| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921901500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921902510 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920992000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3921904090 | Doc | 34.2% | CN | US | 2025-05-12 |

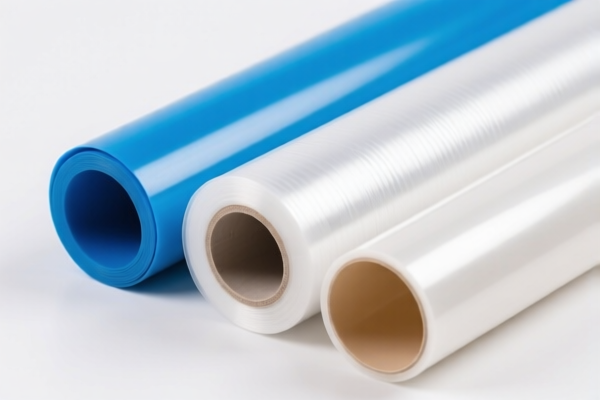

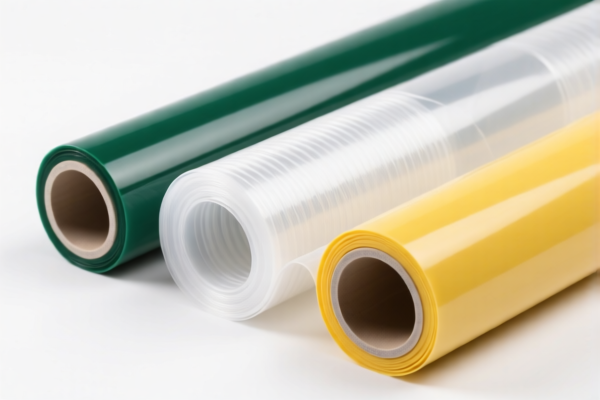

Product Classification: Man-Made Fiber Composite Plastic Films

HS CODEs and Tax Details (April 2025 Update):

✅ HS CODE: 3921901500

Description:

- Applicable to plastic sheets, plates, films, foils, and strips made of plastic and man-made fiber composites, with a weight not exceeding 1.492 kg/m².

Tariff Summary:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

Key Notes:

- This code is for lightweight composite films (≤1.492 kg/m²).

- Ensure the weight per square meter is accurately measured and documented.

✅ HS CODE: 3921902510

Description:

- Applicable to plastic composites combined with textile materials, where textile components are the major weight component, and no single textile fiber exceeds the weight of man-made fiber.

- Plastic must constitute more than 70% of the total weight.

Tariff Summary:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

Key Notes:

- Confirm that plastic is the dominant component (over 70%) and textile fibers are not individually heavier than man-made fibers.

- This code is not suitable for products where textile fibers are the main component.

✅ HS CODE: 3920992000

Description:

- Applicable to plastic sheets, plates, films, etc., that are laminated, supported, or combined with other materials in a similar manner.

Tariff Summary:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

Key Notes:

- This code is for composite materials with other materials (e.g., paper, fabric, etc.) combined with plastic.

- Ensure the combination method (e.g., lamination, support) is clearly described in the product documentation.

✅ HS CODE: 3921905050

Description:

- Applicable to plastic sheets, plates, films, etc., that meet the general description of Chapter 39.

Tariff Summary:

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.8%

Key Notes:

- This code is a catch-all for plastic films that do not fit the more specific codes above.

- Ensure the product does not meet the criteria for the more specific codes (e.g., weight, composition, or combination method).

✅ HS CODE: 3921904090

Description:

- Applicable to other plastic sheets, plates, films, foils, and strips, including composite films that fall under the category of plastic films.

Tariff Summary:

- Base Tariff: 4.2%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.2%

Key Notes:

- This code is for general-purpose plastic films that are not specifically defined by other codes.

- Confirm that the product does not meet the criteria for more specific codes (e.g., weight, composition, or combination method).

📌 Proactive Advice for Importers:

- Verify the exact composition and weight of the composite film (especially the weight per square meter).

- Check the dominant material (plastic vs. textile) and ensure it aligns with the HS code criteria.

- Review the product’s structure (e.g., laminated, combined with other materials) to determine the correct classification.

- Confirm the unit price and material breakdown for accurate customs valuation.

- Check if any certifications (e.g., RoHS, REACH) are required for import into the destination country.

- Be aware of the April 11, 2025, special tariff and plan accordingly for cost estimation and compliance.

Let me know if you need help with certification requirements or customs documentation for this product.

Product Classification: Man-Made Fiber Composite Plastic Films

HS CODEs and Tax Details (April 2025 Update):

✅ HS CODE: 3921901500

Description:

- Applicable to plastic sheets, plates, films, foils, and strips made of plastic and man-made fiber composites, with a weight not exceeding 1.492 kg/m².

Tariff Summary:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

Key Notes:

- This code is for lightweight composite films (≤1.492 kg/m²).

- Ensure the weight per square meter is accurately measured and documented.

✅ HS CODE: 3921902510

Description:

- Applicable to plastic composites combined with textile materials, where textile components are the major weight component, and no single textile fiber exceeds the weight of man-made fiber.

- Plastic must constitute more than 70% of the total weight.

Tariff Summary:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

Key Notes:

- Confirm that plastic is the dominant component (over 70%) and textile fibers are not individually heavier than man-made fibers.

- This code is not suitable for products where textile fibers are the main component.

✅ HS CODE: 3920992000

Description:

- Applicable to plastic sheets, plates, films, etc., that are laminated, supported, or combined with other materials in a similar manner.

Tariff Summary:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

Key Notes:

- This code is for composite materials with other materials (e.g., paper, fabric, etc.) combined with plastic.

- Ensure the combination method (e.g., lamination, support) is clearly described in the product documentation.

✅ HS CODE: 3921905050

Description:

- Applicable to plastic sheets, plates, films, etc., that meet the general description of Chapter 39.

Tariff Summary:

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.8%

Key Notes:

- This code is a catch-all for plastic films that do not fit the more specific codes above.

- Ensure the product does not meet the criteria for the more specific codes (e.g., weight, composition, or combination method).

✅ HS CODE: 3921904090

Description:

- Applicable to other plastic sheets, plates, films, foils, and strips, including composite films that fall under the category of plastic films.

Tariff Summary:

- Base Tariff: 4.2%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.2%

Key Notes:

- This code is for general-purpose plastic films that are not specifically defined by other codes.

- Confirm that the product does not meet the criteria for more specific codes (e.g., weight, composition, or combination method).

📌 Proactive Advice for Importers:

- Verify the exact composition and weight of the composite film (especially the weight per square meter).

- Check the dominant material (plastic vs. textile) and ensure it aligns with the HS code criteria.

- Review the product’s structure (e.g., laminated, combined with other materials) to determine the correct classification.

- Confirm the unit price and material breakdown for accurate customs valuation.

- Check if any certifications (e.g., RoHS, REACH) are required for import into the destination country.

- Be aware of the April 11, 2025, special tariff and plan accordingly for cost estimation and compliance.

Let me know if you need help with certification requirements or customs documentation for this product.

Customer Reviews

No reviews yet.