| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917390010 | Doc | 33.1% | CN | US | 2025-05-12 |

| 3917390010 | Doc | 33.1% | CN | US | 2025-05-12 |

| 3917390010 | Doc | 33.1% | CN | US | 2025-05-12 |

| 3917390010 | Doc | 33.1% | CN | US | 2025-05-12 |

| 3917390010 | Doc | 33.1% | CN | US | 2025-05-12 |

| 3917390010 | Doc | 33.1% | CN | US | 2025-05-12 |

| 3917390010 | Doc | 33.1% | CN | US | 2025-05-12 |

| 3917310000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917390010 | Doc | 33.1% | CN | US | 2025-05-12 |

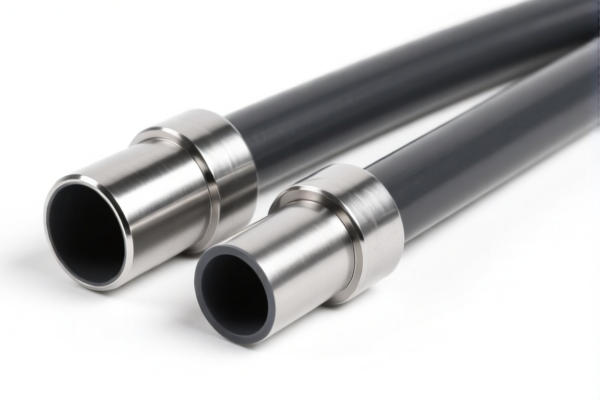

Product Classification: Metal Reinforced Plastic High Temperature Resistant Tubes

HS CODE: 3917390010

🔍 Tariff Overview and Key Details

- Base Tariff Rate: 3.1%

- Additional Tariff (Currently): 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 33.1%

📌 Key Notes on Tax Rates

-

April 11 Special Tariff:

A 30.0% additional tariff will be imposed after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning and customs clearance. -

No Anti-Dumping Duties:

No specific anti-dumping duties on iron or aluminum are currently applicable for this product classification.

📦 Product Description and Classification Considerations

- Product Type: Metal-reinforced plastic tubes with high-temperature resistance.

- Classification Basis:

- The product is classified under HS Code 3917390010 based on its composition (plastic with metal reinforcement) and intended use (high-temperature resistance).

- Other similar HS codes, such as 3917310000 (for general high-temperature plastic tubes without metal reinforcement), have higher total tax rates (58.1%) due to the absence of metal reinforcement.

⚠️ Proactive Advice for Importers

-

Verify Material Composition:

Ensure the product is indeed metal-reinforced and not just a standard plastic tube with high-temperature resistance. This will determine the correct HS code. -

Check Unit Price and Certification Requirements:

Confirm the unit price and whether any certifications (e.g., fire resistance, industrial safety) are required for import compliance. -

Monitor Tariff Changes:

Keep track of the April 11, 2025 deadline for the special tariff. This could significantly impact the total cost of importation. -

Consult Customs Broker:

For complex classifications or large shipments, it is advisable to consult a customs broker or compliance expert to avoid misclassification penalties.

✅ Summary Table

| Tax Component | Rate |

|---|---|

| Base Tariff | 3.1% |

| Additional Tariff (now) | 0.0% |

| Special Tariff (after 2025.4.2) | 30.0% |

| Total Tax Rate | 33.1% |

Let me know if you need help with customs documentation or tariff calculation tools.

Product Classification: Metal Reinforced Plastic High Temperature Resistant Tubes

HS CODE: 3917390010

🔍 Tariff Overview and Key Details

- Base Tariff Rate: 3.1%

- Additional Tariff (Currently): 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 33.1%

📌 Key Notes on Tax Rates

-

April 11 Special Tariff:

A 30.0% additional tariff will be imposed after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning and customs clearance. -

No Anti-Dumping Duties:

No specific anti-dumping duties on iron or aluminum are currently applicable for this product classification.

📦 Product Description and Classification Considerations

- Product Type: Metal-reinforced plastic tubes with high-temperature resistance.

- Classification Basis:

- The product is classified under HS Code 3917390010 based on its composition (plastic with metal reinforcement) and intended use (high-temperature resistance).

- Other similar HS codes, such as 3917310000 (for general high-temperature plastic tubes without metal reinforcement), have higher total tax rates (58.1%) due to the absence of metal reinforcement.

⚠️ Proactive Advice for Importers

-

Verify Material Composition:

Ensure the product is indeed metal-reinforced and not just a standard plastic tube with high-temperature resistance. This will determine the correct HS code. -

Check Unit Price and Certification Requirements:

Confirm the unit price and whether any certifications (e.g., fire resistance, industrial safety) are required for import compliance. -

Monitor Tariff Changes:

Keep track of the April 11, 2025 deadline for the special tariff. This could significantly impact the total cost of importation. -

Consult Customs Broker:

For complex classifications or large shipments, it is advisable to consult a customs broker or compliance expert to avoid misclassification penalties.

✅ Summary Table

| Tax Component | Rate |

|---|---|

| Base Tariff | 3.1% |

| Additional Tariff (now) | 0.0% |

| Special Tariff (after 2025.4.2) | 30.0% |

| Total Tax Rate | 33.1% |

Let me know if you need help with customs documentation or tariff calculation tools.

Customer Reviews

No reviews yet.