Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921131500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921131100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921131950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

| 5907006000 | Doc | 55.0% | CN | US | 2025-05-12 |

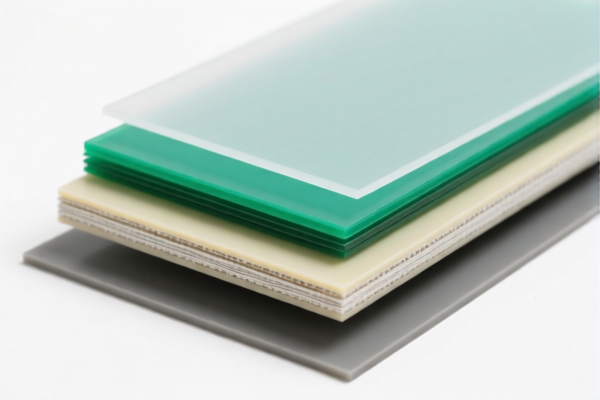

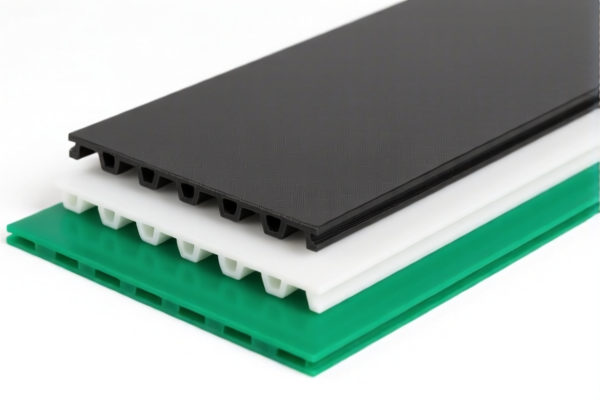

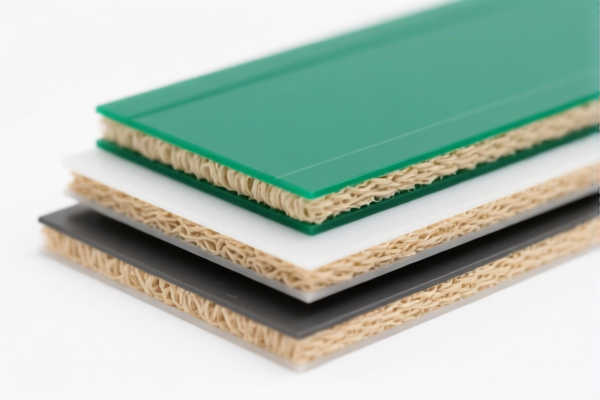

Product Classification: Man-Made Fiber Polyurethane Textile Composite Sheets

HS CODEs and Tax Analysis:

✅ HS CODE: 3921131500

- Description: Polyurethane textile composite sheets, where man-made fiber weight exceeds that of other single textile fibers.

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Key Notes:

- This code applies when the composite sheet is made of polyurethane plastic and combined with textile materials, with man-made fibers being the dominant component.

- Proactive Advice: Confirm the fiber composition and ensure the man-made fiber weight is clearly documented to meet classification criteria.

✅ HS CODE: 3921131100

- Description: Polyurethane textile composite sheets, with no restriction on man-made fiber weight.

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

- Key Notes:

- This code is broader and does not require man-made fibers to be the dominant component.

- Proactive Advice: If the product has a lower man-made fiber content, this may be a more favorable classification.

✅ HS CODE: 3921131950

- Description: Polyurethane composite textile sheets, including cellular polyurethane plastic, combined with textile materials.

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

- Key Notes:

- This code includes cellular (honeycomb) structures and does not restrict plant fiber content.

- Proactive Advice: If the product has a cellular structure, this may be the correct classification.

✅ HS CODE: 3921902550

- Description: Polyester fiber textile composite sheets, with a weight exceeding 1.492 kg/m² and man-made fiber as the dominant component.

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Key Notes:

- This code is specific to polyester fiber composites with a defined weight threshold.

- Proactive Advice: Verify the weight per square meter and fiber composition to ensure compliance.

✅ HS CODE: 5907006000

- Description: Other impregnated, coated, or laminated textile fabrics, made of man-made fibers.

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

- Key Notes:

- This is a broader category for textile fabrics that are coated or laminated, with no specific mention of polyurethane.

- Proactive Advice: If the product is not specifically polyurethane-based, this may be a more general but lower-tax classification.

📌 Important Reminders:

- April 11, 2025 Special Tariff: All listed HS codes will have an additional 30.0% tariff applied after this date.

- Anti-dumping duties: Not applicable for these HS codes.

- Certifications: Ensure proper documentation (e.g., fiber composition, weight, and structure) is available for customs inspection.

- Unit Price: Verify the unit price and weight per square meter to ensure correct classification.

Let me know if you need help selecting the most appropriate HS code based on your product specifications.

Product Classification: Man-Made Fiber Polyurethane Textile Composite Sheets

HS CODEs and Tax Analysis:

✅ HS CODE: 3921131500

- Description: Polyurethane textile composite sheets, where man-made fiber weight exceeds that of other single textile fibers.

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Key Notes:

- This code applies when the composite sheet is made of polyurethane plastic and combined with textile materials, with man-made fibers being the dominant component.

- Proactive Advice: Confirm the fiber composition and ensure the man-made fiber weight is clearly documented to meet classification criteria.

✅ HS CODE: 3921131100

- Description: Polyurethane textile composite sheets, with no restriction on man-made fiber weight.

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

- Key Notes:

- This code is broader and does not require man-made fibers to be the dominant component.

- Proactive Advice: If the product has a lower man-made fiber content, this may be a more favorable classification.

✅ HS CODE: 3921131950

- Description: Polyurethane composite textile sheets, including cellular polyurethane plastic, combined with textile materials.

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

- Key Notes:

- This code includes cellular (honeycomb) structures and does not restrict plant fiber content.

- Proactive Advice: If the product has a cellular structure, this may be the correct classification.

✅ HS CODE: 3921902550

- Description: Polyester fiber textile composite sheets, with a weight exceeding 1.492 kg/m² and man-made fiber as the dominant component.

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Key Notes:

- This code is specific to polyester fiber composites with a defined weight threshold.

- Proactive Advice: Verify the weight per square meter and fiber composition to ensure compliance.

✅ HS CODE: 5907006000

- Description: Other impregnated, coated, or laminated textile fabrics, made of man-made fibers.

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

- Key Notes:

- This is a broader category for textile fabrics that are coated or laminated, with no specific mention of polyurethane.

- Proactive Advice: If the product is not specifically polyurethane-based, this may be a more general but lower-tax classification.

📌 Important Reminders:

- April 11, 2025 Special Tariff: All listed HS codes will have an additional 30.0% tariff applied after this date.

- Anti-dumping duties: Not applicable for these HS codes.

- Certifications: Ensure proper documentation (e.g., fiber composition, weight, and structure) is available for customs inspection.

- Unit Price: Verify the unit price and weight per square meter to ensure correct classification.

Let me know if you need help selecting the most appropriate HS code based on your product specifications.

Customer Reviews

No reviews yet.