| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917390010 | Doc | 33.1% | CN | US | 2025-05-12 |

| 3917390050 | Doc | 33.1% | CN | US | 2025-05-12 |

| 3917400050 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3917320050 | Doc | 58.1% | CN | US | 2025-05-12 |

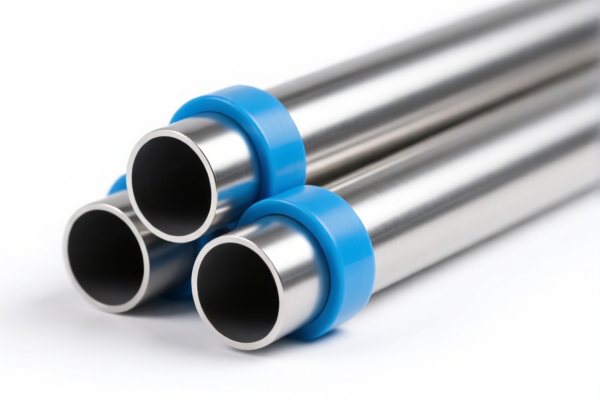

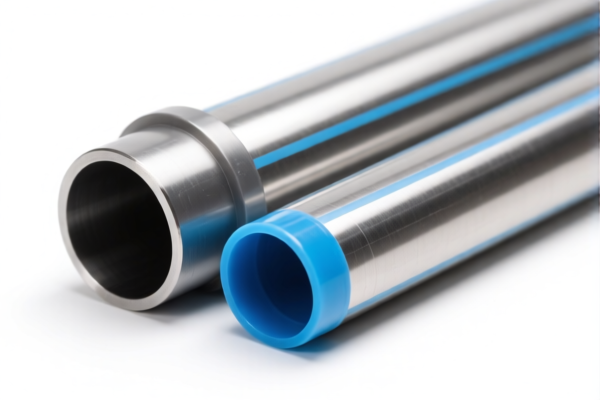

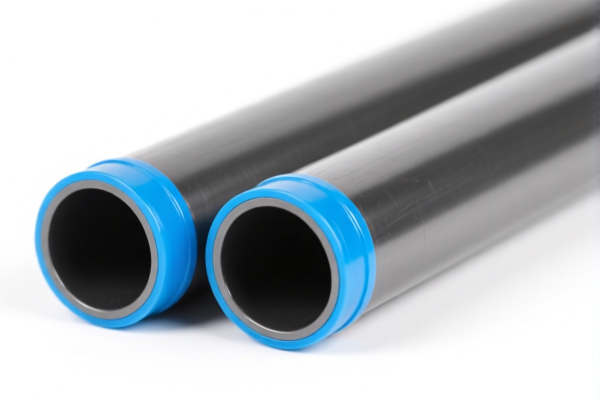

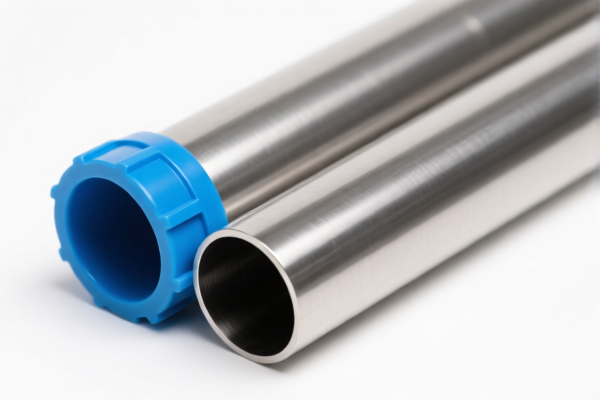

Product Name: Metal Reinforced Plastic Drainage Tubes

Classification Analysis and Tax Information:

- HS CODE: 3917390010

- Description: Applies to metal-reinforced plastic drainage tubes, metal-reinforced plastic pipes, metal-supported plastic tubes, and industrial plastic tubes with metal reinforcement.

- Total Tax Rate: 33.1%

- Base Tariff: 3.1%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is specifically for metal-reinforced plastic pipes, which is different from general plastic drainage tubes.

-

HS CODE: 3917390050

- Description: Applies to general plastic drainage tubes, including pipes and fittings.

- Total Tax Rate: 33.1%

- Base Tariff: 3.1%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is for non-metal-reinforced plastic drainage tubes.

-

HS CODE: 3917400050

- Description: Applies to non-pressure drainage, waste, and ventilation (DWV) piping systems, including other types of connectors.

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is for non-pressure systems and may include more specialized components.

-

HS CODE: 3917320050

- Description: Applies to general plastic pipes, fittings, and connectors.

- Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for general-purpose plastic pipes and fittings, not specifically for drainage.

Key Tax Rate Changes (April 11, 2025 onwards):

- All four HS codes will be subject to an additional 30.0% special tariff after April 11, 2025.

- This is a time-sensitive policy, so ensure your customs declarations are made before this date if you wish to avoid the extra charge.

Proactive Advice:

- Verify the product composition: Confirm whether the drainage tubes are metal-reinforced or non-reinforced, as this determines the correct HS code.

- Check unit price and material details: This will help in accurately calculating the total tax and ensuring compliance.

- Review required certifications: Some products may require specific certifications (e.g., fire resistance, pressure rating) for import.

- Consult with customs brokers: For complex classifications, it's advisable to seek professional guidance to avoid misclassification and penalties.

Let me know if you need help determining the correct HS code based on your product specifications.

Product Name: Metal Reinforced Plastic Drainage Tubes

Classification Analysis and Tax Information:

- HS CODE: 3917390010

- Description: Applies to metal-reinforced plastic drainage tubes, metal-reinforced plastic pipes, metal-supported plastic tubes, and industrial plastic tubes with metal reinforcement.

- Total Tax Rate: 33.1%

- Base Tariff: 3.1%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is specifically for metal-reinforced plastic pipes, which is different from general plastic drainage tubes.

-

HS CODE: 3917390050

- Description: Applies to general plastic drainage tubes, including pipes and fittings.

- Total Tax Rate: 33.1%

- Base Tariff: 3.1%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is for non-metal-reinforced plastic drainage tubes.

-

HS CODE: 3917400050

- Description: Applies to non-pressure drainage, waste, and ventilation (DWV) piping systems, including other types of connectors.

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is for non-pressure systems and may include more specialized components.

-

HS CODE: 3917320050

- Description: Applies to general plastic pipes, fittings, and connectors.

- Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for general-purpose plastic pipes and fittings, not specifically for drainage.

Key Tax Rate Changes (April 11, 2025 onwards):

- All four HS codes will be subject to an additional 30.0% special tariff after April 11, 2025.

- This is a time-sensitive policy, so ensure your customs declarations are made before this date if you wish to avoid the extra charge.

Proactive Advice:

- Verify the product composition: Confirm whether the drainage tubes are metal-reinforced or non-reinforced, as this determines the correct HS code.

- Check unit price and material details: This will help in accurately calculating the total tax and ensuring compliance.

- Review required certifications: Some products may require specific certifications (e.g., fire resistance, pressure rating) for import.

- Consult with customs brokers: For complex classifications, it's advisable to seek professional guidance to avoid misclassification and penalties.

Let me know if you need help determining the correct HS code based on your product specifications.

Customer Reviews

No reviews yet.