| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917390010 | Doc | 33.1% | CN | US | 2025-05-12 |

| 3917390010 | Doc | 33.1% | CN | US | 2025-05-12 |

| 3917390010 | Doc | 33.1% | CN | US | 2025-05-12 |

| 3917390010 | Doc | 33.1% | CN | US | 2025-05-12 |

| 3917390010 | Doc | 33.1% | CN | US | 2025-05-12 |

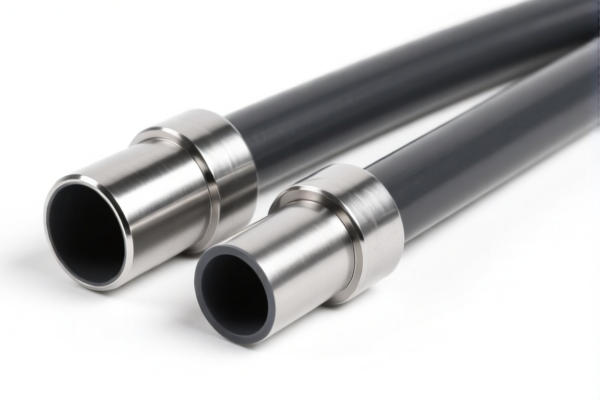

Product Classification: Metal Reinforced Plastic High Pressure Tubes

HS CODE: 3917390010

🔍 Classification Summary

- Product Description: Metal reinforced plastic tubes, plastic pipe fittings, and plastic hoses.

- HS Code: 3917390010 (10-digit code)

- Tariff Summary: 33.1% total tax rate

📊 Tariff Breakdown

- Base Tariff Rate: 3.1%

- Additional Tariff (Currently): 0.0%

- Special Tariff (After April 11, 2025): 30.0%

- Note: This is a time-sensitive policy. If your goods are imported after April 11, 2025, this additional 30% will apply.

⚠️ Important Policy Alerts

- April 11, 2025 Special Tariff: A 30% additional tariff will be imposed on this product category after this date.

- Anti-dumping duties: Not currently applicable for this HS code.

- No current anti-dumping or countervailing duties on metal-reinforced plastic tubes under this classification.

📌 Proactive Advice for Importers

- Verify Material Composition: Ensure the product is indeed "metal reinforced plastic" and not a different composite or fully metal product.

- Check Unit Price: The final tax amount depends on the declared value, so ensure accurate pricing.

- Certifications Required: Confirm if any specific certifications (e.g., safety, pressure resistance) are needed for import compliance.

- Monitor Tariff Changes: Keep track of the April 11, 2025 deadline to avoid unexpected costs.

📚 Example

If you import 100 units of metal-reinforced plastic high-pressure tubes with a total declared value of $10,000:

- Base Tariff: $10,000 × 3.1% = $310

- After April 11, 2025: Additional 30% = $3,000

- Total Tariff (after April 11): $3,310

Let me know if you need help with customs documentation or further classification details.

Product Classification: Metal Reinforced Plastic High Pressure Tubes

HS CODE: 3917390010

🔍 Classification Summary

- Product Description: Metal reinforced plastic tubes, plastic pipe fittings, and plastic hoses.

- HS Code: 3917390010 (10-digit code)

- Tariff Summary: 33.1% total tax rate

📊 Tariff Breakdown

- Base Tariff Rate: 3.1%

- Additional Tariff (Currently): 0.0%

- Special Tariff (After April 11, 2025): 30.0%

- Note: This is a time-sensitive policy. If your goods are imported after April 11, 2025, this additional 30% will apply.

⚠️ Important Policy Alerts

- April 11, 2025 Special Tariff: A 30% additional tariff will be imposed on this product category after this date.

- Anti-dumping duties: Not currently applicable for this HS code.

- No current anti-dumping or countervailing duties on metal-reinforced plastic tubes under this classification.

📌 Proactive Advice for Importers

- Verify Material Composition: Ensure the product is indeed "metal reinforced plastic" and not a different composite or fully metal product.

- Check Unit Price: The final tax amount depends on the declared value, so ensure accurate pricing.

- Certifications Required: Confirm if any specific certifications (e.g., safety, pressure resistance) are needed for import compliance.

- Monitor Tariff Changes: Keep track of the April 11, 2025 deadline to avoid unexpected costs.

📚 Example

If you import 100 units of metal-reinforced plastic high-pressure tubes with a total declared value of $10,000:

- Base Tariff: $10,000 × 3.1% = $310

- After April 11, 2025: Additional 30% = $3,000

- Total Tariff (after April 11): $3,310

Let me know if you need help with customs documentation or further classification details.

Customer Reviews

No reviews yet.