| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921902510 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921901500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 5903902000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 5803005000 | Doc | 55.0% | CN | US | 2025-05-12 |

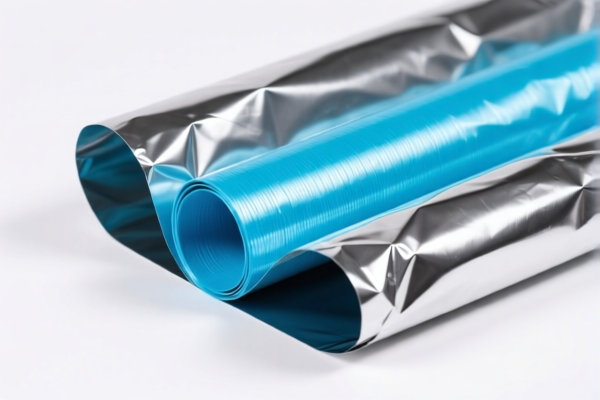

Product Name: Man Made Fiber Composite Plastic Foil

Classification HS CODEs and Tax Details:

✅ HS CODE: 3921902550

Description: Composite textile plastic foil, where the plastic content exceeds 70% by weight, and the textile component is primarily man-made fiber (with man-made fiber weight exceeding any other single textile fiber). The product has a weight of more than 1.492 kg/m².

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Key Notes:

- Applicable for heavier composite materials (over 1.492 kg/m²).

- Ensure the product meets the weight and fiber composition criteria.

✅ HS CODE: 3921902510

Description: Plastic composite board with man-made fiber, where the plastic content exceeds 70% by weight, and man-made fiber is the dominant textile component (weight of any single textile fiber is less than that of man-made fiber).

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Key Notes:

- Similar to 3921902550 but for lighter or different composite structures.

- Verify the exact composition and weight of the textile and plastic components.

✅ HS CODE: 3921901500

Description: Plastic composite film with man-made fiber, where the plastic content exceeds 70% by weight, and the product is combined with textile materials with a weight of no more than 1.492 kg/m².

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Key Notes:

- Designed for lighter composite films or foils.

- Confirm the weight per square meter to ensure correct classification.

✅ HS CODE: 5903902000

Description: Plastic-coated man-made fiber textile fabric, suitable for packaging or other uses.

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

- Key Notes:

- Lower base tariff but still subject to additional tariffs.

- Ensure the product is a textile fabric with a plastic coating.

✅ HS CODE: 5803005000

Description: Man-made fiber composite gauze, not of heading 5806 (narrow-width textile products).

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

- Key Notes:

- Designed for gauze-like products made of man-made fibers.

- Confirm it is not classified under 5806 (narrow-width textile products).

📌 Proactive Advice:

- Verify Material Composition: Confirm the exact weight percentages of plastic and man-made fiber in the product.

- Check Product Weight: For HS CODEs 3921902550 and 3921901500, the weight per square meter is a critical classification factor.

- Review Certifications: Ensure any required certifications (e.g., textile or plastic compliance) are in place.

- Monitor Tariff Changes: Be aware of the April 11, 2025 deadline for additional tariffs (30.0%).

- Consult Customs Authority: For complex or borderline cases, seek confirmation from local customs or a customs broker.

Let me know if you need help with a specific product sample or documentation.

Product Name: Man Made Fiber Composite Plastic Foil

Classification HS CODEs and Tax Details:

✅ HS CODE: 3921902550

Description: Composite textile plastic foil, where the plastic content exceeds 70% by weight, and the textile component is primarily man-made fiber (with man-made fiber weight exceeding any other single textile fiber). The product has a weight of more than 1.492 kg/m².

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Key Notes:

- Applicable for heavier composite materials (over 1.492 kg/m²).

- Ensure the product meets the weight and fiber composition criteria.

✅ HS CODE: 3921902510

Description: Plastic composite board with man-made fiber, where the plastic content exceeds 70% by weight, and man-made fiber is the dominant textile component (weight of any single textile fiber is less than that of man-made fiber).

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Key Notes:

- Similar to 3921902550 but for lighter or different composite structures.

- Verify the exact composition and weight of the textile and plastic components.

✅ HS CODE: 3921901500

Description: Plastic composite film with man-made fiber, where the plastic content exceeds 70% by weight, and the product is combined with textile materials with a weight of no more than 1.492 kg/m².

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Key Notes:

- Designed for lighter composite films or foils.

- Confirm the weight per square meter to ensure correct classification.

✅ HS CODE: 5903902000

Description: Plastic-coated man-made fiber textile fabric, suitable for packaging or other uses.

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

- Key Notes:

- Lower base tariff but still subject to additional tariffs.

- Ensure the product is a textile fabric with a plastic coating.

✅ HS CODE: 5803005000

Description: Man-made fiber composite gauze, not of heading 5806 (narrow-width textile products).

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

- Key Notes:

- Designed for gauze-like products made of man-made fibers.

- Confirm it is not classified under 5806 (narrow-width textile products).

📌 Proactive Advice:

- Verify Material Composition: Confirm the exact weight percentages of plastic and man-made fiber in the product.

- Check Product Weight: For HS CODEs 3921902550 and 3921901500, the weight per square meter is a critical classification factor.

- Review Certifications: Ensure any required certifications (e.g., textile or plastic compliance) are in place.

- Monitor Tariff Changes: Be aware of the April 11, 2025 deadline for additional tariffs (30.0%).

- Consult Customs Authority: For complex or borderline cases, seek confirmation from local customs or a customs broker.

Let me know if you need help with a specific product sample or documentation.

Customer Reviews

No reviews yet.