| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920620020 | Doc | 59.2% | CN | US | 2025-05-12 |

| 4811902000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3920620050 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920620020 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920620020 | Doc | 59.2% | CN | US | 2025-05-12 |

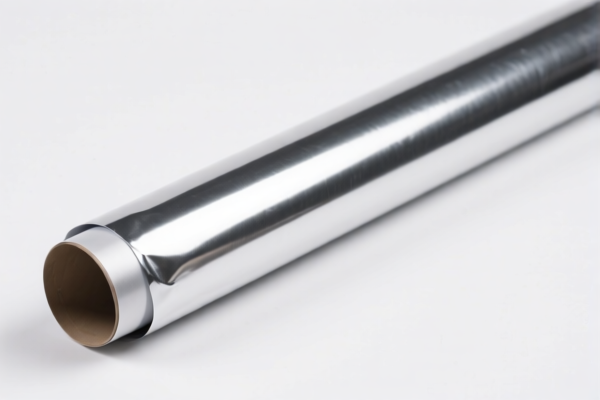

Product Classification and Tax Information for "Metallized PET Film Gift Wrap"

Below is the detailed classification and tariff information for the product "Metallized PET Film Gift Wrap" based on the provided HS codes and tax details:

✅ HS CODE: 3920620020

Product Description: Metallized PET Film Gift Wrap / Gift Packaging PET Metalized Film / PET Metalized Packaging Film

Total Tax Rate: 59.2%

🔍 Tariff Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable (not a metal product, but a plastic film)

⏱️ Time-sensitive Policy Alert:

- April 11, 2025 Special Tariff: Applies to imports after this date. Ensure compliance with updated tariff rates if importing after this date.

✅ HS CODE: 4811902000

Product Description: Metallized Gift Packaging Paper

Total Tax Rate: 55.0%

🔍 Tariff Breakdown:

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable (paper product, not metal)

⏱️ Time-sensitive Policy Alert:

- April 11, 2025 Special Tariff: Applies to imports after this date. Ensure compliance with updated tariff rates if importing after this date.

✅ HS CODE: 3920620050

Product Description: Metallized PET Film

Total Tax Rate: 59.2%

🔍 Tariff Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable (plastic film, not metal)

⏱️ Time-sensitive Policy Alert:

- April 11, 2025 Special Tariff: Applies to imports after this date. Ensure compliance with updated tariff rates if importing after this date.

📌 Proactive Advice for Importers:

- Verify Material and Unit Price: Confirm the exact composition of the metallized PET film (e.g., thickness, type of metal coating) to ensure correct classification.

- Check Required Certifications: Some products may require specific certifications (e.g., RoHS, REACH) for compliance with environmental and safety regulations.

- Monitor Tariff Updates: The April 11, 2025 special tariff is a key date. If your import schedule is after this date, you must account for the 30.0% additional tariff.

- Consider HS Code Selection: Multiple HS codes may apply depending on the product's description and use. Choose the most accurate code to avoid delays or penalties.

Let me know if you need help determining the most appropriate HS code for your specific product description or if you need assistance with customs documentation. Product Classification and Tax Information for "Metallized PET Film Gift Wrap"

Below is the detailed classification and tariff information for the product "Metallized PET Film Gift Wrap" based on the provided HS codes and tax details:

✅ HS CODE: 3920620020

Product Description: Metallized PET Film Gift Wrap / Gift Packaging PET Metalized Film / PET Metalized Packaging Film

Total Tax Rate: 59.2%

🔍 Tariff Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable (not a metal product, but a plastic film)

⏱️ Time-sensitive Policy Alert:

- April 11, 2025 Special Tariff: Applies to imports after this date. Ensure compliance with updated tariff rates if importing after this date.

✅ HS CODE: 4811902000

Product Description: Metallized Gift Packaging Paper

Total Tax Rate: 55.0%

🔍 Tariff Breakdown:

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable (paper product, not metal)

⏱️ Time-sensitive Policy Alert:

- April 11, 2025 Special Tariff: Applies to imports after this date. Ensure compliance with updated tariff rates if importing after this date.

✅ HS CODE: 3920620050

Product Description: Metallized PET Film

Total Tax Rate: 59.2%

🔍 Tariff Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable (plastic film, not metal)

⏱️ Time-sensitive Policy Alert:

- April 11, 2025 Special Tariff: Applies to imports after this date. Ensure compliance with updated tariff rates if importing after this date.

📌 Proactive Advice for Importers:

- Verify Material and Unit Price: Confirm the exact composition of the metallized PET film (e.g., thickness, type of metal coating) to ensure correct classification.

- Check Required Certifications: Some products may require specific certifications (e.g., RoHS, REACH) for compliance with environmental and safety regulations.

- Monitor Tariff Updates: The April 11, 2025 special tariff is a key date. If your import schedule is after this date, you must account for the 30.0% additional tariff.

- Consider HS Code Selection: Multiple HS codes may apply depending on the product's description and use. Choose the most accurate code to avoid delays or penalties.

Let me know if you need help determining the most appropriate HS code for your specific product description or if you need assistance with customs documentation.

Customer Reviews

No reviews yet.