| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921901500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921902100 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921904010 | Doc | 34.2% | CN | US | 2025-05-12 |

| 3918902000 | Doc | 61.5% | CN | US | 2025-05-12 |

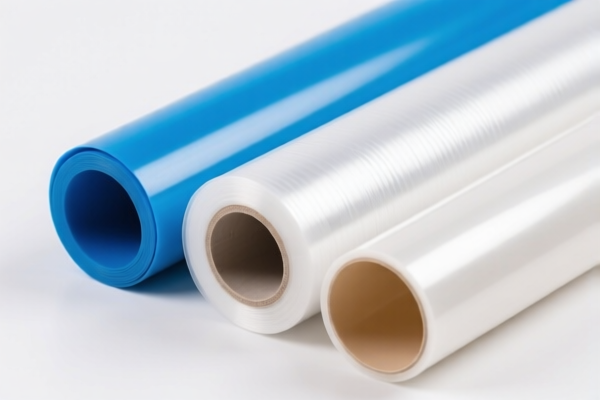

Product Name: Man-Made Fiber Reinforced Plastic Films

Classification: Based on HS codes and tariff details provided, the product falls under several HS codes depending on specific composition and application. Below is a structured breakdown of the relevant HS codes and their associated tariffs:

🔍 HS Code: 3921901500

Description: Plastic and man-made fiber composite films

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Notes: This code applies to films made from a combination of plastic and man-made fibers (e.g., polyester, nylon).

🔍 HS Code: 3921902100

Description: Cotton-reinforced plastic films

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Notes: This code is for films reinforced with cotton fibers.

🔍 HS Code: 3921902550

Description: Textile-reinforced plastic films

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Notes: This code applies to films reinforced with textile fibers (not cotton).

🔍 HS Code: 3921904010

Description: Reinforced plastic films (general)

- Base Tariff Rate: 4.2%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.2%

- Notes: This code is for general reinforced plastic films, possibly with unspecified or non-textile reinforcement.

🔍 HS Code: 3918902000

Description: Man-made fiber-reinforced plastic wall materials

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Notes: This code is for wall materials reinforced with man-made fibers, not for general films.

⚠️ Important Notes:

- April 11, 2025 Special Tariff: A 30% additional tariff is imposed on all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

- Anti-dumping duties: Not explicitly mentioned for this product category, but always verify if applicable based on the country of origin.

- Material Verification: Confirm the exact composition of the film (e.g., type of fiber, reinforcement material) to ensure correct HS code classification.

- Certifications: Check if any certifications (e.g., RoHS, REACH, or import permits) are required for the product in the destination country.

✅ Proactive Advice:

- Verify the exact composition of the product (e.g., whether it is cotton-reinforced, textile-reinforced, or man-made fiber-reinforced).

- Check the unit price and total value to determine if any preferential tariff rates apply.

- Consult customs authorities or a customs broker for confirmation on the most accurate HS code and applicable duties.

- Plan ahead for the April 11, 2025 tariff increase to avoid unexpected costs.

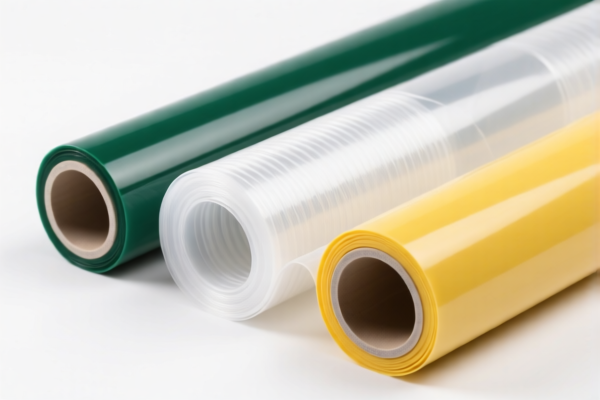

Product Name: Man-Made Fiber Reinforced Plastic Films

Classification: Based on HS codes and tariff details provided, the product falls under several HS codes depending on specific composition and application. Below is a structured breakdown of the relevant HS codes and their associated tariffs:

🔍 HS Code: 3921901500

Description: Plastic and man-made fiber composite films

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Notes: This code applies to films made from a combination of plastic and man-made fibers (e.g., polyester, nylon).

🔍 HS Code: 3921902100

Description: Cotton-reinforced plastic films

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Notes: This code is for films reinforced with cotton fibers.

🔍 HS Code: 3921902550

Description: Textile-reinforced plastic films

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Notes: This code applies to films reinforced with textile fibers (not cotton).

🔍 HS Code: 3921904010

Description: Reinforced plastic films (general)

- Base Tariff Rate: 4.2%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.2%

- Notes: This code is for general reinforced plastic films, possibly with unspecified or non-textile reinforcement.

🔍 HS Code: 3918902000

Description: Man-made fiber-reinforced plastic wall materials

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Notes: This code is for wall materials reinforced with man-made fibers, not for general films.

⚠️ Important Notes:

- April 11, 2025 Special Tariff: A 30% additional tariff is imposed on all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

- Anti-dumping duties: Not explicitly mentioned for this product category, but always verify if applicable based on the country of origin.

- Material Verification: Confirm the exact composition of the film (e.g., type of fiber, reinforcement material) to ensure correct HS code classification.

- Certifications: Check if any certifications (e.g., RoHS, REACH, or import permits) are required for the product in the destination country.

✅ Proactive Advice:

- Verify the exact composition of the product (e.g., whether it is cotton-reinforced, textile-reinforced, or man-made fiber-reinforced).

- Check the unit price and total value to determine if any preferential tariff rates apply.

- Consult customs authorities or a customs broker for confirmation on the most accurate HS code and applicable duties.

- Plan ahead for the April 11, 2025 tariff increase to avoid unexpected costs.

Customer Reviews

No reviews yet.