Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 4411141000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4410110010 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4410190010 | Doc | 55.0% | CN | US | 2025-05-12 |

| 8440900000 | Doc | 37.5% | CN | US | 2025-05-12 |

| 8440100000 | Doc | 37.5% | CN | US | 2025-05-12 |

✅ Customs Classification and Tariff Analysis for Medium Density Fiberboard (MDF) Exceeding 9mm Thickness (Unworked)

🔍 Product Description

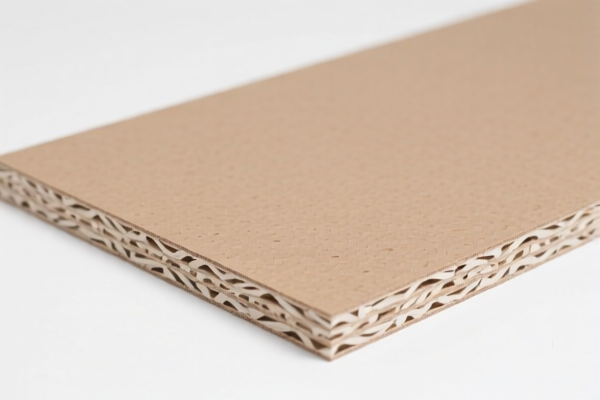

- Description: Fiberboard of wood or other ligneous materials, whether or not bonded with resins or other organic substances: Medium density fiberboard (MDF): Of a thickness exceeding 9 mm: Not mechanically worked or surface covered

- HS Code: 4411141000

- Tariff Details:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 55.0%

📌 Key Tariff Notes and Considerations

- Base Tariff: 0.0% – No standard import duty is applied.

- Additional Tariff: 25.0% – This is a general additional tariff applicable to most goods.

- Special Tariff after April 11, 2025: 30.0% – A time-sensitive increase in tariffs, effective after April 11, 2025. This is likely due to trade policy changes or retaliatory measures.

- Total Tariff: 55.0% – The sum of all applicable tariffs.

⚠️ Important Alerts

- April 11, 2025 Tariff Increase: If your import is scheduled after April 11, 2025, the total tariff will increase to 55.0%. Ensure your customs clearance is planned accordingly.

- No Anti-Dumping or Countervailing Duties: No specific anti-dumping or countervailing duties are currently listed for this product.

- No Special Tariffs on Iron or Aluminum: This product is not related to iron or aluminum, so no additional duties apply in that context.

📋 Proactive Advice for Importers

- Verify Material and Unit Price: Confirm that the product is indeed MDF and not a different type of fiberboard (e.g., particle board or OSB), as classification can vary.

- Check Required Certifications: Ensure that any necessary documentation (e.g., import licenses, product conformity certificates) is in place.

- Monitor Tariff Changes: Keep an eye on any updates to the tariff schedule, especially around the April 11, 2025 deadline.

- Consult a Customs Broker: For complex or high-value shipments, consider engaging a customs broker to ensure compliance and avoid delays.

📌 Summary Table

| Item | Description | HS Code | Base Tariff | Additional Tariff | Special Tariff (after 2025.4.11) | Total Tariff |

|---|---|---|---|---|---|---|

| MDF | Medium density fiberboard, unworked, >9mm | 4411141000 | 0.0% | 25.0% | 30.0% | 55.0% |

Let me know if you need help with classification of other products or assistance with customs documentation.

✅ Customs Classification and Tariff Analysis for Medium Density Fiberboard (MDF) Exceeding 9mm Thickness (Unworked)

🔍 Product Description

- Description: Fiberboard of wood or other ligneous materials, whether or not bonded with resins or other organic substances: Medium density fiberboard (MDF): Of a thickness exceeding 9 mm: Not mechanically worked or surface covered

- HS Code: 4411141000

- Tariff Details:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 55.0%

📌 Key Tariff Notes and Considerations

- Base Tariff: 0.0% – No standard import duty is applied.

- Additional Tariff: 25.0% – This is a general additional tariff applicable to most goods.

- Special Tariff after April 11, 2025: 30.0% – A time-sensitive increase in tariffs, effective after April 11, 2025. This is likely due to trade policy changes or retaliatory measures.

- Total Tariff: 55.0% – The sum of all applicable tariffs.

⚠️ Important Alerts

- April 11, 2025 Tariff Increase: If your import is scheduled after April 11, 2025, the total tariff will increase to 55.0%. Ensure your customs clearance is planned accordingly.

- No Anti-Dumping or Countervailing Duties: No specific anti-dumping or countervailing duties are currently listed for this product.

- No Special Tariffs on Iron or Aluminum: This product is not related to iron or aluminum, so no additional duties apply in that context.

📋 Proactive Advice for Importers

- Verify Material and Unit Price: Confirm that the product is indeed MDF and not a different type of fiberboard (e.g., particle board or OSB), as classification can vary.

- Check Required Certifications: Ensure that any necessary documentation (e.g., import licenses, product conformity certificates) is in place.

- Monitor Tariff Changes: Keep an eye on any updates to the tariff schedule, especially around the April 11, 2025 deadline.

- Consult a Customs Broker: For complex or high-value shipments, consider engaging a customs broker to ensure compliance and avoid delays.

📌 Summary Table

| Item | Description | HS Code | Base Tariff | Additional Tariff | Special Tariff (after 2025.4.11) | Total Tariff |

|---|---|---|---|---|---|---|

| MDF | Medium density fiberboard, unworked, >9mm | 4411141000 | 0.0% | 25.0% | 30.0% | 55.0% |

Let me know if you need help with classification of other products or assistance with customs documentation.

Customer Reviews

No reviews yet.