Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921902510 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

| 3918902000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 7019739090 | Doc | 61.0% | CN | US | 2025-05-12 |

| 7019905150 | Doc | 59.3% | CN | US | 2025-05-12 |

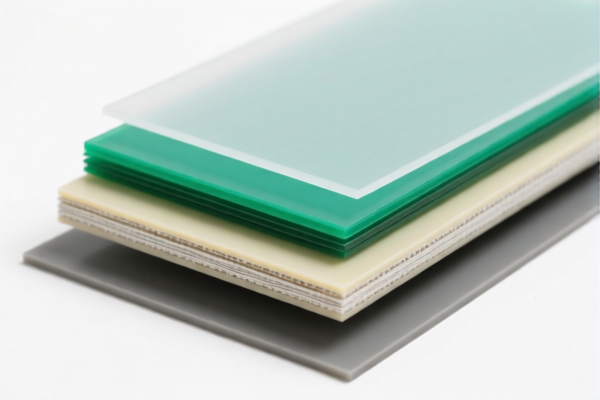

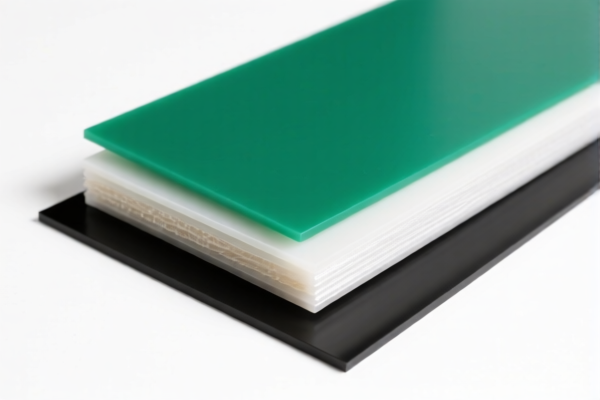

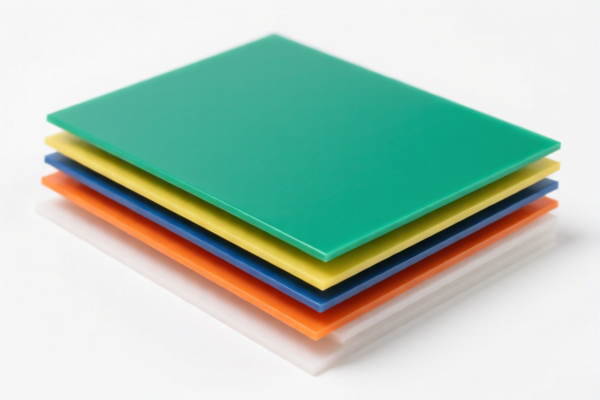

Product Classification: Man-Made Fiber Reinforced Plastic Sheets

HS CODEs and Tax Details:

- HS CODE: 3921902510

- Description: Applicable to man-made fiber composite plastic sheets with a weight exceeding 1.492 kg/m², where the textile component is the main weight component, and the weight of any single textile fiber is less than that of man-made fiber, with plastic weight accounting for more than 70%.

- Total Tax Rate: 61.5%

- Tax Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Key Notes:

- This code is suitable for products where the plastic content is the dominant component.

- Ensure the product meets the weight and composition criteria.

-

HS CODE: 3921902900

- Description: Applicable to fiber-reinforced textile plastic sheets, sheets, films, foils, and strips with a weight exceeding 1.492 kg/m², combined with other materials.

- Total Tax Rate: 59.4%

- Tax Breakdown:

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Key Notes:

- This code is for composite products with textile fibers and plastic.

- Confirm the product is not classified under a more specific code.

-

HS CODE: 3918902000

- Description: Applicable to man-made fiber-reinforced plastic wall coverings with textile or synthetic fiber backing.

- Total Tax Rate: 61.5%

- Tax Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Key Notes:

- This code is for wall coverings with a textile or synthetic fiber backing.

- Ensure the product is not classified under a more specific category.

-

HS CODE: 7019739090

- Description: Applicable to glass fiber-reinforced plastic sheets.

- Total Tax Rate: 61.0%

- Tax Breakdown:

- Base Tariff: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Key Notes:

- This code is for products reinforced with glass fiber.

- Confirm the product is not classified under a more specific code.

-

HS CODE: 7019905150

- Description: Applicable to glass fiber-reinforced plastic sheets, which fall under other products of glass fiber and articles thereof.

- Total Tax Rate: 59.3%

- Tax Breakdown:

- Base Tariff: 4.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Notes:

- This code is for other glass fiber-reinforced products.

- Ensure the product is not classified under a more specific category.

Proactive Advice:

- Verify Material Composition: Confirm the exact composition and weight percentages of the product to ensure correct classification.

- Check Unit Price and Certification: Some products may require specific certifications (e.g., safety, environmental compliance) for import.

- Monitor Tariff Changes: The additional tariffs after April 11, 2025, will significantly increase the total tax burden.

-

Consult Customs Authority: For complex or borderline cases, consult with customs or a qualified customs broker to avoid misclassification and penalties. Product Classification: Man-Made Fiber Reinforced Plastic Sheets

HS CODEs and Tax Details: -

HS CODE: 3921902510

- Description: Applicable to man-made fiber composite plastic sheets with a weight exceeding 1.492 kg/m², where the textile component is the main weight component, and the weight of any single textile fiber is less than that of man-made fiber, with plastic weight accounting for more than 70%.

- Total Tax Rate: 61.5%

- Tax Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Key Notes:

- This code is suitable for products where the plastic content is the dominant component.

- Ensure the product meets the weight and composition criteria.

-

HS CODE: 3921902900

- Description: Applicable to fiber-reinforced textile plastic sheets, sheets, films, foils, and strips with a weight exceeding 1.492 kg/m², combined with other materials.

- Total Tax Rate: 59.4%

- Tax Breakdown:

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Key Notes:

- This code is for composite products with textile fibers and plastic.

- Confirm the product is not classified under a more specific code.

-

HS CODE: 3918902000

- Description: Applicable to man-made fiber-reinforced plastic wall coverings with textile or synthetic fiber backing.

- Total Tax Rate: 61.5%

- Tax Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Key Notes:

- This code is for wall coverings with a textile or synthetic fiber backing.

- Ensure the product is not classified under a more specific category.

-

HS CODE: 7019739090

- Description: Applicable to glass fiber-reinforced plastic sheets.

- Total Tax Rate: 61.0%

- Tax Breakdown:

- Base Tariff: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Key Notes:

- This code is for products reinforced with glass fiber.

- Confirm the product is not classified under a more specific code.

-

HS CODE: 7019905150

- Description: Applicable to glass fiber-reinforced plastic sheets, which fall under other products of glass fiber and articles thereof.

- Total Tax Rate: 59.3%

- Tax Breakdown:

- Base Tariff: 4.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Notes:

- This code is for other glass fiber-reinforced products.

- Ensure the product is not classified under a more specific category.

Proactive Advice:

- Verify Material Composition: Confirm the exact composition and weight percentages of the product to ensure correct classification.

- Check Unit Price and Certification: Some products may require specific certifications (e.g., safety, environmental compliance) for import.

- Monitor Tariff Changes: The additional tariffs after April 11, 2025, will significantly increase the total tax burden.

- Consult Customs Authority: For complex or borderline cases, consult with customs or a qualified customs broker to avoid misclassification and penalties.

Customer Reviews

No reviews yet.