| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921131500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 4807009400 | Doc | 55.0% | CN | US | 2025-05-12 |

| 7220206015 | Doc | 30.0% | CN | US | 2025-05-12 |

| 4411139090 | Doc | 58.9% | CN | US | 2025-05-12 |

Here is the structured analysis and customs compliance guidance for the Medical Composite Boards based on the provided HS codes and tariff details:

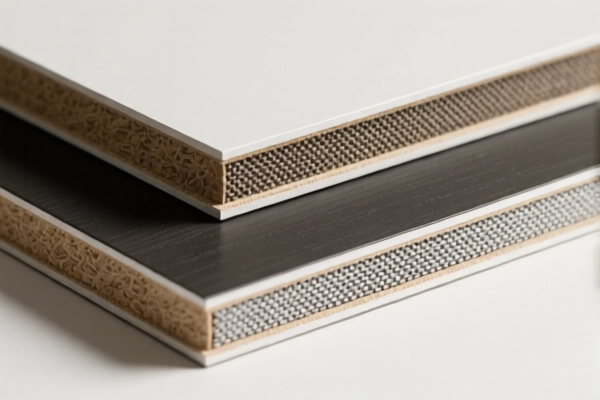

✅ HS CODE: 3921902550

Product Description:

- Medical textile composite plastic boards

- Plastic sheets, films, foils, and strips combined with textile materials

- Weight > 1.492 kg/m²

- Textile component contains synthetic fibers in greater weight than any other single textile fiber

- Plastic weight > 70%

Tariff Summary:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tax Rate: 61.5%

Key Notes:

- This code applies to composite materials with a high plastic content and specific textile composition.

- Ensure the product meets the weight and fiber composition criteria.

- Verify the material composition and weight per square meter to avoid misclassification.

✅ HS CODE: 3921131500

Product Description:

- Polyurethane textile composite medical boards

- Composite polyurethane plastic sheets with textile materials

Tariff Summary:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tax Rate: 61.5%

Key Notes:

- This code is specific to polyurethane-based composite boards used in medical applications.

- Confirm the type of plastic used (must be polyurethane) and composite structure.

- Ensure compliance with medical device or material certification requirements if applicable.

✅ HS CODE: 4807009400

Product Description:

- Medical-grade composite paperboard or composite paperboard for medical packaging

- Uncoated or unimpregnated composite paper or paperboard

Tariff Summary:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tax Rate: 55.0%

Key Notes:

- This code applies to composite paperboard used in medical packaging.

- Ensure the product is not coated or impregnated.

- Confirm if medical packaging certification is required for import.

✅ HS CODE: 7220206015

Product Description:

- Stainless steel medical plates

- Flat-rolled stainless steel products used in medical fields

- Width < 600 mm, cold-rolled, width < 300 mm

Tariff Summary:

- Base Tariff: 0.0%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tax Rate: 30.0%

Key Notes:

- This code applies to stainless steel plates used in medical applications.

- Confirm the width and processing method (cold-rolled).

- Ensure material specifications match the HS code description.

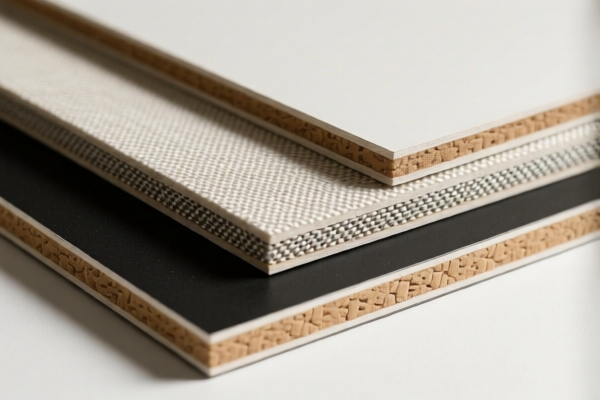

✅ HS CODE: 4411139090

Product Description:

- Composite fiberboard

- Wood or other wooden fiberboard, regardless of whether bonded with resin or other organic substances

- Thickness > 5 mm but ≤ 9 mm

Tariff Summary:

- Base Tariff: 3.9%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tax Rate: 58.9%

Key Notes:

- This code applies to composite fiberboard with specific thickness and material requirements.

