Found 3 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921902510 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3918902000 | Doc | 61.5% | CN | US | 2025-05-12 |

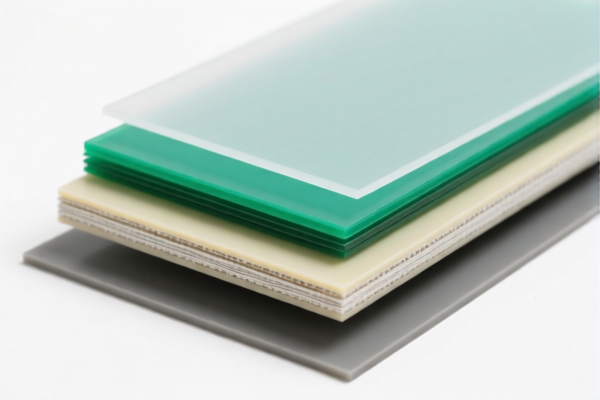

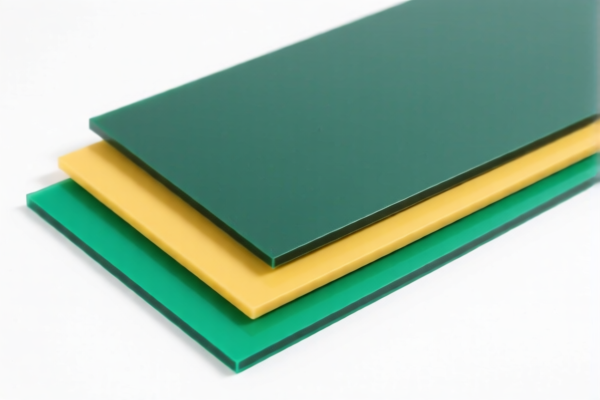

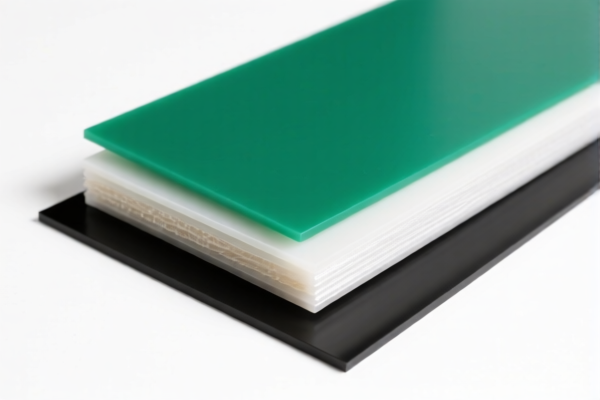

Product Classification: Man Made Fiber Composite Plastic Sheets

HS CODEs and Tax Details:

- HS CODE: 3921902510

- Description: Applicable to composite plastic sheets combined with textile materials, where the total weight exceeds 1.492 kg/m², textile components constitute the majority by weight, and the weight of any single textile fiber is less than that of man-made fibers. Plastic content must exceed 70% by weight.

- Total Tax Rate: 61.5%

-

Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921902550

- Description: Applicable to composite plastic sheets made with other textile materials, such as synthetic fiber-based composites.

- Total Tax Rate: 61.5%

-

Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3918902000

- Description: Applicable to plastic wall coverings with fiber backing.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Key Notes and Recommendations:

- Tariff Increase Alert: A 30.0% additional tariff will be applied after April 11, 2025 for all three HS codes. Ensure your import timeline accounts for this change.

- Material Verification: Confirm the exact composition of the product (e.g., plastic percentage, type of textile fibers used) to ensure correct HS code classification.

- Certifications: Check if any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product in the destination country.

- Unit Price: Verify the unit price and weight per square meter to ensure compliance with the weight thresholds specified in the HS code descriptions.

- Customs Declaration: Provide detailed product specifications to customs to avoid classification disputes or delays.

Let me know if you need help with HS code selection based on specific product details.

Product Classification: Man Made Fiber Composite Plastic Sheets

HS CODEs and Tax Details:

- HS CODE: 3921902510

- Description: Applicable to composite plastic sheets combined with textile materials, where the total weight exceeds 1.492 kg/m², textile components constitute the majority by weight, and the weight of any single textile fiber is less than that of man-made fibers. Plastic content must exceed 70% by weight.

- Total Tax Rate: 61.5%

-

Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921902550

- Description: Applicable to composite plastic sheets made with other textile materials, such as synthetic fiber-based composites.

- Total Tax Rate: 61.5%

-

Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3918902000

- Description: Applicable to plastic wall coverings with fiber backing.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Key Notes and Recommendations:

- Tariff Increase Alert: A 30.0% additional tariff will be applied after April 11, 2025 for all three HS codes. Ensure your import timeline accounts for this change.

- Material Verification: Confirm the exact composition of the product (e.g., plastic percentage, type of textile fibers used) to ensure correct HS code classification.

- Certifications: Check if any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product in the destination country.

- Unit Price: Verify the unit price and weight per square meter to ensure compliance with the weight thresholds specified in the HS code descriptions.

- Customs Declaration: Provide detailed product specifications to customs to avoid classification disputes or delays.

Let me know if you need help with HS code selection based on specific product details.

Customer Reviews

No reviews yet.