry.

- 11: This code covers other printed matter.

- 99.80.00: This is a broad "catch-all" category for other printed matter not specifically classified elsewhere. If the book is a simple storage solution with minimal printing, this could be applicable.

Important Considerations & Recommendations:

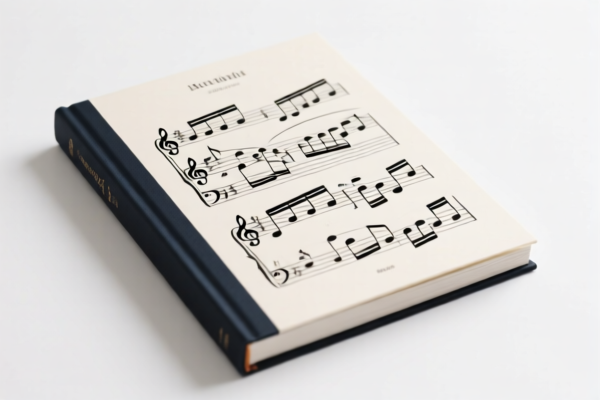

- Binding Type: The key distinction is whether the book is bound or simply a folder. "Bound" implies a more permanent joining of the sheets (e.g., stitched, glued).

- Material Composition: The material of the book's cover and pages is important.

- Functionality: Is it primarily for storage, or does it have other features (e.g., catalog, promotional material)?

- Tax Rate: All codes listed currently have a total tax rate of 37.5% until April 2, 2025, after which it increases to 43.5%.

- Further Verification: To ensure accurate classification, please provide details about the book's construction, materials, and intended use.

Customer Reviews

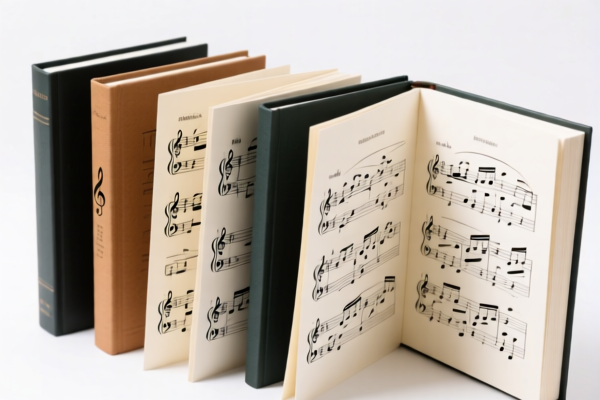

The images of the music sheet storage book were helpful in visualizing what the product looks like. The HS code breakdown was thorough, though the tax rate change date could be more prominent.

The classification of 4911.10.00.80 was exactly what I needed since my storage book includes some promotional material. Very specific and accurate.

The information on the 37.5% tariff rate is clear, but I wish there was more detail on how the tax rate changes after April 2025.

Great breakdown of the HS codes for music sheet storage books. The explanation about 4904.00.00.20 was super helpful for my export needs.