| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917390010 | Doc | 33.1% | CN | US | 2025-05-12 |

| 4009220050 | Doc | 57.5% | CN | US | 2025-05-12 |

| 4009210000 | Doc | 57.5% | CN | US | 2025-05-12 |

| 8307106000 | Doc | 58.8% | CN | US | 2025-05-12 |

| 3917390010 | Doc | 33.1% | CN | US | 2025-05-12 |

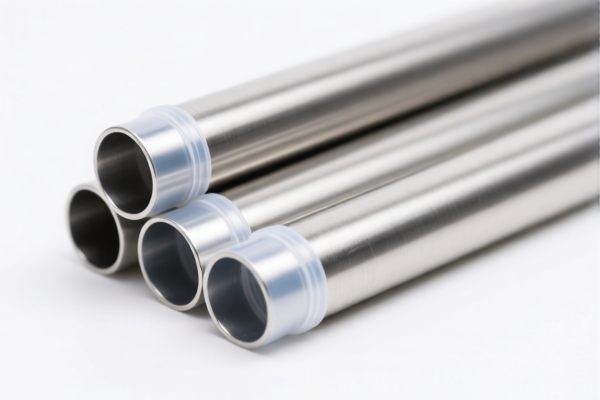

Here is the structured classification and tariff information for "Metal Lined Plastic Tubes" based on the provided HS codes and tax details:

🔍 Product Classification Overview: Metal Lined Plastic Tubes

✅ HS CODE: 3917390010

Description: Metal reinforced plastic tubes, fittings, and hoses (including unspecified specific materials)

Total Tax Rate: 33.1%

Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this category

⚠️ Note: This code applies to plastic tubes with metal reinforcement, and the material is not explicitly specified in the description.

✅ HS CODE: 4009220050

Description: Rubber hoses with metal reinforcement or combination

Total Tax Rate: 57.5%

Breakdown:

- Base Tariff: 2.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this category

⚠️ Note: This code is for rubber hoses with metal reinforcement, not for plastic tubes.

✅ HS CODE: 4009210000

Description: Rubber hoses, only with metal reinforcement or combination

Total Tax Rate: 57.5%

Breakdown:

- Base Tariff: 2.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this category

⚠️ Note: This is a more specific version of 4009220050, but still applies to rubber, not plastic.

✅ HS CODE: 8307106000

Description: Flexible pipes of iron or steel

Total Tax Rate: 58.8%

Breakdown:

- Base Tariff: 3.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: May apply depending on the origin and specific product

⚠️ Note: This code is for metal pipes, not plastic with metal lining.

📌 Proactive Advice for Importers:

- Verify the material composition of the tubes (e.g., plastic type, metal reinforcement material) to ensure correct HS code classification.

- Check the unit price and certifications required (e.g., RoHS, REACH, or specific import permits).

- Be aware of the April 11, 2025, tariff increase (30.0%) which will significantly impact the total tax rate.

- Consider anti-dumping duties if the product is imported from countries under such measures (e.g., certain steel or aluminum products).

- Consult a customs broker or classification expert if the product description is vague or overlaps with multiple HS codes.

Let me know if you need help with certification requirements or customs documentation for this product. Here is the structured classification and tariff information for "Metal Lined Plastic Tubes" based on the provided HS codes and tax details:

🔍 Product Classification Overview: Metal Lined Plastic Tubes

✅ HS CODE: 3917390010

Description: Metal reinforced plastic tubes, fittings, and hoses (including unspecified specific materials)

Total Tax Rate: 33.1%

Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this category

⚠️ Note: This code applies to plastic tubes with metal reinforcement, and the material is not explicitly specified in the description.

✅ HS CODE: 4009220050

Description: Rubber hoses with metal reinforcement or combination

Total Tax Rate: 57.5%

Breakdown:

- Base Tariff: 2.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this category

⚠️ Note: This code is for rubber hoses with metal reinforcement, not for plastic tubes.

✅ HS CODE: 4009210000

Description: Rubber hoses, only with metal reinforcement or combination

Total Tax Rate: 57.5%

Breakdown:

- Base Tariff: 2.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this category

⚠️ Note: This is a more specific version of 4009220050, but still applies to rubber, not plastic.

✅ HS CODE: 8307106000

Description: Flexible pipes of iron or steel

Total Tax Rate: 58.8%

Breakdown:

- Base Tariff: 3.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: May apply depending on the origin and specific product

⚠️ Note: This code is for metal pipes, not plastic with metal lining.

📌 Proactive Advice for Importers:

- Verify the material composition of the tubes (e.g., plastic type, metal reinforcement material) to ensure correct HS code classification.

- Check the unit price and certifications required (e.g., RoHS, REACH, or specific import permits).

- Be aware of the April 11, 2025, tariff increase (30.0%) which will significantly impact the total tax rate.

- Consider anti-dumping duties if the product is imported from countries under such measures (e.g., certain steel or aluminum products).

- Consult a customs broker or classification expert if the product description is vague or overlaps with multiple HS codes.

Let me know if you need help with certification requirements or customs documentation for this product.

Customer Reviews

No reviews yet.