Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917390010 | Doc | 33.1% | CN | US | 2025-05-12 |

| 3917390010 | Doc | 33.1% | CN | US | 2025-05-12 |

| 3917390010 | Doc | 33.1% | CN | US | 2025-05-12 |

| 3917390010 | Doc | 33.1% | CN | US | 2025-05-12 |

| 3917390010 | Doc | 33.1% | CN | US | 2025-05-12 |

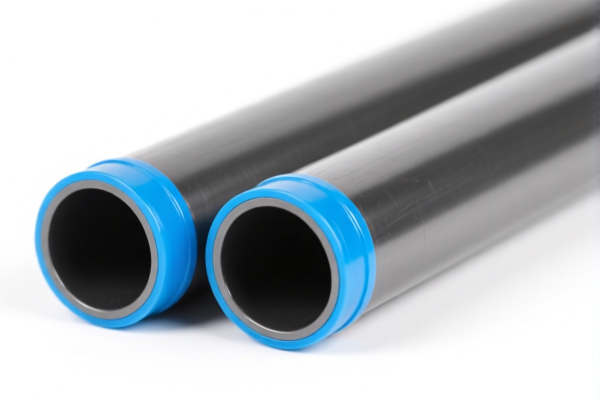

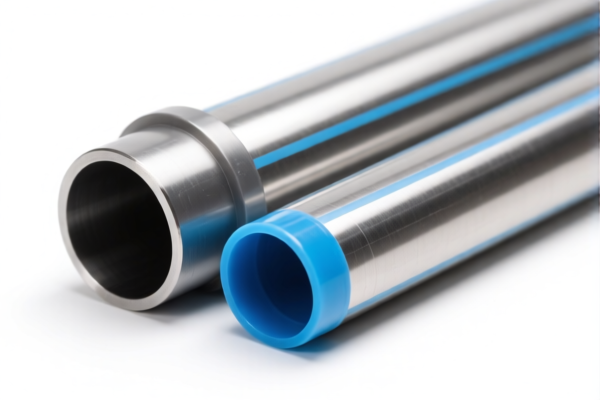

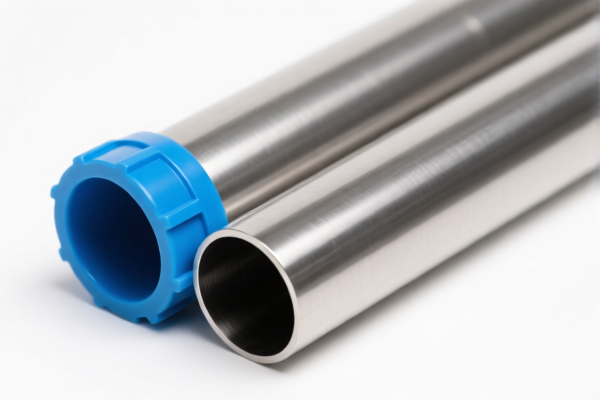

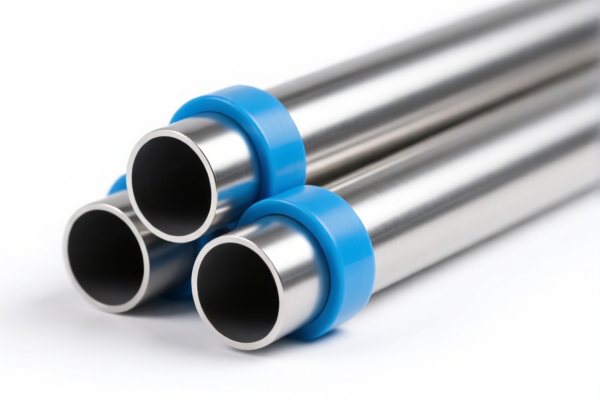

Product Classification: Metal Reinforced Plastic Cold Water Tubes

HS CODE: 3917.39.00.10

🔍 Classification Summary

- Product Type: Metal reinforced plastic tubes (cold water use)

- HS Code: 3917.39.00.10

- Description: Includes various types such as drainage, industrial, high-temperature resistant, and low-temperature resistant metal-reinforced plastic tubes.

📊 Tariff Breakdown

- Base Tariff Rate: 3.1%

- Additional Tariff (Currently): 0.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 33.1%

⚠️ Important Notes

- April 11, 2025 Special Tariff: A 30% additional tariff will be imposed on this product after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost planning and customs declarations.

- No Anti-Dumping Duties: No specific anti-dumping duties are currently applicable for this product category.

- No Additional Tariffs (Currently): As of now, no other additional tariffs are in effect.

📌 Proactive Advice for Importers

- Verify Material Composition: Confirm that the product is indeed metal-reinforced plastic and not made of entirely metal or other materials that may fall under a different HS code (e.g., 7306 for metal pipes).

- Check Unit Price and Certification: Ensure that the product meets any required certifications (e.g., fire resistance, pressure rating) and that the unit price is correctly declared for accurate tax calculation.

- Plan for Tariff Increase: If importing after April 11, 2025, factor in the 30% additional tariff in your cost estimation and consider alternative sourcing or duty relief options.

- Consult Customs Broker: For complex or high-value shipments, consult a customs broker or compliance expert to ensure proper classification and documentation.

Let me know if you need help with customs documentation or tariff calculation tools.

Product Classification: Metal Reinforced Plastic Cold Water Tubes

HS CODE: 3917.39.00.10

🔍 Classification Summary

- Product Type: Metal reinforced plastic tubes (cold water use)

- HS Code: 3917.39.00.10

- Description: Includes various types such as drainage, industrial, high-temperature resistant, and low-temperature resistant metal-reinforced plastic tubes.

📊 Tariff Breakdown

- Base Tariff Rate: 3.1%

- Additional Tariff (Currently): 0.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 33.1%

⚠️ Important Notes

- April 11, 2025 Special Tariff: A 30% additional tariff will be imposed on this product after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost planning and customs declarations.

- No Anti-Dumping Duties: No specific anti-dumping duties are currently applicable for this product category.

- No Additional Tariffs (Currently): As of now, no other additional tariffs are in effect.

📌 Proactive Advice for Importers

- Verify Material Composition: Confirm that the product is indeed metal-reinforced plastic and not made of entirely metal or other materials that may fall under a different HS code (e.g., 7306 for metal pipes).

- Check Unit Price and Certification: Ensure that the product meets any required certifications (e.g., fire resistance, pressure rating) and that the unit price is correctly declared for accurate tax calculation.

- Plan for Tariff Increase: If importing after April 11, 2025, factor in the 30% additional tariff in your cost estimation and consider alternative sourcing or duty relief options.

- Consult Customs Broker: For complex or high-value shipments, consult a customs broker or compliance expert to ensure proper classification and documentation.

Let me know if you need help with customs documentation or tariff calculation tools.

Customer Reviews

No reviews yet.