- Confirm the thickness and bonding material (e.g., resin).

- Ensure the product is not classified under a different HS code (e.g., 4411131090 for other thicknesses).

📌 Proactive Advice for All Products:

- Verify Material Composition: Confirm the exact materials used (e.g., plastic type, fiber content, bonding agents).

- Check Unit Price and Classification: Ensure the product is not misclassified due to incorrect HS code selection.

- Review Certification Requirements: Some medical products may require CE, FDA, or ISO certification for import.

- Monitor Tariff Changes: The April 11, 2025 special tariff applies to all listed products.

- Consult Customs Broker: For complex or high-value shipments, seek professional customs clearance assistance.

Let me know if you need help with certification requirements or customs documentation for any of these products. Here is the structured analysis and customs compliance guidance for the Medical Composite Boards based on the provided HS codes and tariff details:

✅ HS CODE: 3921902550

Product Description:

- Medical textile composite plastic boards

- Plastic sheets, films, foils, and strips combined with textile materials

- Weight > 1.492 kg/m²

- Textile component contains synthetic fibers in greater weight than any other single textile fiber

- Plastic weight > 70%

Tariff Summary:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tax Rate: 61.5%

Key Notes:

- This code applies to composite materials with a high plastic content and specific textile composition.

- Ensure the product meets the weight and fiber composition criteria.

- Verify the material composition and weight per square meter to avoid misclassification.

✅ HS CODE: 3921131500

Product Description:

- Polyurethane textile composite medical boards

- Composite polyurethane plastic sheets with textile materials

Tariff Summary:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tax Rate: 61.5%

Key Notes:

- This code is specific to polyurethane-based composite boards used in medical applications.

- Confirm the type of plastic used (must be polyurethane) and composite structure.

- Ensure compliance with medical device or material certification requirements if applicable.

✅ HS CODE: 4807009400

Product Description:

- Medical-grade composite paperboard or composite paperboard for medical packaging

- Uncoated or unimpregnated composite paper or paperboard

Tariff Summary:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tax Rate: 55.0%

Key Notes:

- This code applies to composite paperboard used in medical packaging.

- Ensure the product is not coated or impregnated.

- Confirm if medical packaging certification is required for import.

✅ HS CODE: 7220206015

Product Description:

- Stainless steel medical plates

- Flat-rolled stainless steel products used in medical fields

- Width < 600 mm, cold-rolled, width < 300 mm

Tariff Summary:

- Base Tariff: 0.0%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tax Rate: 30.0%

Key Notes:

- This code applies to stainless steel plates used in medical applications.

- Confirm the width and processing method (cold-rolled).

- Ensure material specifications match the HS code description.

✅ HS CODE: 4411139090

Product Description:

- Composite fiberboard

- Wood or other wooden fiberboard, regardless of whether bonded with resin or other organic substances

- Thickness > 5 mm but ≤ 9 mm

Tariff Summary:

- Base Tariff: 3.9%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tax Rate: 58.9%

Key Notes:

- This code applies to composite fiberboard with specific thickness and material requirements.

- Confirm the thickness and bonding material (e.g., resin).

- Ensure the product is not classified under a different HS code (e.g., 4411131090 for other thicknesses).

📌 Proactive Advice for All Products:

- Verify Material Composition: Confirm the exact materials used (e.g., plastic type, fiber content, bonding agents).

- Check Unit Price and Classification: Ensure the product is not misclassified due to incorrect HS code selection.

- Review Certification Requirements: Some medical products may require CE, FDA, or ISO certification for import.

- Monitor Tariff Changes: The April 11, 2025 special tariff applies to all listed products.

- Consult Customs Broker: For complex or high-value shipments, seek professional customs clearance assistance.

Let me know if you need help with certification requirements or customs documentation for any of these products.

Customer Reviews

No reviews yet.