| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921190010 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3921904090 | Doc | 34.2% | CN | US | 2025-05-12 |

| 3901105020 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921190010 | Doc | 61.5% | CN | US | 2025-05-12 |

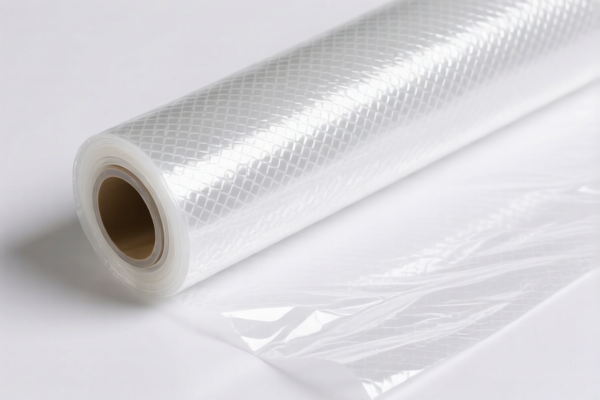

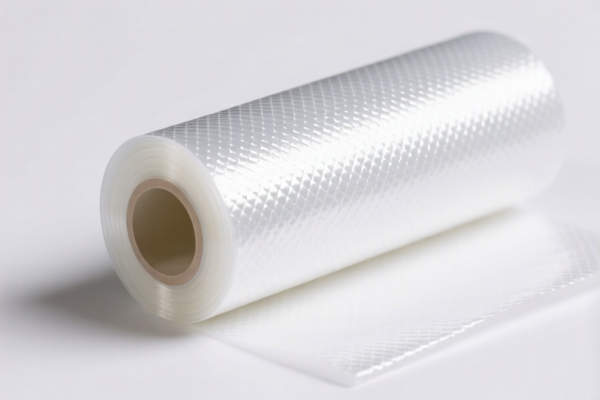

Product Name: Microporous Polyethylene Film for Packaging

Classification HS Code Analysis:

- HS CODE: 3921190010

- Description: Matches the description of "microporous sheets of polyethylene or polypropylene film."

- Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is specifically for microporous films made of polyethylene or polypropylene, which aligns with your product.

-

HS CODE: 3921905050

- Description: Applies to "other plastic sheets, plates, films, foils, and strips" used for packaging.

- Total Tax Rate: 34.8%

- Base Tariff Rate: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is broader and may apply if the product is not specifically microporous or not explicitly defined under 3921190010.

-

HS CODE: 3921904090

- Description: Also falls under "other plastic sheets, plates, films, foils, and strips."

- Total Tax Rate: 34.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Similar to 3921905050, but with a slightly lower base tariff.

-

HS CODE: 3901105020

- Description: Applies to low-density polyethylene film used for packaging, specifically non-linear low-density polyethylene.

- Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for low-density polyethylene film, which may not be the best fit unless your product is explicitly low-density and non-linear.

✅ Recommendation:

- Preferred HS Code: 3921190010

- This is the most accurate and specific code for your product (microporous polyethylene film for packaging).

-

Total Tax Rate: 61.5% (including the 30% special tariff after April 11, 2025).

-

Important Notes:

- Verify Material: Ensure the product is indeed made of polyethylene and is microporous.

- Check Unit Price: The tax rate may vary based on the declared value and whether it falls under preferential trade agreements.

- Certifications: Confirm if any certifications (e.g., food-grade, medical-grade) are required for customs clearance.

-

April 11, 2025 Deadline: Be aware of the additional 30% tariff that will apply after this date. Plan accordingly for cost estimation and compliance.

-

Action Required:

- Confirm the exact composition and structure of the film.

-

Consult with a customs broker or classification expert if the product has additional features (e.g., treated with chemicals, used in medical or food packaging). Product Name: Microporous Polyethylene Film for Packaging

Classification HS Code Analysis: -

HS CODE: 3921190010

- Description: Matches the description of "microporous sheets of polyethylene or polypropylene film."

- Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is specifically for microporous films made of polyethylene or polypropylene, which aligns with your product.

-

HS CODE: 3921905050

- Description: Applies to "other plastic sheets, plates, films, foils, and strips" used for packaging.

- Total Tax Rate: 34.8%

- Base Tariff Rate: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is broader and may apply if the product is not specifically microporous or not explicitly defined under 3921190010.

-

HS CODE: 3921904090

- Description: Also falls under "other plastic sheets, plates, films, foils, and strips."

- Total Tax Rate: 34.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Similar to 3921905050, but with a slightly lower base tariff.

-

HS CODE: 3901105020

- Description: Applies to low-density polyethylene film used for packaging, specifically non-linear low-density polyethylene.

- Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for low-density polyethylene film, which may not be the best fit unless your product is explicitly low-density and non-linear.

✅ Recommendation:

- Preferred HS Code: 3921190010

- This is the most accurate and specific code for your product (microporous polyethylene film for packaging).

-

Total Tax Rate: 61.5% (including the 30% special tariff after April 11, 2025).

-

Important Notes:

- Verify Material: Ensure the product is indeed made of polyethylene and is microporous.

- Check Unit Price: The tax rate may vary based on the declared value and whether it falls under preferential trade agreements.

- Certifications: Confirm if any certifications (e.g., food-grade, medical-grade) are required for customs clearance.

-

April 11, 2025 Deadline: Be aware of the additional 30% tariff that will apply after this date. Plan accordingly for cost estimation and compliance.

-

Action Required:

- Confirm the exact composition and structure of the film.

- Consult with a customs broker or classification expert if the product has additional features (e.g., treated with chemicals, used in medical or food packaging).

Customer Reviews

No reviews yet.