| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3926909950 | Doc | 42.8% | CN | US | 2025-05-12 |

| 3926902100 | Doc | 41.7% | CN | US | 2025-05-12 |

| 3926902100 | Doc | 41.7% | CN | US | 2025-05-12 |

| 5903903090 | Doc | 57.7% | CN | US | 2025-05-12 |

| 3921904090 | Doc | 34.2% | CN | US | 2025-05-12 |

Product Classification and Tax Information for "Medical Textile Plastic Sheets"

Below is the detailed breakdown of the HS codes and associated tariffs for the declared product:

✅ HS CODE: 3926909950

Product Description: Medical Mask Plastic Products

- Base Tariff Rate: 5.3%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 42.8%

- Notes:

- This code applies to general plastic products used in medical masks.

- Be sure to confirm the exact composition and intended use of the product to ensure correct classification.

✅ HS CODE: 3926902100

Product Description:

- Option 1: Plastic Medical Assistive Devices

- Option 2: Plastic Medical Care Accessories

- Base Tariff Rate: 4.2%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 41.7%

- Notes:

- This code is for a variety of plastic medical devices and accessories.

- Ensure the product is not classified under a more specific HS code (e.g., 3926902100 is a general category).

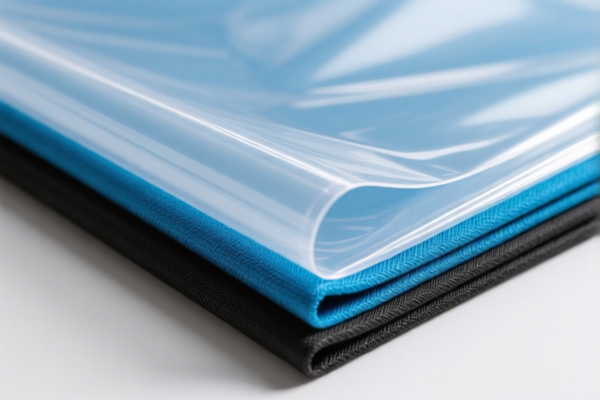

✅ HS CODE: 5903903090

Product Description: Medical Use Plastic-Coated Textile Products

- Base Tariff Rate: 2.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 57.7%

- Notes:

- This code applies to textile products coated with plastic for medical use (e.g., gowns, drapes).

- Verify if the product is a textile with a plastic coating or a fully plastic product, as this can affect classification.

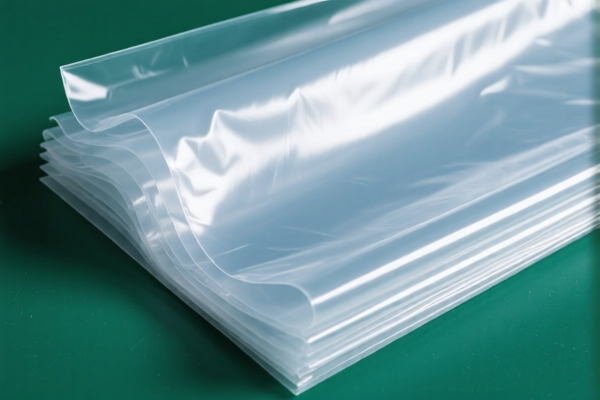

✅ HS CODE: 3921904090

Product Description: Plastic Medical Packaging Film

- Base Tariff Rate: 4.2%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.2%

- Notes:

- This code is for plastic films used in medical packaging.

- Confirm the material and thickness of the film to ensure correct classification.

📌 Proactive Advice for Importers:

- Verify Material and Unit Price: Ensure the product's composition and intended use match the HS code description.

- Check Required Certifications: Medical products may require specific certifications (e.g., CE, FDA) for import compliance.

- Monitor Tariff Changes: The April 11, 2025 special tariff applies to all listed products and may significantly increase the total tax burden.

- Consult a Customs Broker: For complex classifications or high-value shipments, seek professional customs advice to avoid delays or penalties.

Let me know if you need help determining the most accurate HS code for your specific product. Product Classification and Tax Information for "Medical Textile Plastic Sheets"

Below is the detailed breakdown of the HS codes and associated tariffs for the declared product:

✅ HS CODE: 3926909950

Product Description: Medical Mask Plastic Products

- Base Tariff Rate: 5.3%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 42.8%

- Notes:

- This code applies to general plastic products used in medical masks.

- Be sure to confirm the exact composition and intended use of the product to ensure correct classification.

✅ HS CODE: 3926902100

Product Description:

- Option 1: Plastic Medical Assistive Devices

- Option 2: Plastic Medical Care Accessories

- Base Tariff Rate: 4.2%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 41.7%

- Notes:

- This code is for a variety of plastic medical devices and accessories.

- Ensure the product is not classified under a more specific HS code (e.g., 3926902100 is a general category).

✅ HS CODE: 5903903090

Product Description: Medical Use Plastic-Coated Textile Products

- Base Tariff Rate: 2.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 57.7%

- Notes:

- This code applies to textile products coated with plastic for medical use (e.g., gowns, drapes).

- Verify if the product is a textile with a plastic coating or a fully plastic product, as this can affect classification.

✅ HS CODE: 3921904090

Product Description: Plastic Medical Packaging Film

- Base Tariff Rate: 4.2%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.2%

- Notes:

- This code is for plastic films used in medical packaging.

- Confirm the material and thickness of the film to ensure correct classification.

📌 Proactive Advice for Importers:

- Verify Material and Unit Price: Ensure the product's composition and intended use match the HS code description.

- Check Required Certifications: Medical products may require specific certifications (e.g., CE, FDA) for import compliance.

- Monitor Tariff Changes: The April 11, 2025 special tariff applies to all listed products and may significantly increase the total tax burden.

- Consult a Customs Broker: For complex classifications or high-value shipments, seek professional customs advice to avoid delays or penalties.

Let me know if you need help determining the most accurate HS code for your specific product.

Customer Reviews

No reviews yet.