Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3904100000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3904100000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3904100000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3904100000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3904100000 | Doc | 61.5% | CN | US | 2025-05-12 |

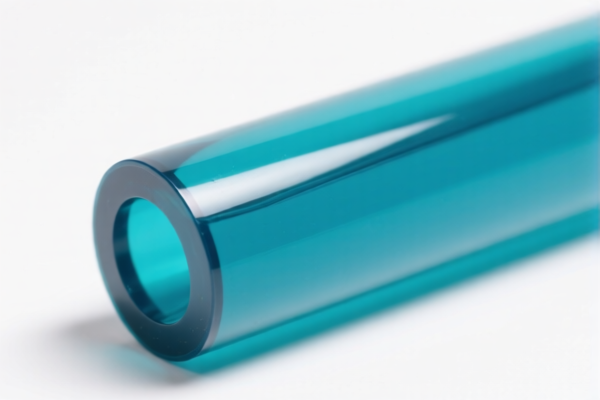

Product Name: Medical Grade PVC Resin

HS CODE: 3904100000

✅ Classification Summary:

- HS Code: 3904100000

- Description: This code applies to polyvinyl chloride (PVC) resins in primary form, including medical-grade PVC resin.

- Chapter 3904 covers polyvinyl chloride (PVC) or other halogenated ethylene polymers in primary form.

📊 Tariff Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tariff Rate: 61.5%

⚠️ Important Note: The 30.0% additional tariff applies after April 11, 2025. Ensure your import timeline aligns with this policy change.

📌 Key Considerations:

- Medical-grade PVC resin falls under the same HS code as industrial, food-grade, and packaging-grade PVC resins, as the classification is based on chemical composition and form, not end-use.

- Certifications: Depending on the destination country, you may need safety certifications (e.g., FDA, ISO, REACH) for medical-grade materials.

- Material Verification: Confirm the exact chemical composition and form (e.g., powder, pellets) to ensure correct classification.

- Unit Price: Tariff calculations depend on FOB value and unit price—ensure accurate documentation.

🛑 Proactive Advice:

- Check with customs authority for any local additional duties or special regulations for medical-grade materials.

- Review documentation (e.g., material safety data sheets, certificates of analysis) to support classification.

- Monitor policy updates after April 11, 2025, as the special tariff may affect cost projections.

Let me know if you need help with certification requirements or customs documentation for this product.

Product Name: Medical Grade PVC Resin

HS CODE: 3904100000

✅ Classification Summary:

- HS Code: 3904100000

- Description: This code applies to polyvinyl chloride (PVC) resins in primary form, including medical-grade PVC resin.

- Chapter 3904 covers polyvinyl chloride (PVC) or other halogenated ethylene polymers in primary form.

📊 Tariff Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tariff Rate: 61.5%

⚠️ Important Note: The 30.0% additional tariff applies after April 11, 2025. Ensure your import timeline aligns with this policy change.

📌 Key Considerations:

- Medical-grade PVC resin falls under the same HS code as industrial, food-grade, and packaging-grade PVC resins, as the classification is based on chemical composition and form, not end-use.

- Certifications: Depending on the destination country, you may need safety certifications (e.g., FDA, ISO, REACH) for medical-grade materials.

- Material Verification: Confirm the exact chemical composition and form (e.g., powder, pellets) to ensure correct classification.

- Unit Price: Tariff calculations depend on FOB value and unit price—ensure accurate documentation.

🛑 Proactive Advice:

- Check with customs authority for any local additional duties or special regulations for medical-grade materials.

- Review documentation (e.g., material safety data sheets, certificates of analysis) to support classification.

- Monitor policy updates after April 11, 2025, as the special tariff may affect cost projections.

Let me know if you need help with certification requirements or customs documentation for this product.

Customer Reviews

No reviews yet.