| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921190010 | Doc | 61.5% | CN | US | 2025-05-12 |

| 8421990140 | Doc | 55.0% | CN | US | 2025-05-12 |

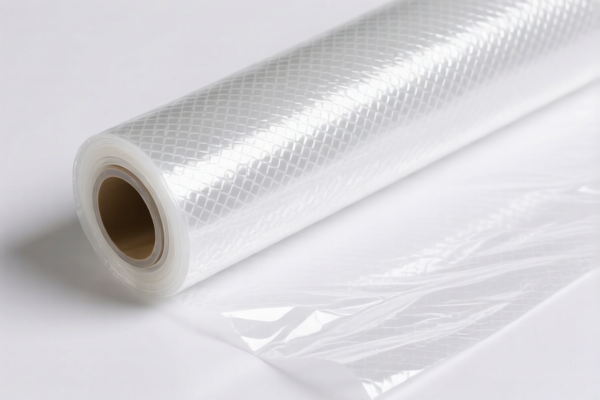

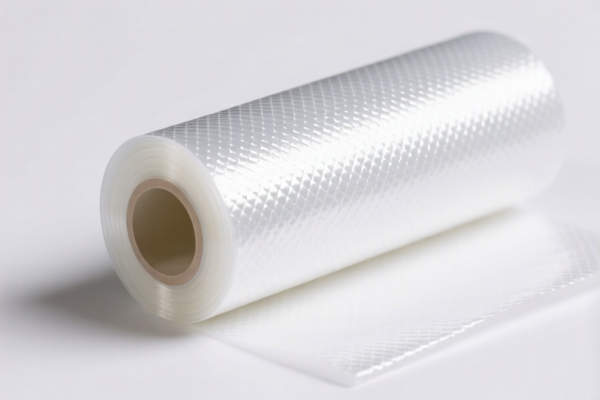

Product Name: Microporous Polyethylene Film for Filtration

Classification: Based on the provided HS codes, the product can be classified under two potential HS codes depending on the context of use and product form.

🔍 HS Code 3921190010

Description: Microporous sheets of polyethylene or polypropylene

Total Tax Rate: 61.5%

Breakdown of Tax Rates:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable (this product is polyethylene, not metal).

Key Notes: - This classification is appropriate if the product is primarily a microporous film made of polyethylene, intended for general industrial use (not as a component of a machine or equipment). - Time-sensitive alert: The additional tariff increases to 30.0% after April 11, 2025.

Proactive Advice: - Confirm the material composition (e.g., is it 100% polyethylene or blended with other polymers?). - Ensure the product is not classified as a part of a filtration machine, which would fall under a different HS code. - Check if certifications (e.g., FDA, ISO) are required for export or import.

🔍 HS Code 8421990140

Description: Parts of machines and apparatus for the filtration of liquids

Total Tax Rate: 55.0%

Breakdown of Tax Rates:

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable (this is a plastic part, not metal).

Key Notes: - This classification is appropriate if the microporous polyethylene film is used as a component or part of a liquid filtration machine or apparatus. - Time-sensitive alert: The additional tariff increases to 30.0% after April 11, 2025.

Proactive Advice: - Confirm the end-use of the product (e.g., is it sold as a standalone film or as a part of a filtration system?). - Verify the technical specifications and function of the product to ensure correct classification. - If exporting to countries with specific import regulations, check for customs documentation and product compliance requirements.

✅ Summary of Tax Implications:

| HS Code | Description | Base Tariff | Additional Tariff | Special Tariff (After 2025.4.2) | Total Tax |

|---|---|---|---|---|---|

| 3921190010 | Microporous polyethylene film | 6.5% | 25.0% | 30.0% | 61.5% |

| 8421990140 | Part of liquid filtration equipment | 0.0% | 25.0% | 30.0% | 55.0% |

📌 Final Recommendations:

- Verify the product's intended use (standalone film vs. component of a machine).

- Check the material composition and technical specifications for accurate classification.

- Monitor the April 11, 2025 deadline for tariff changes.

- Consult with customs brokers or classification experts if the product is borderline between categories.

Product Name: Microporous Polyethylene Film for Filtration

Classification: Based on the provided HS codes, the product can be classified under two potential HS codes depending on the context of use and product form.

🔍 HS Code 3921190010

Description: Microporous sheets of polyethylene or polypropylene

Total Tax Rate: 61.5%

Breakdown of Tax Rates:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable (this product is polyethylene, not metal).

Key Notes: - This classification is appropriate if the product is primarily a microporous film made of polyethylene, intended for general industrial use (not as a component of a machine or equipment). - Time-sensitive alert: The additional tariff increases to 30.0% after April 11, 2025.

Proactive Advice: - Confirm the material composition (e.g., is it 100% polyethylene or blended with other polymers?). - Ensure the product is not classified as a part of a filtration machine, which would fall under a different HS code. - Check if certifications (e.g., FDA, ISO) are required for export or import.

🔍 HS Code 8421990140

Description: Parts of machines and apparatus for the filtration of liquids

Total Tax Rate: 55.0%

Breakdown of Tax Rates:

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable (this is a plastic part, not metal).

Key Notes: - This classification is appropriate if the microporous polyethylene film is used as a component or part of a liquid filtration machine or apparatus. - Time-sensitive alert: The additional tariff increases to 30.0% after April 11, 2025.

Proactive Advice: - Confirm the end-use of the product (e.g., is it sold as a standalone film or as a part of a filtration system?). - Verify the technical specifications and function of the product to ensure correct classification. - If exporting to countries with specific import regulations, check for customs documentation and product compliance requirements.

✅ Summary of Tax Implications:

| HS Code | Description | Base Tariff | Additional Tariff | Special Tariff (After 2025.4.2) | Total Tax |

|---|---|---|---|---|---|

| 3921190010 | Microporous polyethylene film | 6.5% | 25.0% | 30.0% | 61.5% |

| 8421990140 | Part of liquid filtration equipment | 0.0% | 25.0% | 30.0% | 55.0% |

📌 Final Recommendations:

- Verify the product's intended use (standalone film vs. component of a machine).

- Check the material composition and technical specifications for accurate classification.

- Monitor the April 11, 2025 deadline for tariff changes.

- Consult with customs brokers or classification experts if the product is borderline between categories.

Customer Reviews

No reviews yet.